THE Hunter coal industry is set to end a difficult year on a high note, with prices up and year-long exports down only slightly on last year's 162 million tonnes, despite the pressure of the Chinese "bans" on Australian coal.

Although official figures will not be available until the new year, various measures indicate the Port of Newcastle is likely to export about 159 million tonnes of coal this year, a fall of just 2 per cent on the 2019 total.

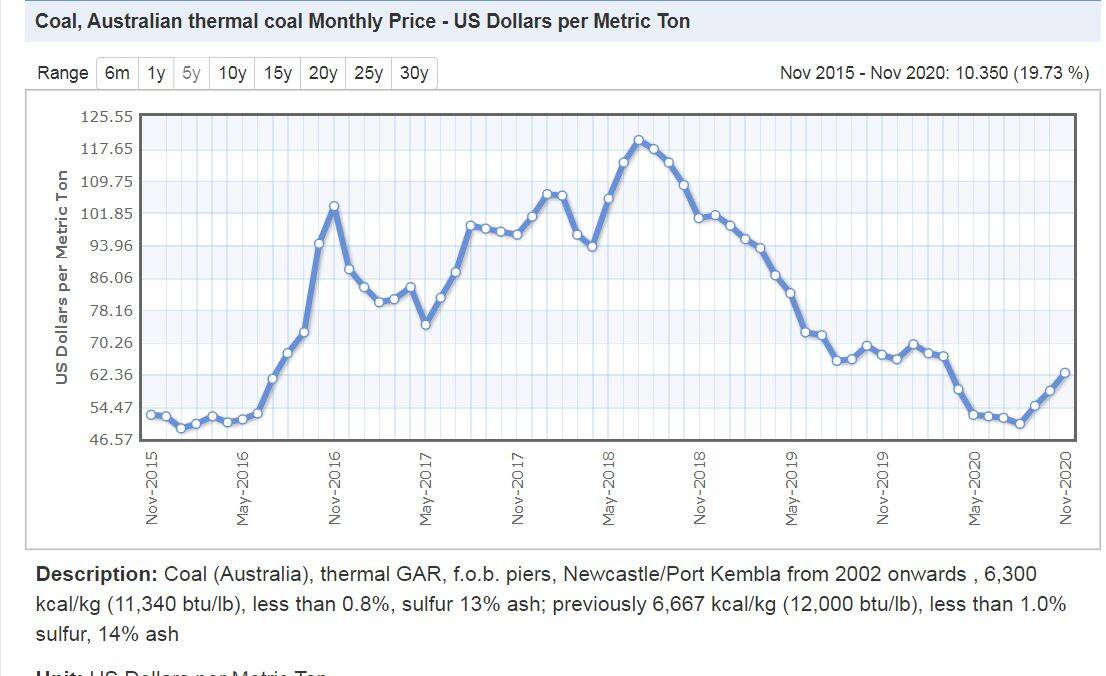

Prices for "spot", or one-off, cargoes of high-quality Newcastle thermal coal for power stations have rebounded strongly from August lows of about $US50 ($68.40) a tonne to reach a mid-December level of more than $US76 ($104.10), with the Australian Coal Report predicting prices could soon top $US80 ($109.60) a tonne.

RELATED READING

-

Industry calls for 'rules based' trade as China ban bites

- The Herald's Opinion: Chinese whispers cannot be ignored

-

Global Times says coal ban 'political punishment

-

Unions, Labor warn Morrison on China rhetoric

-

Chinese investment in the Hunter

- Hunter coal fueling Chinese growth

In a year when the COVID-19 pandemic ate into the outputs of most countries, the relatively strong Newcastle performance can be viewed as part of a broader resurgence of the seaborne coal trade, as reported by a number of industry and financial analysts in recent weeks.

A late November presentation from global coal trader and miner Noble Resources, titled The Coal Market in 2021: Are we out of the woods yet?, forecasts worldwide price increases as "demand starts to recover" although "the (price) signal is not enough to drive the market into bullish territory".

A "week 51" overview by an online industry portal The Coal Hub confirms that other coal-producing nations are benefiting from China's ban on Australian coal, while China itself experiences power shortages as its domestic coal industry struggles to keep pace with demand in the absence of Australian imports.

Despite the industry confidence, the Institute for Energy Economics and Financial Analysis says "a growing tsunami of climate commitments" presents "profound" problems for coal.

Japan remains Newcastle's biggest customer, taking almost half of the tonnage leaving the port, but the Chinese ban on Australian coal is having a major impact on the market, both politically and commercially.

The English-language Chinese newspaper The Global Times, said before Christmas that the country had "run into a regional power shortage with multiple localities having curbed electricity use and imposed rationing in recent days".

Although the article linked the shortages to China's expansion of "renewables in its energy mix to meet its ambitious climate goal to reach carbon neutrality by 2060", other Global Times articles have related the power shortages to the ban on Australian thermal coal.

China produces most of its own coal, but the Australian imports must be made up elsewhere to balance supply.

Another Global Times article earlier this month said: "As China's top leadership has committed to carbon neutrality by 2060, fundamental reform measures to address China's energy mix will be worked out and implemented, pivoting towards new and clean energy sources.

"Naturally, Chinese authorities will continue to push forward with the elimination of domestic coal-fired power generating capacities.

"Meanwhile, China itself is a major coal producer and a reduction of imports from abroad will provide opportunities for local players to fill the gap.

"Moreover, it seems that China has been strengthening trade ties with other major coal suppliers, after Canberra's repetitive anti-China posturing this year has alienated the two countries."

In the short term, Hunter export coal prices are being nudged up by the loss of a Newcastle Coal Infrastructure Group (NCIG) shiploader on Kooragang Island during a wild storm last month.

NCIG has described the loss of the shiploader as cutting the terminal's capacity by a third, but sources say extra coal has been moved through the Kooragang and Carrington terminals operated by Port Waratah Coal Services (PWCS), minimising the potential losses.

Australian Bureau of Statistics figures show PWCS exported 110.9 million tonnes last year, while NCIG did 51.2 million tonnes, for a total of 161.2 million tonnes.

PWCS confirmed it had shipped 94.9 million tonnes to the end of November, compared with 99.9 million tonnes in the first 11 months of 2019.

Although PWCS expects shipments to fall by about 5 per cent to 106 million tonnes this year, ABS filings show NCIG lifted its imports by 3.7 million tonnes to the end of October to 45.9 million tonnes, meaning the combined exports of the three terminals should be within a few percentage points of 2019.

For faster access to the latest Newcastle news download our NEWCASTLE HERALD APP and sign up for breaking news, sport and what's on sent directly to your email.

IN THE NEWS: