Overview

HeartCore Enterprises (NASDAQ:HTCR) is an established software development company based in Tokyo, Japan and operates in three core segments. These include 1) Content Management in which the core product is HeartCore CMS, 2) Digital Transformation which includes Controlio, myInvenio, Apromore and HeartCore Robo, and 3) GO IPO, a consulting service that helps Japanese companies prepare for a U.S. Nasdaq public listing.

HeartCore was founded in 2019 and has 64 employees at this time of which approximately half are devoted to software programming and engineering. The company has an established customer base with over 800 active customers and maintains a very high retention rate of approximately 95%. The company went public through an initial public offering in February 2022 raising $15 million in proceeds. The IPO was priced at $5.00 per share.

Content Management

Large enterprises or organizations that operate complex websites, blogs, mobile apps, ecommerce businesses or social networks need to utilize and manage large amounts of content to deliver their services or products. These websites often contain many thousands of pages. To handle this complex task, most large enterprises use a content management system, also referred to as a customer experience management platform. These platforms integrate marketing, sales, service, and content management systems as well as other tools and integrations that enable companies to attract and engage customers throughout the customer lifecycle.

The company's core offering that provides these services is the HeartCore CMS which allows the user to create, manage, and modify content on websites without the need for specialized technical knowledge. Key benefits to this system include a high degree of user-friendliness, relatively quick deployment compared to other complex processes, low ongoing maintenance requirements, extendable functionality, and SEO friendly features.

Specific HeartCore CMS features include an easy-to-use editor that can create and update web pages as easily as entering text into a word processor as well as the ability to import data by simply copying and pasting specific information and content. The system offers secure and privacy-oriented publishing settings where the user can view private information on the website before it gets publicly disclosed. The company believes HeartCore CMS is the only CMS in the world that can publish tens of thousands of pages simultaneously as well as thousands of PDF files at the same time. The product also offers granular access rights and detailed access permissions and flexible workflows. This allows users to reduce the production and operation time and ensure the accuracy of information. Lastly, HeartCore CMS offers extensive review and preview functions that's show final versions across all screen sizes and device types. The program can also preview registered content from two or three generations ahead with a future date on the same page.

The total addressable market size for content management software is approximately $6.0 billion and expected to grow at annualized rate of 18% over the next ten years. The content management segment represented 81% of 1st quarter 2022 revenues.

Digital Transformation

This segment consists of three separate offerings which includes robotic process automation (RPA), task mining and process mining. They share a common goal of accelerating the digital transformation of enterprises across their entire business lines, particularly in the areas of marketing, sales, and customer service.

Robotic process automation is an advanced technology that allows automation for a predetermined set of tasks. RPA robots can mimic most human-computer interactions to carry out error-free tasks at high volume and speed. These task cans include invoice processing, process sales orders, account reconciliation, employee onboarding, payroll, and enterprise data entry for core processes such as finance, human resources, manufacturing, supply chain, services, and procurement.

HeartCore Robo is the company's flagship RPA product and offers automation of key business applications such as packaged business software, internally developed software, website applications and mobile apps. This RPA offering can work across all platforms including remote and virtual environments as well as all operating systems and browsers. Specific features include high-speed identification of operation targets on the screen using a proprietary image analysis engine as well as automatic HTML operations and data acquisition within web pages. The product also utilizes highly advanced optical character recognition tools. The company believes it may be the only major RPA provider to focus on Android and Mac devices.

Task mining is an important technology that enables organizations to detect and analyze the tasks employees perform as they relate to completing larger processes which works by monitoring the actions users take. The purpose of using task mining software is to discover and understand the tasks employees are performing. This software process became particularly important during the Covid-19 pandemic as a substantial number of office-based employees were forced to work from home.

The company's task mining offering is Controlio which was acquired in December 2019. The company believes Controlio has a much more comprehensive and inclusive solution than competitors such as Skysea, LanScope, and MeeCap. Task mining represents approximately 4.0% of total company revenues.

Process mining is the technology that investigates and analyzes the large amounts of data in enterprise event logs to discover and present end-to-end processes that the organization is performing to complete work. The purpose of most process mining applications is to optimize and improve business processes which may lead to more efficient operations and even automation of processes.

