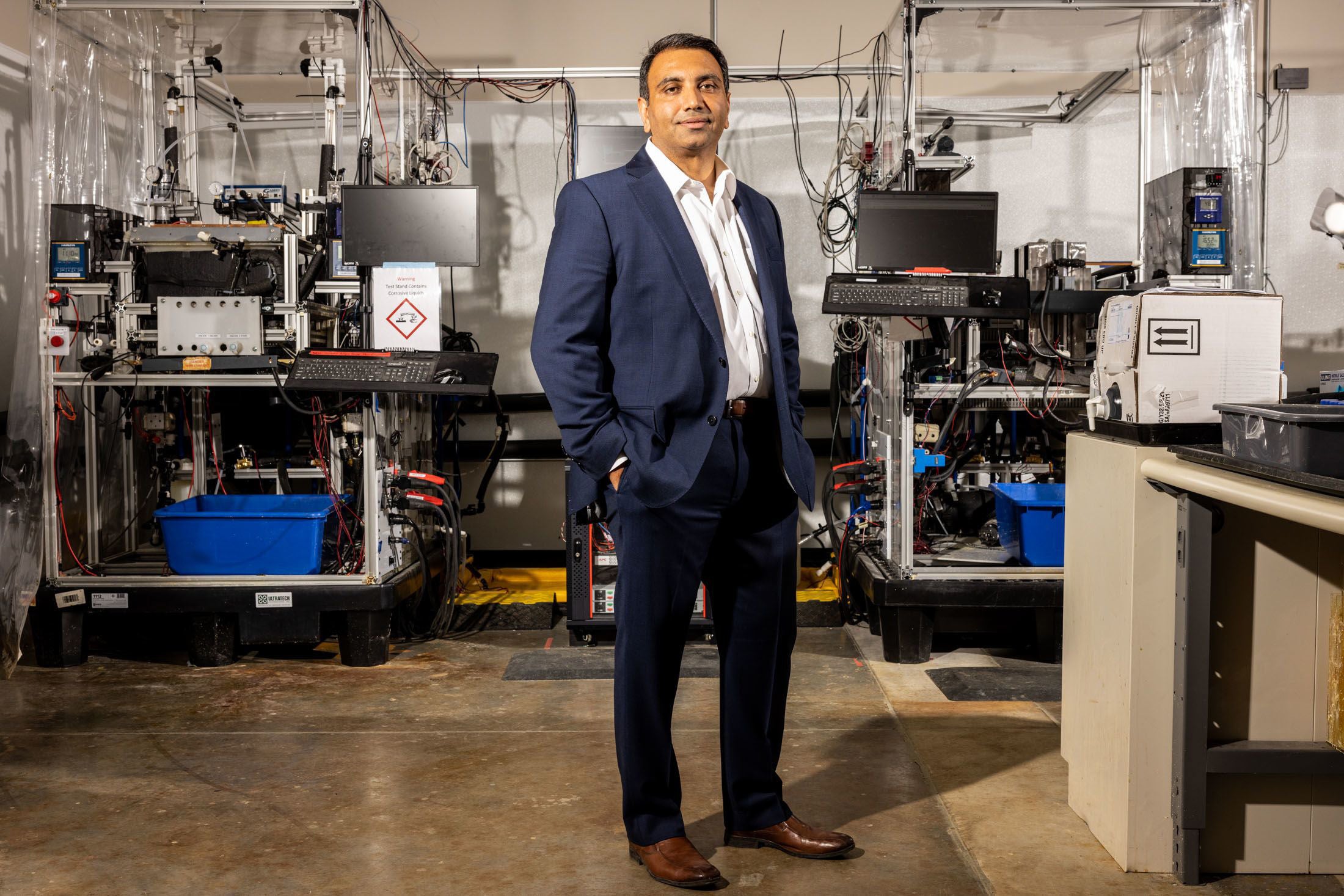

Sandeep Nijhawan brought four business ideas, each addressing rising global temperatures, to his March 2020 meeting with an investor at Bill Gates-founded Breakthrough Energy Ventures. Freshly departed from founding two startups – one on hydrogen, another on batteries – Nijhawan had just seven slides to show. The first pitch in his deck was to make iron without coal, intense heat or emissions, powered by only renewable electricity.

“Let me stop you right there,” BEV investor Dave Danielson told him. “If you could do this thing, then that’s what I would do. I don’t want to hear the next three ideas.”

Iron, of course, makes up 98 per cent of the substance in steel, the ubiquitous material that’s built the modern world. In furnaces heated by coal to more than 1400C, the carbon in coal combines with the oxygen in iron ore to separate out impurities and unwanted oxygen atoms, releasing huge amounts of carbon dioxide.

