Imagine entering an antique store and coming across an old wooden trunk. Your eyes wander to a dusty corner where an old radio sits beside a stack of audio cassettes. Suddenly, you’re transported to a time when these items were cutting-edge technology, a time when their presence in households was commonplace. However, today, these items are deemed obsolete. This nostalgic scene could well be a metaphor for our current process of tracking the Consumer Price Index (CPI) and subsequently calculating inflation. We continue to monitor a basket of goods that includes torches, radios, tape recorders, CDs, DVDs, audio/video cassettes, and trunks, among some 300 other items. Although these have a minimal weight in the overall CPI calculation, we are clinging onto the past, tracking items that no longer hold the same relevance in our consumption patterns.

An evolving basket

The CPI basket should not be viewed as an unchangeable artefact frozen in time. On the contrary, the real consumption basket of a common Indian is fluid and continually evolving, mirroring the shifts in societal needs, preferences, and economic conditions. As time progresses, consumption patterns of individuals and households inevitably change. Technological advancements introduce new products and services.

It is not just these items which make the CPI flawed. In the current CPI (base year 2012), weights of various groups are as follows: food and beverages (45.86); paan, tobacco and intoxicants (2.38); clothing and footwear (6.53); housing (10.07); fuel and light (6.84); miscellaneous (28.32). The weightage of food in the CPI basket has decreased from 60.9 (in 1960) to 57.0 (in 1982) and to 46.2 (in 2001). This gradual decline indicates that as the economy grows, the proportion of income spent on food decreases. This is a common trend known as Engel’s Law, which suggests that as income rises, the proportion of income spent on food falls, even if the absolute expenditure on food rises. Over-reliance on food inflation today distinguishes Indian inflation from many other developed countries where the food weight is much smaller.

These shifts imply that as people’s income rises, they tend to allocate a larger proportion of their spending towards non-food items such as housing, education, healthcare, personal care, entertainment, and digital services such as the Internet. This reflects a general improvement in living standards and a broadening of consumer demands.

Further, the startlingly high weight of 9.67 assigned to cereals in the current CPI is undoubtedly excessive and casts a stark light on two critical issues. First, as nations undergo economic advancement and societal progress, a typical trajectory involves diversifying food intake and embracing a broader range of nutrient-rich options beyond cereals. This paradigm shift in dietary habits would have undoubtedly manifested over the past decade, diluting the relative expenditure on cereals. Second, the Pradhan Mantri Garib Kalyan Yojana has substantially reduced cereal expenditure for a large segment of the populace. It has likely led to modifying consumption patterns and further reducing the relative expenditure on cereals.

There are other examples. Ashok Gulati has written about how tomatoes, onions and potatoes have a considerably higher impact on inflation. It should be lower. The currently soaring tomato prices will disproportionately affect the CPI.

Consumption expenditure

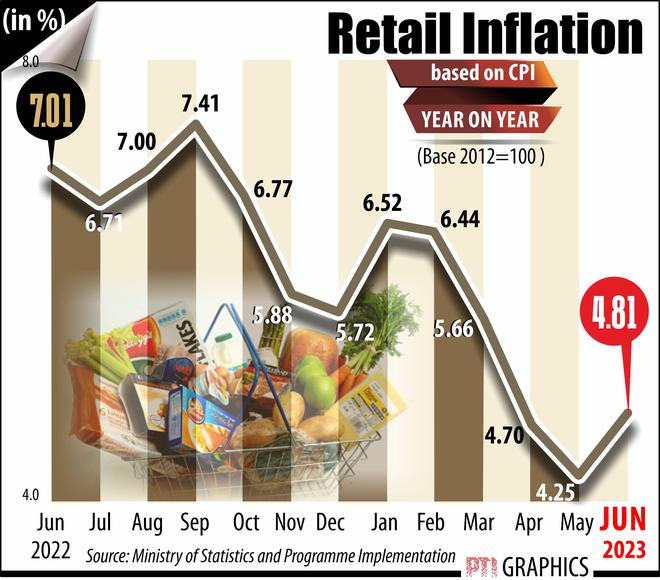

While it’s essential to comprehend the evolution of consumption patterns with growing economic prosperity, the challenge lies in effectively reflecting these changes in our inflation metrics without access to up-to-date consumption expenditure data. Weights for CPI can only undergo a significant shift after we have data from the Household Consumption Expenditure Survey (CES) data. Currently, the Ministry of Statistics and Programme Implementation (MoSPI) is in the midst of the CES, with the first round slated to conclude in July 2023 and the second round a year later, in July 2024. The Ministry will require an additional three to six months to process the collected electronic data. However, one should be perturbed with such long processing times in this digital age. Nevertheless, even when the CES results are finally published around December 2024, the creation of a new CPI based on this fresh data will consume several more months.

Therefore, we find ourselves in a predicament: we will rely on archaic parameters such as DVD players and trunks for at least the next two years to gauge our inflation. This isn’t merely a theoretical challenge; it’s a question of how accurately we are measuring the cost of living and economic well-being. In a rapidly evolving digital economy, our data collection and inflation estimation methods must adapt and evolve in tandem to ensure they accurately reflect the realities of modern-day consumption and living.

The absence of CES has spawned a slew of issues. We’re unable to determine the population under the poverty line accurately, and our ability to track inflation effectively has been severely undermined. Our tools for understanding and managing our economic reality are grossly inadequate. Consequently, it’s an absolute necessity for MoSPI to address these gaps promptly. Additionally, efficient data processing should be a non-negotiable priority. Lastly, for MoSPI to sit indefinitely on the findings of different surveys is an abdication of responsibility that India can ill afford.

Bibek Debroy is Chairman of the Economic Advisory Council to the Prime Minister; Aditya Sinha is Additional Private Secretary (Policy & Research), Economic Advisory Council to the Prime Minister