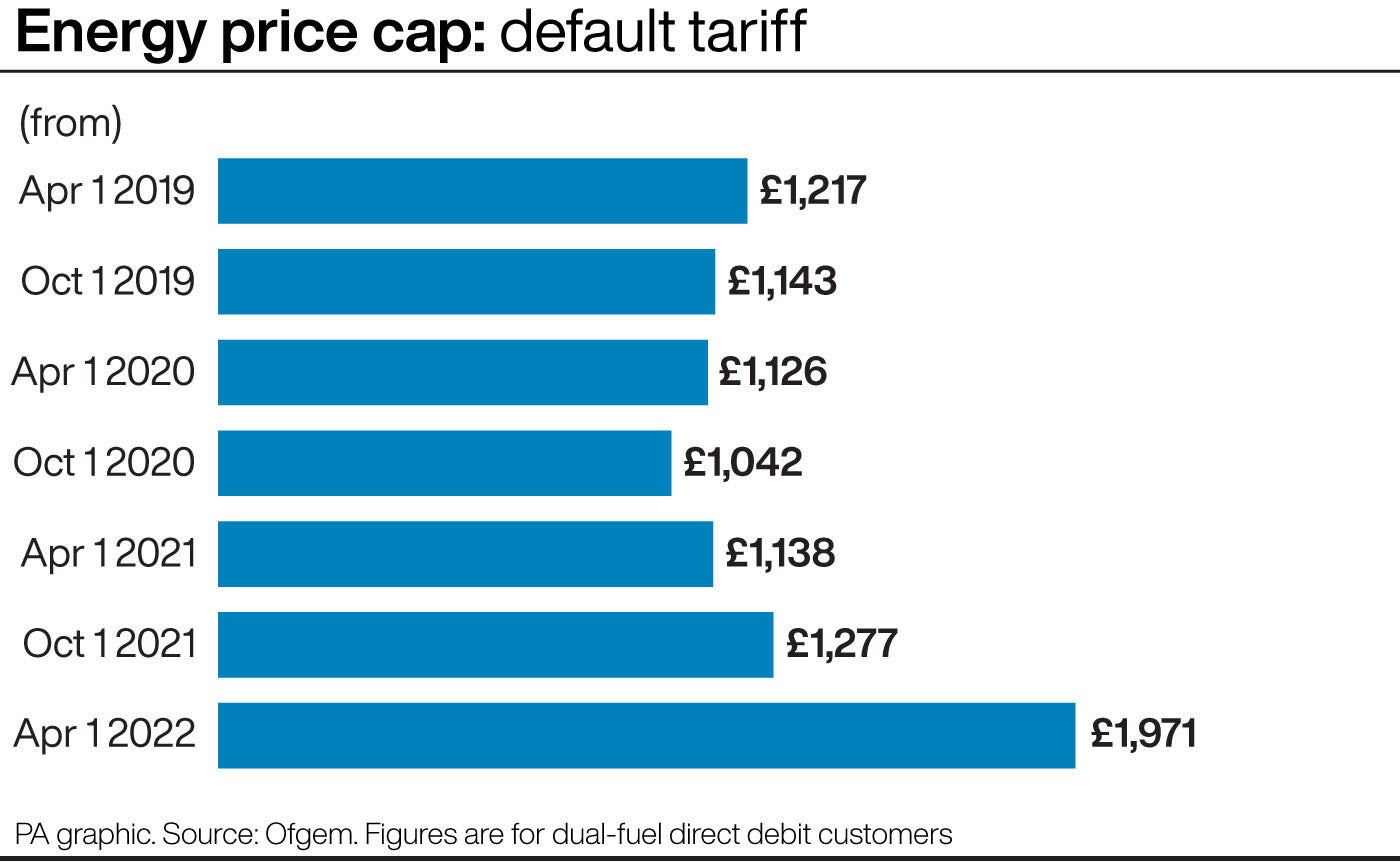

Regulator Ofgem has announced an increase in the price cap for energy prices which will cause a spike in bills for consumers.

Gas prices have been increasing significantly in the last few months, and the change in the price cap could leave many struggling to pay for their heating.

Justina Miltienyte, energy policy expert at Uswitch.com, said: “This is the most difficult energy price hike in recent memory and comes at a time when other essential bills are also being hiked. It’s vital that people stay engaged with what’s happening across all their bills.

“If you’re worried about getting into debt, it is important to contact your supplier as soon as possible. It’s also worth checking what grants and schemes might be available to help cover your energy bills, particularly if you or someone you know is vulnerable.”

Here are some long and short-term options on how to keep your energy usage low and to keep your monthly bills down:

– Call your supplier to see if you can agree a repayment plan

Under Ofgem rules your supplier must work with you on this. You can ask them for a review of your payments and debt repayments, payment breaks or reductions, more time to pay, or access to hardship funds.

You can also ask for the priority service registration, a free support service if you are in a vulnerable situation.

– Check on existing grant schemes from your supplier or the Government

Many suppliers offer grants to help you make your home more energy efficient or for boiler checks and other work.

The Government also offers grants under conditions:

– Winter Fuel Payment: A £100 to £300 fuel payment for people born on or before October 5 1954.

– Cold Weather Payment: A £25 payment for every seven days of very cold weather between November and March.

– Warm Home Discount: A £140 discount for some people getting Pension Credit or some people in low-income households.

– Household Support Fund: A funding package to help vulnerable households this winter. Contact your local council for advice and help on accessing the fund.

– Charities also offer support with bills

The Citizens Advice consumer service can provide advice on how customers can resolve problems with their energy provider. For complex or urgent cases, or if a person is vulnerable, they may then be referred on to the “extra help unit”.

The StepChange Debt Charity also provides support for those struggling financially.

– Make your home more eco-friendly

Improving your insulation, upgrading your boiler and appliances, and installing solar panels or other renewable technologies will reduce your energy bill. However, these are long term, and often costly solutions so looking at grant schemes available will be vital.

– Use less energy in the home

Simple things such as turning off the lights and appliances, doing laundry at 30C, bleeding radiators and having shorter showers can cut your energy usage in the home significantly. This will mean your energy bill will be much lower.

– Get a smart meter

This keeps your bills accurate and will save you the hassle of sending your meter readings regularly. You should still check all your direct debit transactions to ensure they are correct.

– Choose energy-efficient appliances

If you are replacing any items, try to choose energy-efficient versions. The easiest way to check this is looking at its EU energy efficiency rating. You can also check specific appliances with Which?.

According to Which?, an energy-efficient tumble dryer can save you £106 per year, a fridge freezer can save £76 and a washing machine could save £55.

– Draught-proof your house

Use draft proofing strips on your windows, doors, floorboards and skirting to prevent heat getting out.

This will mean you can have your heating on a lower temperature for less time, and still be warm through winter.

Draught-proofing foam strips can also be used on your loft hatches and in a chimney or fireplace to block any gaps.