The iron later goes through a series of steps to be turned into steel, but the iron-creation step accounts for 90 per cent of the greenhouse gas generated. Steel production is responsible for 7 per cent of greenhouse-gas emissions dumped into the air each year – more than the climate impact of shipping and aviation combined. Producing iron at lukewarm temperatures and without coal would skip the most emissions-heavy step without relying on expensive technologies.

That’s why Nijhawan’s idea caught Danielson’s attention: Affordable green steel is a big deal, and could disrupt an industry that generates more than $870bn in revenues each year. With the green light to go ahead and $2.25m from BEV and other investors, Nijhawan started Electra - in stealth mode – to do just that.

Stereotypically for a startup, Electra began its experiments in a garage. Nijhawan’s former colleague Quoc Pham joined as chief technology officer. His first job was to figure out whether it’s possible to dissolve iron ore in water laced with acid.

Failure came within weeks. “I have bad news for you,” Pham told Nijhawan. “This could be the shortest startup of my life.”

To understand what went wrong, let’s look at the three known ways in which you can cut emissions from steelmaking.

First, capture emissions generated by the process and bury them deep underground. The first such plant was built in 2016 in the United Arab Emirates, but thanks to the upfront expense of carbon-capture technology, none have been built since.

Second, use hydrogen as a replacement for coal. The first shipment of steel made using hydrogen was produced last year, but commercial volumes won’t be available until 2026. And since hydrogen made from renewable electricity is still more expensive than coal, companies are forced to use high-grade iron ore, which there isn’t that much of.

“The world is running out of high-grade ores that are available for steelmaking,” says Nijhawan.

Third, use electricity. Metals like aluminium, copper and zinc are made using electricity – admittedly, in much smaller amounts than iron. Until electricity became cheap, it wasn’t economical to think about applying it to iron production.

Once you have a process running at molten-metal temperatures, it has to run 24 hours and 365 days. If it does stop, the ore solidifies and new vats need to be put in place

However, you cannot pass electricity through solid iron ore. One solution is to melt it. That’s what Boston Metal Co, a startup founded in 2012, has done. For the past 10 years, it’s been perfecting and scaling the technology, which works by heating iron ore to 1400C using enough electricity to power thousands of homes, and concentrating it into a metal box not much bigger than a dumpster.

Concentrating that much electricity into such a small area has to be done using special materials. Boston Metal can achieve it using carbon as an electrode – a piece of equipment that allows energy to flow through without itself melting – but that too generates carbon dioxide, defeating the purpose of using green electricity. Boston Metal found an alternative material made up of iron and chromium, but so far it only works on a pilot scale.

Nijhawan didn’t want to melt anything. Once you have a process running at molten-metal temperatures, it has to run 24 hours and 365 days. If it does stop, the ore solidifies and new vats need to be put in place, causing months of delay. So the process had to be “benign from a temperature perspective,” he says – nothing hotter than the temperature at which “coffee is brewed.” That would allow for easy start and stop, and make it possible to rely on intermittent renewables. But making the process work at such a low temperature required Pham to dissolve iron ore in water laced with acid.

“My pitch to all [the investors] was: ‘Look, I don’t know if this can be done. I’ve thought through the problem and asked the experts. I think there’s a feasible path,” Nijhawan says. “All I need is less than 10 people and maybe a year or year and a half to run this thing to the ground.”

He didn’t have to wait that long. Pham went back to the drawing board, read scientific literature and consulted experts, including Dan Steingart, professor of chemical metallurgy at Columbia University. After weeks of trying new experiments, he found a successful workaround.

Electra is now exiting stealth mode, and it refuses to publicly divulge its exact process. However, Nijhawan and Pham shared enough details for independent experts to confirm that what the company claims to do is technologically feasible.

“Electra has managed to pull off a difficult conversion going from iron oxide to iron using only electricity at such low temperatures,” says Venkat Viswanathan, associate professor at Carnegie Mellon University. “The steps they take trick iron to be in just the right state.”

