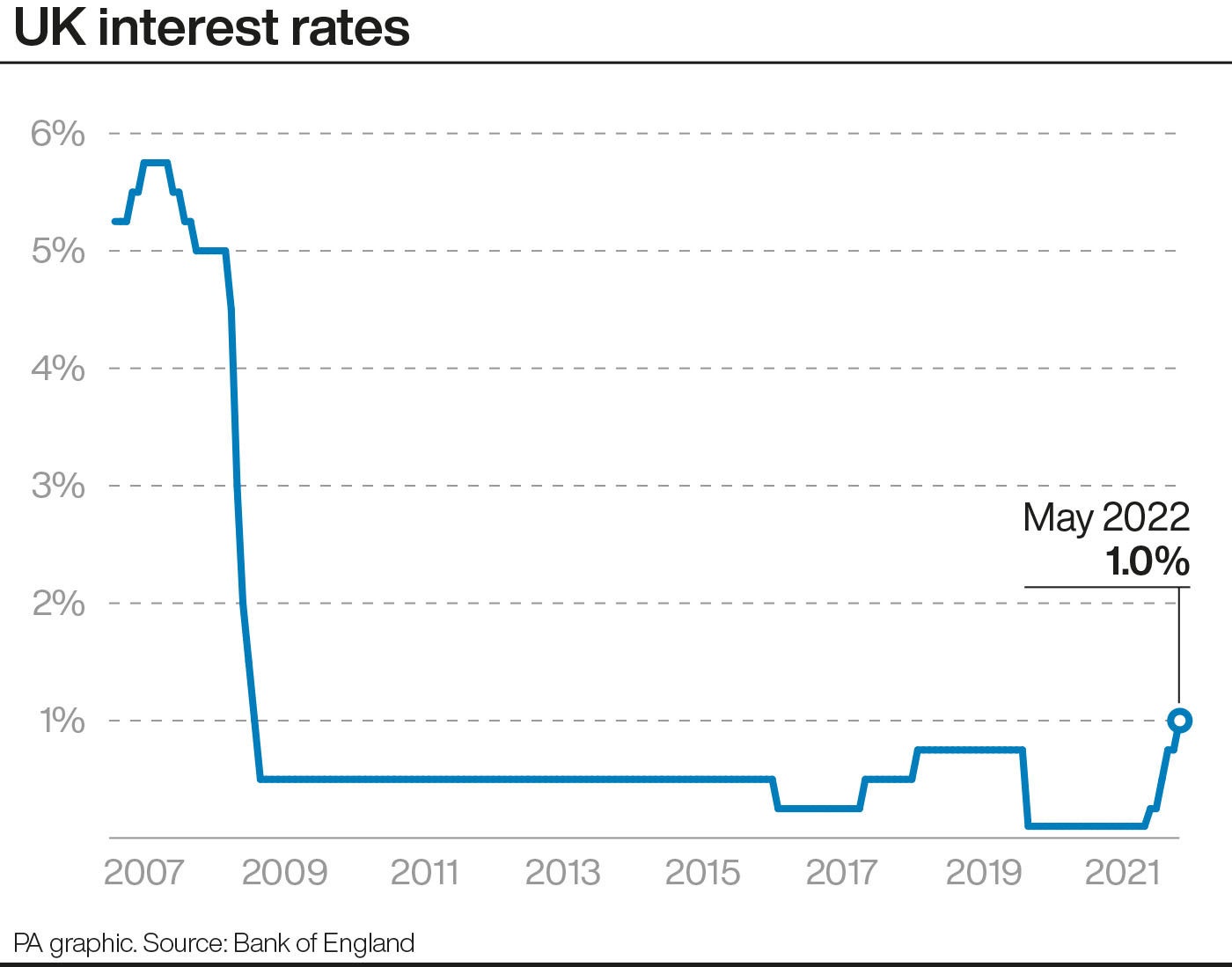

The Bank of England base rate has been increased to a level many homeowners will never have experienced before.