The company has two process mining offerings, myInvenio which was acquired in April 2019, and Apromore which was acquired in June 2021. Similar to the company's task mining offerings, the company believes myInvenio has a far more comprehensive process mining solution than competitors such as Celonis, Signavio, and UiPath. Process mining represents approximately 10% of total company revenues.

Go IPO Consultation

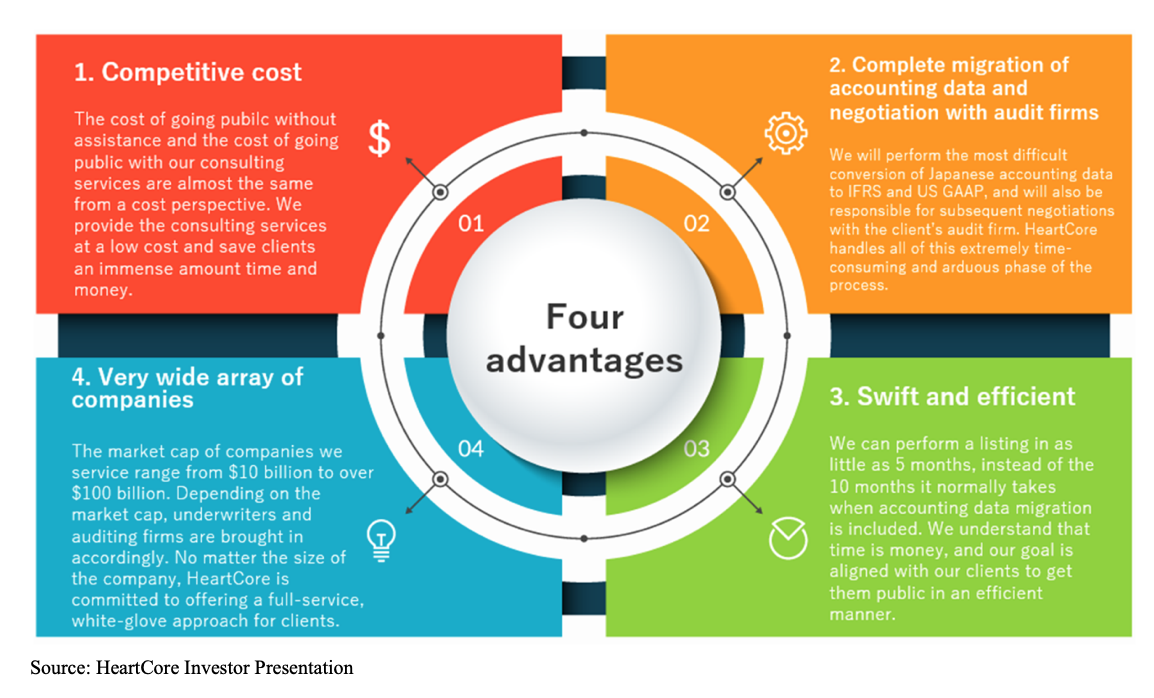

GO IPO is a new service from HeartCore that helps Japanese companies achieve a NASDAQ public listing in the U.S. Launched in March 2022, this NASDAQ consulting service is based on the company's own go-public experience as well as its general business expertise in navigating cross border issues between Japan and the U.S. From the Japanese market perspective, the company helps with audit attestation, underwriter exams and Tokyo Stock Exchange related information and processes. For the U.S. markets, the company helps with auditor audit attestation for two years, reviews by the underwriter and their attorneys, as well as SEC confirmation. More specifically, the company performs the difficult task of converting Japanese accounting data to IFRS and U.S. GAAP accounting principles and works with the audit firm.

Business model and marketing strategy

For the Content Management segment, the company is targeting enterprises with over $100 million in annual revenues and particularly those business that use websites for e-commerce, or to engage and inform customers. HeartCore markets its products at software and technology trades shows, partnership arrangements, direct sales to companies through their own sales team, and referrals from current customers. The pricing arrangement is typically $26,000 per on-premise server plus 18% from licensing. There are also annual maintenance fees.

For most of the digital transformation businesses, the company is targeting larger organizations with over $1 billion in revenues and those that have a need to make their operations and business processes more efficient and productive. Similar to the CMS segment, the company markets its products at trades shows, seminars, partnership arrangements, and direct sales to companies through their own sales team. The pricing model is $50,000 per year for process mining, $250 per year per unit for task mining, and an annual $5,000 subscription fee per year for RPA. The company has an alliance with IBM that they hope to expand, as well as other partnerships with consulting and ERP firms.

