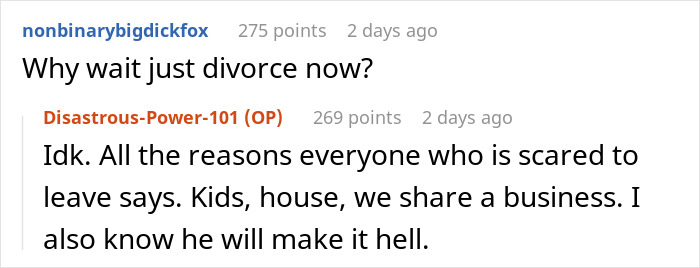

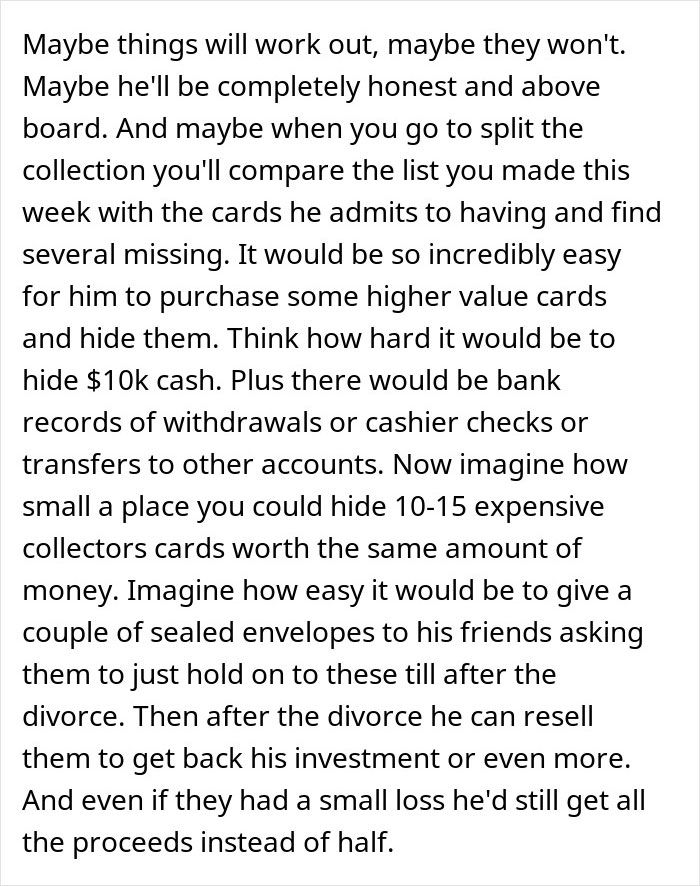

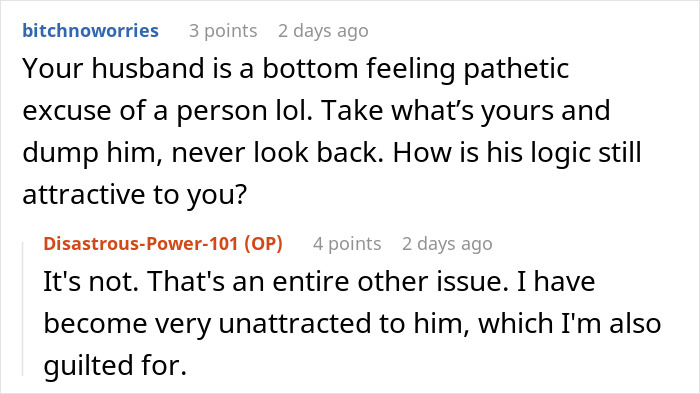

Money can seriously complicate family relationships. Especially when it’s spouses keeping financial secrets from each other. Interestingly, it’s quite a common occurrence. A recent study by Bankrate found that 42% of Americans keep money secrets from their partner. So many couples might have to deal with financial infidelity in one form or another.