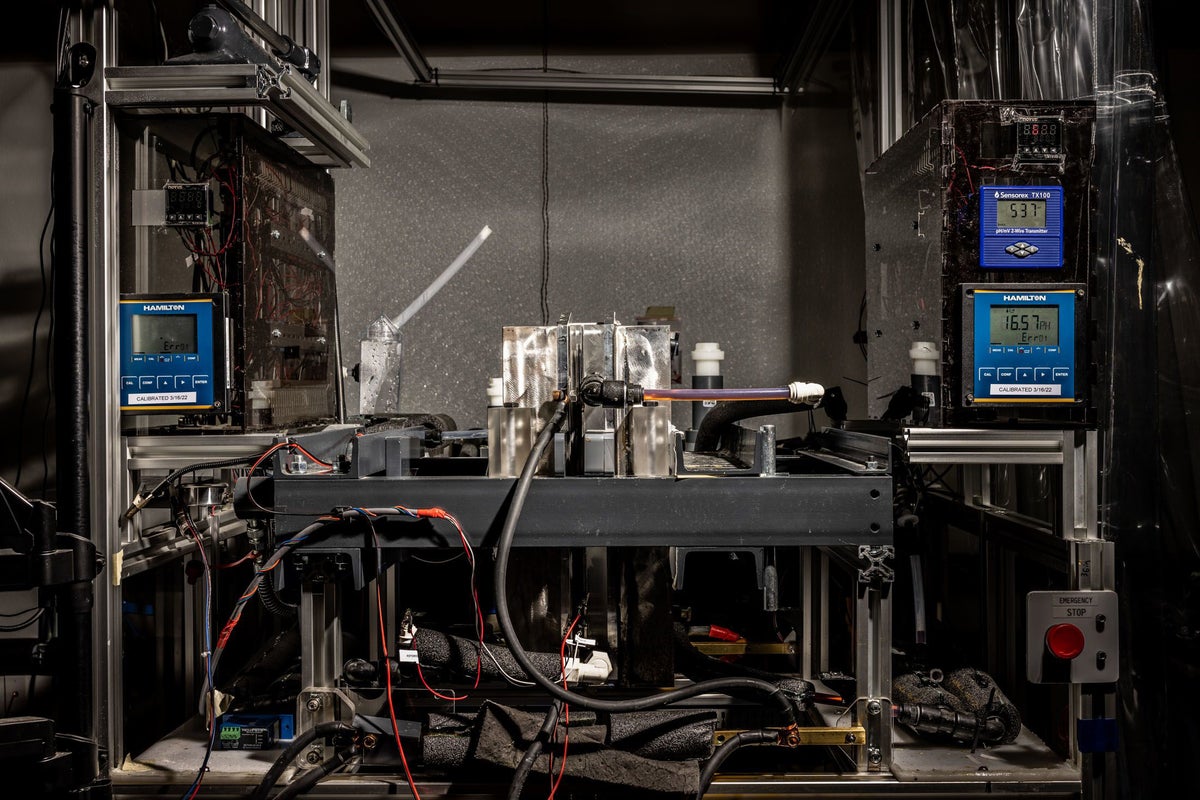

A tour of the company’s Colorado facility also highlights its progress. There’s no coal-fired furnace or molten metal, and lab demonstrations show how iron ore could be dissolved. After the electrical process is run, Electra produces plates the size of office paper with a thick layer of iron metal on them – silvery grey in appearance and surprisingly heavy.

The success of those experiments has helped Electra raise $85m in total from BEV, mining giant BHP Group, Singapore-based fund Temasek Holdings, Amazon Inc and a few other investors. Now it just has to scale up the technology.

Electra is promising to build a facility next year that will have several commercial-sized iron plates; a few years after that, it plans to make thousands of plates in a larger factory. With Swedish steel giant SSAB aiming to make commercial amounts of carbon-free steel by 2026 and Boston Metal promising to produce emissions-free iron by 2026, the race is officially on.

A full-sized commercial Electra plant would be much smaller than conventional steel plants, which can generate 2 million metric tonnes of steel per year, cost more than $1bn, and are so large that entire towns spring up around them. Electra will look to build plants that make only 300,000 tonnes of steel each year, a size that would allow the startup to place itself near existing electric arc furnaces. These furnaces take scrap steel and recycle it, and can also use the iron Electra produces and tweak the process to make add more virgin iron than scrap steel.

Another advantage could be placing Electra plants close to iron ore mines, which are typically located far away from urban centres and near land where renewable power can be built. Electra plants could then process ore into iron on-site while getting rid of all impurities, drastically reducing the volume of material that needs to be transported to a steel plant and further lowering costs.

It might even be Electra’s first commercial application. In coming up with a process to dissolve iron ore, the company has also managed to remove impurities much more easily than conventional steelmaking: at lower temperatures, the impurities don’t chemically react as they would in a furnace at 1600C. The world is sitting on billions of tonnes of low-grade iron ore. It might be possible for Electra to build factories close to those mines, and make existing operations economically viable.

“Do or die in a startup is real,” says Nijhawan. “You don’t have 10 years to develop new science. You have to be in that pressure cooker, to be honest with you, rather than having infinite time available and resources available to see what can be done in a different way.”

Bloomberg’s Christine Driscoll and Oscar Boyd contributed to this report

© The Washington Post