Sample customers for the company include such iconic names as Japan Airlines, Hitachi, Seibu Railway, Mitsubishi UFJ Morgan Stanley Securities, Ricoh, Tokyu department stores.

Financial review

For the 2021 fiscal year ending 12/31/21, the company generated $10.8 million in revenues which was an increase of approximately 20% over the prior year. Gross margins were 47.9% for the year compared to 44.5% in 2020. The company experienced growth in most its product offerings and achieved higher gross margins due to increased volumes and strong pricing power.

Operating income decreased to $59,018 for the year compared to $258,705 in the prior year largely due to an increase in listing expenses in preparation for the company's February 2022 IPO. Listing expenses totaled $867,624 compared to no listing related expenses in the prior year. Despite a net loss of ($338,156) for the year, HeartCore generated positive operating cash flow of $766,300 and with capital expenditures of only $36,153, free cash flow came in at $730,147.

Cash on the balance sheet as of year-end 2021 stood at $3.1 million, however, in February 2022, the company raised gross proceeds of $15 million in its initial public offering. Cash balances as of the end of 3/31/22 were $13.9 million with total debt of $2.5 million. The company experienced a burn rate in the 1st quarter of 2022, primarily due to increased expenses related to the company's IPO.

We expect HeartCore to reach breakeven profitability in the 2nd quarter of 2022 and show net profits and free cash flow in the 3rd and 4th quarters. The company will not likely have to access the capital markets to fund operations, however it may do so to finance potential acquisitions as they occur.

The company has 18.9 million common shares outstanding and 1.5 million warrants outstanding. Insiders hold approximately 71% of total shares with CEO with founder Sumitaka Kanno (Yamamoto) owning 58.0% of total common shares.

Management team

Sumitaka Kanno (Yamamoto), CEO, is the founder of HeartCore and has served as the Chief Executive Officer and member of the Board of Directors of HeartCore since June 2009. Mr. Kanno is an experienced information technology software programmer and graduated with a bachelor's degree from Kansai Gaidai University, Osaka, Japan. He has worked at BroadVision.com in Japan, a global software vendor and former NASDAQ company, where he specialized in websites and software.

Kimio Hosaka, Chief Operating Officer, has been a member of the Board of Directors since May 18, 2021. Mr. Hosaka has served as the Chief Operating Officer and member of the Board of Managers of HeartCore since August 2015. Mr. Hosaka graduated with a bachelor's degree in physics from Chuo University, Tokyo, Japan. Mr. Hosaka brings 20 years of experience in technology as an engineer and manager at All Nippon Airways Systems, Electronic Data Systems, and Heartcore.

Hidekazu Miyata has served as Chief Technical Officer since May 18, 2021. Mr. Miyata has also served as the head of the DX division of HeartCore since June 2009. Mr. Miyata graduated with a bachelor's degree in economics from Doshisha University, Japan. Mr. Miyata worked for software development company, Electronic Data Systems and has more than 20 years of software development experience.

Qizhi Gao has served as the Chief Financial Officer of HeartCore since May 2017. From December 2007 through April 2017, Mr. Gao served as the Group Leader, Finance & Accounting Department at Marubishi Corporation in Tokyo, Japan. Mr. Gao graduated with a bachelor's degree in computer accounting from Chuo College of Information and Accounting.

Summary

We believe HeartCore Enterprises is entering a strong growth phase due to multiple factors:

➢ The company's key industry verticals of customer management, content management, and data mining are expected to grow at strong double-digit rates.

➢ The company has multiple cross-selling opportunities across all of its segments and product lines.

➢ Expansion into the U.S market is just beginning with a new office being opened up in the Silicon Valley region of California.

➢ The 90%+ retention rate will provide a solid base of recurring revenues and will also help with marketing and sales efforts as its satisfied customer base is reflected in those numbers.

➢ Over 650 customers will be able to upgrade to the latest version of HeartCore CMS (Version 12).

HeartCore has the potential to grow both revenues and earnings at very robust double-digit growth rates if it is able to execute on its strategic plans. Prudent tuck-in acquisitions will also play a role in future growth as the company attempts to capitalize on synergistic opportunities. The company's current stock price does not likely reflect that potential level of profitable growth going forward.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives quarterly payments totaling a maximum fee of up to $40,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.