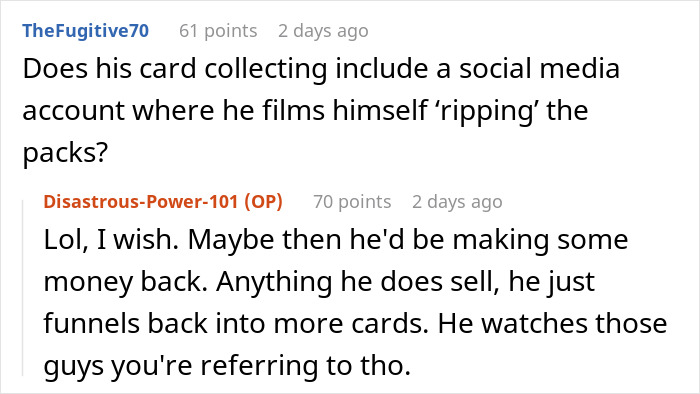

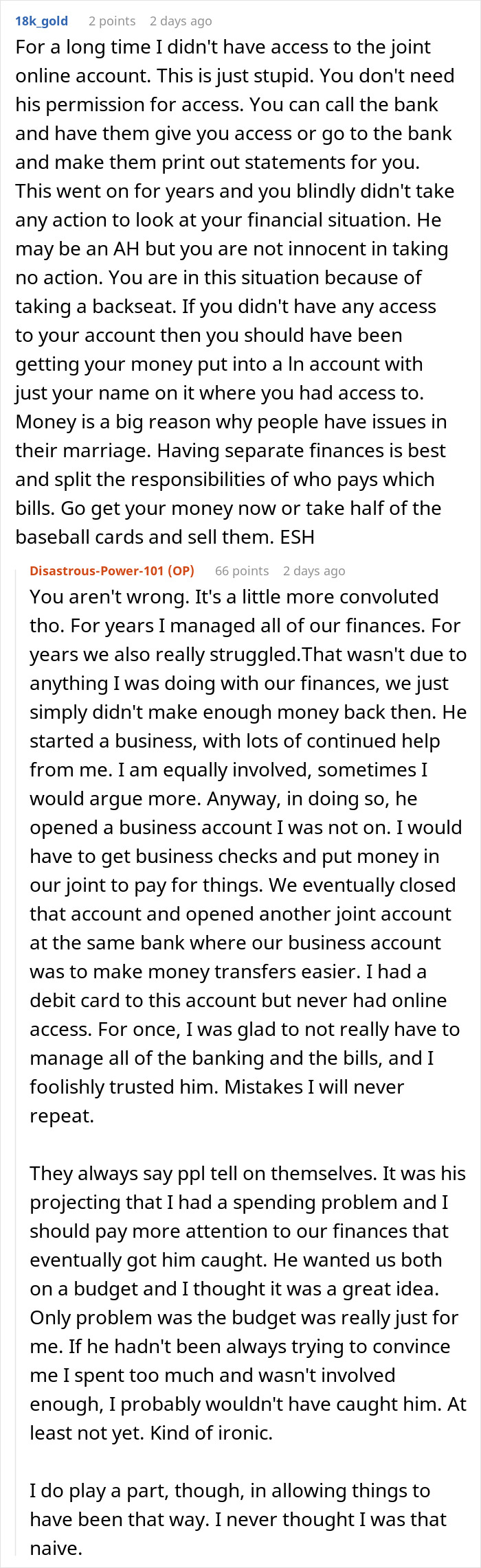

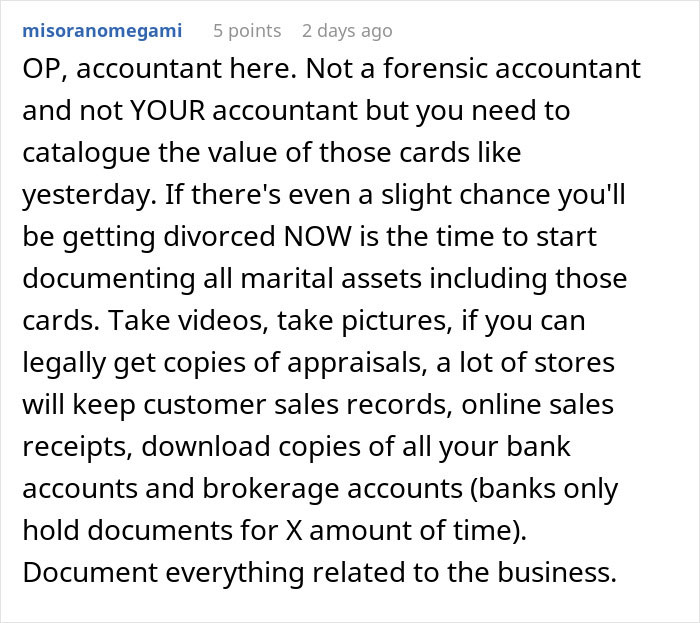

This particular husband was spending money from a joint account for something he didn’t discuss with his wife. The woman recently shared her story about how she decided to get her half back by making monthly transfers from the joint account to hers. However, when the husband found out, he thought it was unfair. So the wife decided to check with the Internet: who was the jerk in this situation?

Finding out your spouse was spending money behind your back can be heartbreaking

Image credits: s_kawee (not the actual image)

When this woman found out, she wanted to get her half back, but her husband disagreed

Image credits: Mick Haupt (not the actual image)

Image credits: Karolina Grabowska (not the actual image)