The rate of 1% has not seen since 2009. It was increased from 0.75% after a string of hikes in recent months.

The latest rise follows a range of bill increases in April, with rocketing inflation expected to peak at more than 10%.

Here is a look at how people’s mortgages, savings and investments could be affected by the latest base rate hike.

– How will homeowners be affected?

Three-quarters of outstanding mortgages are on fixed rates, meaning these homeowners will not feel the immediate impact of a base rate rise, according to figures from trade association UK Finance.

Nearly one in 10 (9%) mortgages are trackers, with variable rates.

Some homeowners are on their lender’s standard variable rate (SVR). People end up on SVRs when their initial mortgage deal has ended, and the rate is set by the individual lender.

– What will the impact on mortgages look like in cash terms?

Among the nearly nine million outstanding mortgages, the average balance on a tracker deal is £121,034.

Based on an average tracker balance, a 0.25 percentage point rise in the base rate would mean a homeowner paying around £25 per month more in mortgage interest, according to UK Finance.

The average fixed-rate mortgage balance is £161,774 while homeowners on their lender’s SVR typically have an outstanding balance of £76,499.

Someone on a typical SVR balance could pay around £16 per month more, assuming the lender passes on the 0.25 percentage point base rate rise in full.

– What can mortgage holders do about the rises?

Rachel Springall, a finance expert at Moneyfacts.co.uk, said: “Borrowers sitting on a variable rate may want to lock into a competitive fixed-rate mortgage deal to protect themselves from rising interest rates, perhaps sooner rather than later as fixed rates rise, with the average two-year fixed rate surpassing 3.00%.

“Fixing for longer may be a logical choice for peace of mind with mortgage payments when other household costs are increasing.”

– Will the rate rise mean better news for cash savers?

After a string of base rate hikes in recent months, savers will be hoping to see the impact on their accounts.

But Ms Springall said the average easy access savings account interest rate has crept up by just 0.20 percentage points since November, from 0.19% to 0.39%.

She added: “There is still room for improvement across the sector, but as rates rise, comparing deals and switching is wise.

“As we have seen before, it can take a few months for customers to see any benefit from a base rate rise but there is no guarantee that savings providers will increase their rates.”

Ms Springall said a 0.25 percentage point increase passed on in full would equate to receiving £50 more a year in interest based on a £20,000 investment.

– Apart from shopping around, is there anything else savers can consider?

Paul Titterton, head of digital at abrdn, suggests some people may want to consider stocks and shares options.

Generally, keeping a cash savings buffer for emergencies is wise, but people looking to the longer term may also consider the stock market, although capital is at risk and people may end up with less than they put in.

Mr Titterton said: “Anyone in a position to put money aside for their future should consider where they save and their attitude to risk. While cash savings are safe, they are impacted by low interest rates and growing inflation. Stocks and shares and investment Isas carry more risk but could potentially provide greater returns in the long term.”

– What could the implications of rising rates be for investments?

Jason Hollands, managing director of Bestinvest, said: “Rising borrowing costs have implications for the way investors assess businesses and in this respect, ‘growth’ companies in sectors like technology and communication services are particularly vulnerable.

“That’s because investors assess these companies primarily on the basis of projections of future earnings, rather than their profits today, so when rising borrowing costs and inflation create greater uncertainty about the future value of money, investors revise their view of what such companies should be valued at.

“On the flipside, some businesses are a lot more resilient to the current environment. Banks can actually benefit from rising interest rates, energy companies are a major component of inflation and some businesses offer hard-to-replicate products and services that customers cannot do without, so are able to pass on cost increases without sacrificing profit margins.

“The UK market has more than its fair share of such businesses and so the UK stock market has held up relatively well so far this year. In the environment we are in, solid companies with conservatively financed balance sheets that are able to churn out attractive dividends should be on investors’ radars.

“In recent years these have often been overlooked by investors as boring, but it is time to take another look.”