Investors sold off shares in major real estate investment trusts (REITs) sold off after Federal Reserve Chairman Jerome Powell announced Wednesday that benchmark interest rates would go up by 0.75% to 3% and 3.25%.

Many big REITs are dividend-paying securities and are the ones most affected by rate changes. Although this level of rise was widely expected, the reality of it is now having an effect.

The Fed intends to fight inflationary trends by making it more expensive to borrow money. Such tactics directly affect the real estate markets by making mortgages more expensive and lowering the price of underlying properties as buyers begin to stay away.

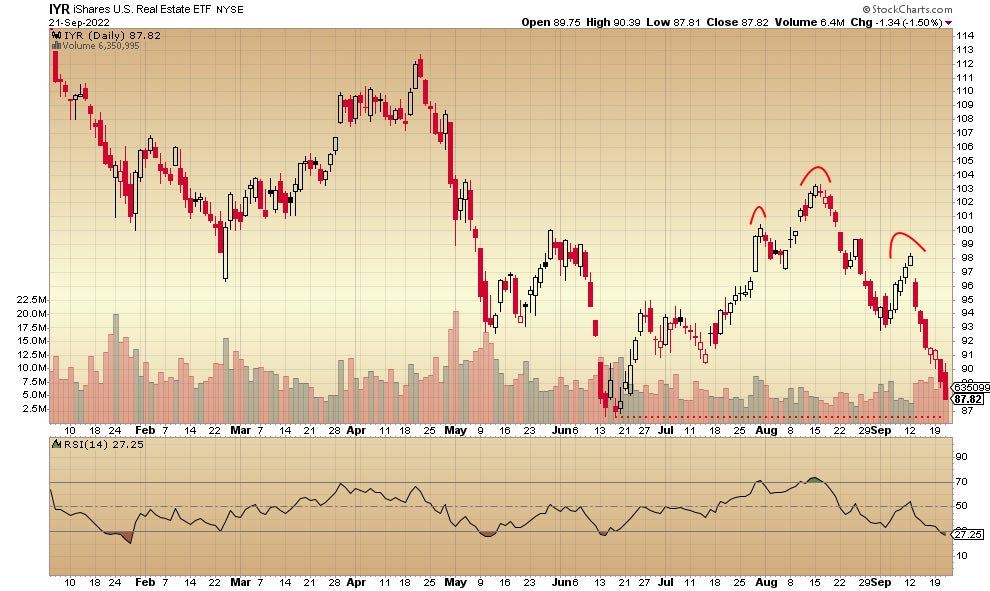

Here’s the daily price chart for the iShares Real Estate Exchange-Traded Fund (NYSE:IYR):

This benchmark for REITs is taking the news hard with a loss at the close of trading of 1.5%. Note how quickly this chart is back into the area of the mid-June lows down there just below Wednesday’s close. Also note the unfortunate appearance of a bearish short-term inverse head-and-shoulders pattern, annotated with the red curves.

The iShares Real Estate Exchange Traded Fund is widely diversified with a total of 80 components, including the majors and a good number of the smaller funds in the sector. Here’s how three of the most widely followed of the REITs closed Wednesday:

American Tower Corp. (NYSE:AMT)

This REIT dropped a little more than the benchmark with a negative 1.55% close. It remains well above the late February low, however, and above the mid-May low. American Tower supports wireless networks with towers and pays a dividend of 2.4%.

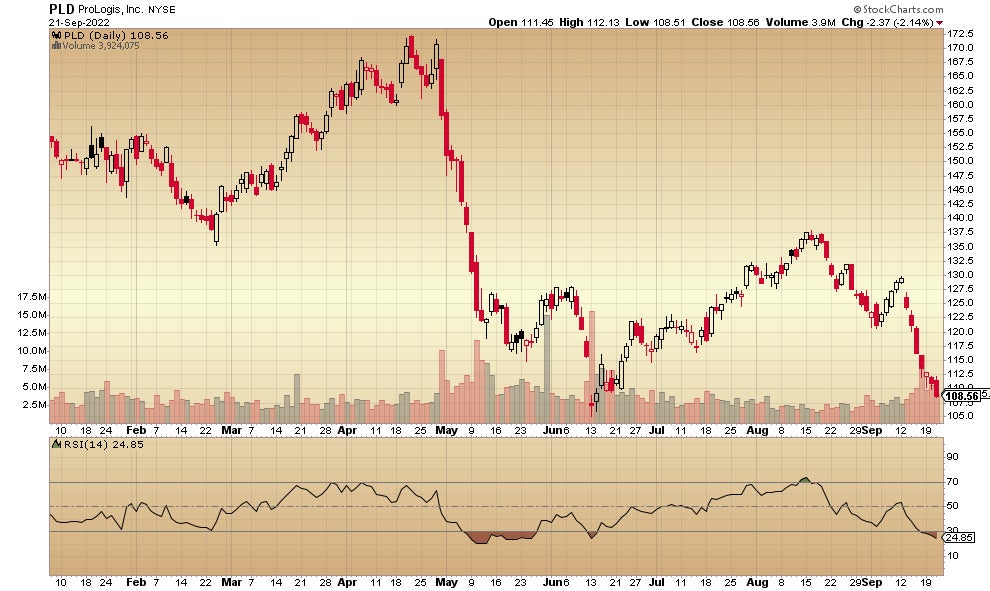

Prologis Inc. (NYSE:PLD)

Wednesday’s loss of 2.14% is significantly greater than the drop of the benchmark. Prologis has had a tough year price-wise, as you can see by the huge sell-off in the April to June time frame. It’s unfortunate for shareholders that the REIT is back into the June low, approaching $105. The company pays a 2.85% dividend.

VICI Properties Inc. (NYSE:VICI)

This is another one of the major REITs that fell by more than the iShares Real Estate Exchange Traded Fund. VICI Properties dropped by 1.75%. The good news is that it remains well above this year’s lows, which were reached mostly in the first quarter at the $25.50 level. The REIT doesn’t seem to be about to test its lows, a different look than the others mentioned here. VICI operates many of well-known Las Vegas resorts and a number of hotels in large cities around the country. It pays a 4.73% dividend.

Read next: This Little Known REIT Has Produced Double-Digit Annual Returns For The Past Five Years

Looking For High Dividend Yields Without The Price Volatility?

Real estate is one of the most reliable sources of recurring passive income, but publicly-traded REITs are just one option for gaining access to this income-producing asset class. Check out Benzinga's coverage on private market real estate and find more ways to add cash flow to your portfolio without having to time the market or fall victim to wild price swings.

Latest Private Market Insights:

- Arrived Homes expanded its offerings to include shares in short-term rental properties with a minimum investment of $100. The platform has already funded over 150 single-family rentals valued at over $55 million.

- The Flagship Real Estate Fund through Fundrise is up 7.3% year to date and has just added a new rental home community in Charleston, SC to its portfolio.

Find more news, insights and offerings on Benzinga Alternative Investments

Not investment advice. For educational purposes only.