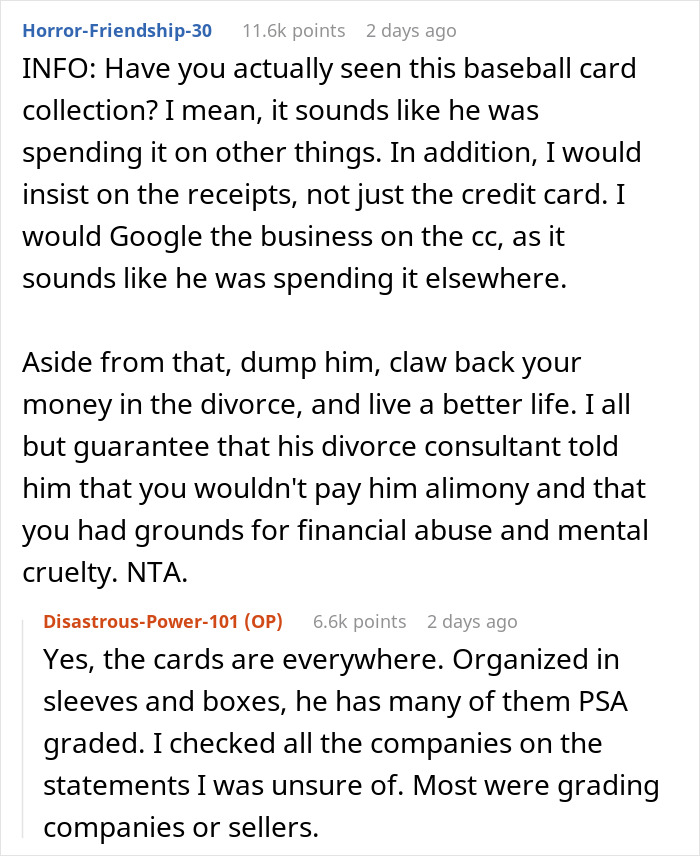

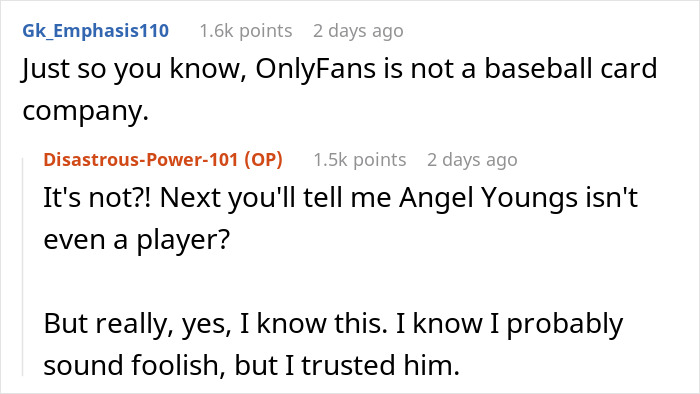

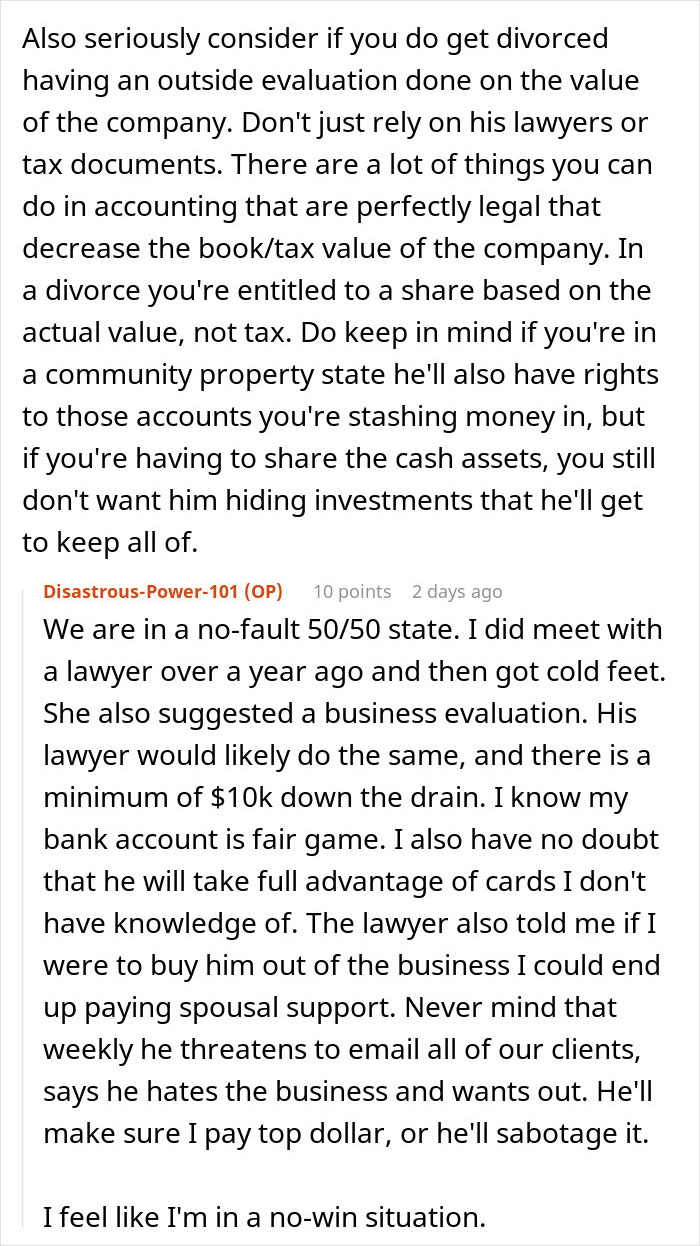

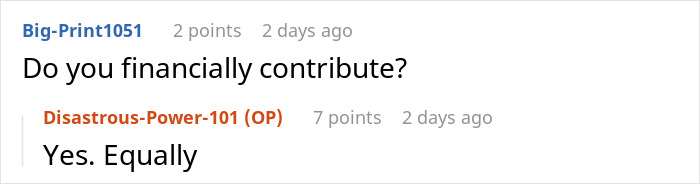

Image credits: Disastrous-Power-101

Joint bank accounts require genuine trust between partners

When reading about cases like these, one cannot escape thinking about whether merging finances with your partner is a good idea. There isn’t really one correct answer. Some experts, like David Ramsey, believe separate accounts are nonsense. Others, like Suze Orman, are believers in merging only a portion of the finances.

