(Please enjoy this updated version of my weekly commentary published August 22nd, 2022 from the POWR Growth newsletter).

As usual, we will start by reviewing the past week…

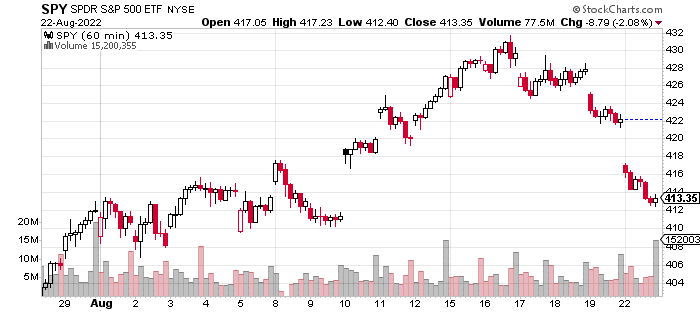

Here is an hourly, 3-week chart of the S&P 500 (SPY):

The week before, we were up 4%. And this week, we are down by a similar amount.

The major reasons were big misses in economic data such as the NAHB which shows homebuilder sentiment and buyer traffic plunging to new lows. This invalidates the thesis of the housing market starting to recover or plateau which is probably necessary for a ‘soft landing’.

We also had a big miss for the Philly Fed report which points to more economic weakening that conflicts with the recent bout of optimism about the economy’s prospects.

Finally, there were blowout inflation reports in Europe. Additionally, the outlook there continues to get worse as evidenced by rising electricity and natural gas prices. This translated into the 10Y yield getting above 3% at which point the market seems to get uncomfortable.

2 Dueling Impulses

As we laid out in the intro, the market is defined by 2 major forces – one bullish and the other bearish.

Bullish: Inflation has peaked and is falling. Even if the Fed doesn’t pivot, it’s a leading indicator of the Fed pivoting. Think about it this way – you are pressing the brakes because of hazardous road conditions and prepared to brake harder if necessary.

But, conditions improve (even if some hazards remain), but you can let up on the brake and are able to relax.

So, you have longer-term rates moving lower over time. The economy has proven itself to be resilient and absorbed 6 months of tighter monetary policy without seriously contracting or having major employment issues.

The economy being not bad is not usually bullish in most circumstances, but it can be when the majority of fund managers are underweight stocks and expecting a recession.

Bearish sentiment and positioning is at major lows that correlate to previous major lows in the market like December 2018, February 2016, etc.

Now, let’s look at the bearish force…

Bearish: Yes, inflation may have peaked, but it’s because the economy is rapidly slowing and plunging into a recession that is not fully captured by leading indicators. This means that we will see more pain for corporate earnings.

After having just regained a modicum of credibility due to its steady dose of rate hikes, the Fed can’t just give it all back, especially if employment continues to be strong.

Gameplan…

On the bearish front, you have a recipe for earnings weakness. On the bullish side, you have falling inflation which will lead to lower rates and bring us closer to economic normalization.

In a vacuum, earnings weakness overwhelms marginal improvements in inflation. But of course, the stock market (SPY) never makes it that easy.

Equally important is what the market expects and how are people positioned. Some expectation of earnings weakness is priced in as evidenced by the number of people in cash and holding short positions.

Additionally, a recession is not a ‘tail risk’ but something that has gone mainstream.

As discussed previously, we want to keep taking advantage of this market rally, fueled by an unwind in sentiment and positioning. Therefore, we will stay bullish above 4,100 and get closer to neutral below these levels.

Market Topics

[In this section, I want to review some topics that we discussed in past commentaries and provide some brief updates.]

Now let’s look at various market topics…

Auto Parts

One silver lining is that auto production is back to full capacity. This has multiple benefits including a boost to economic activity and relief on the inflation front as vehicles make up about 11% of CPI.

This is a sector I like very much over the next couple of years due to what I see as crushed valuations and explosive earnings growth.

Energy

Energy has been interesting, and the market has had considerable divergence.

But, the major headline is oil below $90 which seemed inconceivable a couple of months ago. In fact, many commodities are now below pre-Russian invasion prices.

The major factors are that Russian oil is being bought into the market, Chinese demand is down, and the SPR release. Another potential bearish catalyst would be an agreement with Iran.

On the bullish side, the long-term tightness in the oil market still remains especially if Chinese demand picks up as it should at some point. European prices for electricity and natural gas continue to rise and could cause a crisis in the case of extreme winter.

Finally, it seems unlikely that energy prices won’t start rising if the recovery continues. And at some point, higher energy prices could lead the Fed to shortcircuit the recovery as it was the crux of the inflation problem.

Biotechs

The biotech ETF, IBB, was up nearly 30% until early this week. Since then, prices have pulled back along with other growth stocks.

Although some near-term consolidation is likely, this sector remains my pick for outperformance in the next bull market (regardless of if it started already or we have to wait a few more months).

In fact, it reminds me of energy stocks in the spring of 2020 which is a sector that no one was really interested in and was being ignored by institutions. Biotechs are in a similar place and offer tremendous value, while all the longer-term growth catalysts remain intact.

Travel

Another part of the market that I continue to like is the travel sector. Travel is booming which is clear from the earnings reports of hotels and online booking sites or from anyone who has traveled recently.

In fact, the strength in the sector adds credence to the ‘soft landing’ case as it’s hard to imagine a brutal recession if one part of the economy is booming. Not to mention that there is more potential for growth as the sector remains about a million jobs short of pre-pandemic levels.

What To Do Next?

The POWR Growth portfolio was launched in April last year and since then has greatly outperformed just about every comparable index…including the S&P 500, Russell 2000 and Cathie Wood’s Ark Innovation ETF.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +49.10% annual returns. I then take the very best stocks from this strategy and tell you exactly what to buy & when to sell, so you can maximize your gains.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

SPY shares were trading at $415.18 per share on Tuesday morning, up $1.83 (+0.44%). Year-to-date, SPY has declined -11.94%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles.

How These 2 Dueling Impulses Could Impact the Stock Market StockNews.com