Orman recommends couples open two shared accounts: one for shared expenses, and the other for savings. And generally, she doesn’t believe in taking couples’ finances to extremes. According to her, partners should have joint accounts, but they also should have separate checking accounts.

According to Nerd Wallet, a joint bank account is a good idea when there’s a lot of trust between the two parties. Couples, married or not, may use it to cover shared expenses. That includes utilities, food, rent, and common savings goals, like a vacation.

One of the disadvantages of having a shared account, as the wife in this story had to find out the hard way, is that both parties are responsible for the fees, like the overdraft charges. Also, if one of the co-owners racks up a huge debt, creditors may go after money in the joint account.

Emma Edwards, founder of The Broke Generation, has defended her decision not to combine finances with her partner. She writes how their salaries are almost the same and how they trust each other wholeheartedly, therefore they see no point in merging their bank accounts.

She also believes that having a joint account is a tad outdated. “In the past, couples had to combine their finances because the man was generally the sole income earner,” she writes. “Nowadays, the world is set up for women and men to manage their money themselves.”

If for some reason a partner becomes suspicious of their spouse’s financial activities, there might be something deeper to work through than just money, Edwards says. In the end, it all seems to come back to trust.

Image credits: Ketut Subiyanto (not the actual image)

Couples who merge their finances report being happier

Two sets of research – one in 2022, the other in 2023 – found that having joint bank accounts might contribute to couples having stronger and happier relationships. The lead researcher for the former, Emily Garbinsky of Cornell University, said that “pooling resources matters for relationship satisfaction – especially for lower-income individuals.”

The researcher believes it’s all about bringing the two people together. There’s also more transparency in the relationship, so the couple may trust each other more. When they have a shared account, partners work towards shared goals. It all becomes about ‘our money’ and not just ‘my money.’ Garbinsky says that this logic for people triggers “higher-order beliefs about their relationship.”

Jenny Olson, assistant professor of marketing at Indiana University’s Kelley School of Business, co-authored the 2023 study “Common Cents: Bank Account Structure and Couples’ Relationship Dynamics.” They found that couples who opened joint bank accounts reported an increase in the quality of their relationship two years later.

Olson said that couples with separate accounts viewed their financial decisions in transactional terms. “It’s ‘I help you because you’re going to help me later.’ They’re prepaying for later favors, and that’s tit-for-tat, which we see a bit more with separate accounts. They’re not working together like those with joint accounts – who have the same pool of money – and that’s more common in business-type relationships,” Olson concluded.

But whether or not partners reported being happier, trust was still a major factor. “It’s really important for you to feel like you’re on the same team and set financial goals with your partner,” Garbinsky explained. “Combining your finances seems to be one way to force you to do that.”

Image credits: Mikhail Nilov (not the actual image)

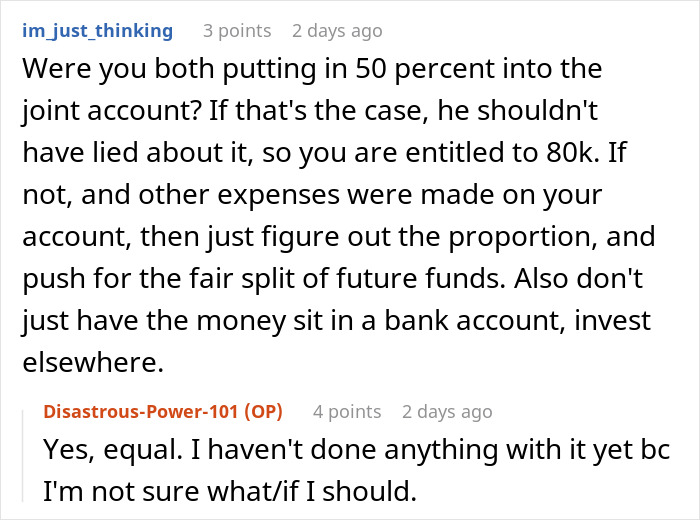

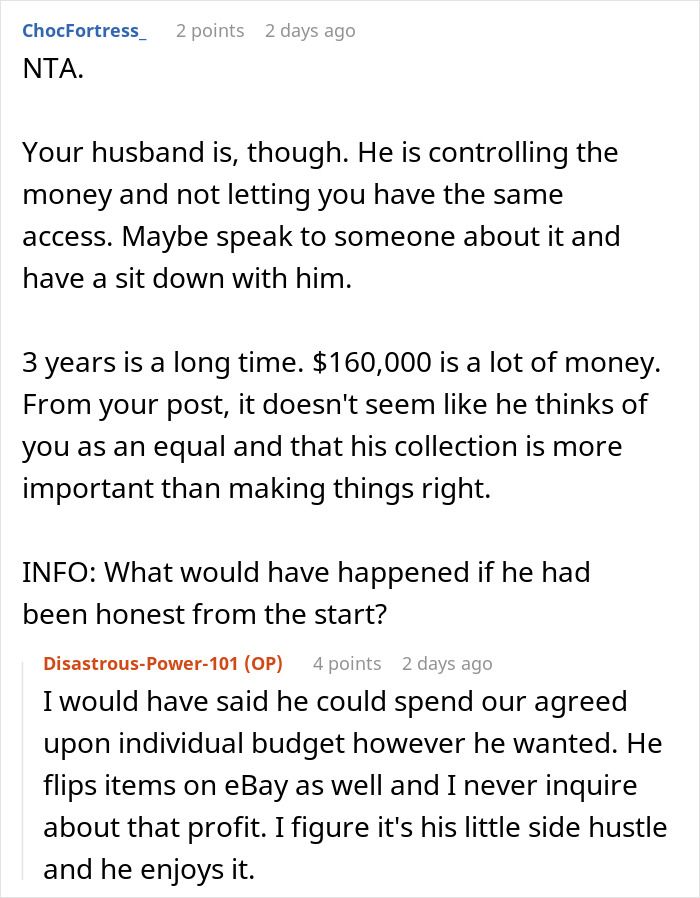

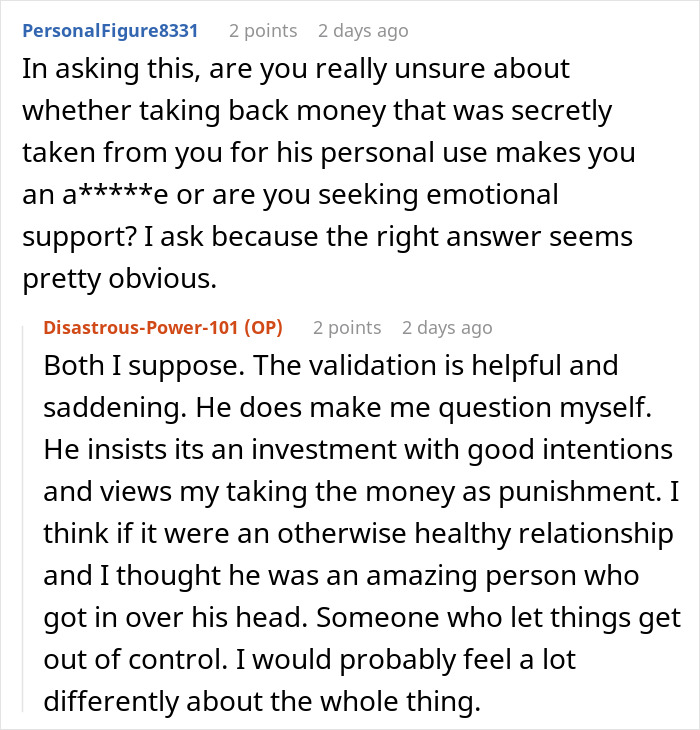

The wife gave more information about their finances in the comments