In the last five years, numerous CEOs and other top executives have been investigated and prosecuted by the Securities and Exchange Commission (SEC) and the Department of Justice (DOJ) for trading in the securities of their companies. The government has ramped up its onslaught on the C-suite as the SEC and DOJ recently announced the first-ever prosecution of a CEO for insider trading based on an executive’s use of a 10b5-1 trading plan, a good faith defense in the federal securities laws, specifically designed to protect executives against insider trading allegations. The government has also reportedly launched investigations into trading by former Silicon Valley Bank executives in connection with the avoidance of millions of dollars in losses through 10b5-1 plans before the bank’s collapse.

Rule 10b5-1 plans allow executives to buy and sell their company’s stock without violating insider trading laws because trades are executed according to a predetermined plan, rather than by the insider directly.

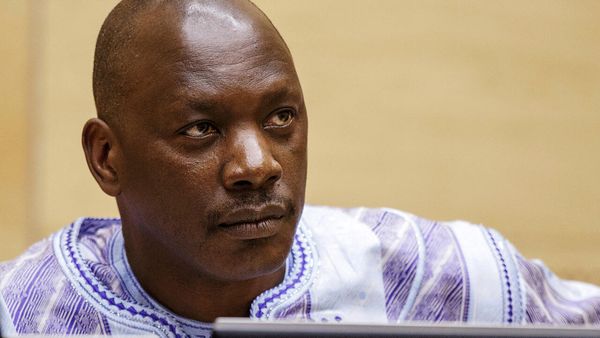

While these plans used to be safe harbors for executives, the government has begun treating them as red flags for investigation. In a press release, the DOJ noted that the recent prosecution of Terren Peizer, the CEO and Executive Chairman of healthcare treatment company Ontrak, was not random, but rather the result of a targeted “data-driven initiative led by the Fraud Section to identify executive abuses of 10b5-1 trading plans.” This is a stunning admission that the government was not just monitoring market activity but also actively targeting executives who were merely taking advantage of a statutory defense.

Going forward, if an executive establishes a 10b5-1 plan, makes a trade pursuant to that plan, and makes a considerable profit or avoids a loss, that transaction will be investigated. These plans can still be effective, but they must be carefully designed with an awareness that the government will be watching and second-guessing your motives.

Rule 10b5-1 plans have been in the government’s crosshairs for years, with SEC Chairman Gary Gensler remarking in June 2021 that “these plans have led to real cracks in our insider trading regime.” Following the Peizer indictment, DOJ officials expressed similar sentiments, with Assistant Attorney General Kenneth Polite recently warning that “other such cases will follow.” As the government continues its unprecedented scrutiny of 10b5-1 plans, executives need to be aware that they make for convenient targets, particularly when making large profits or avoiding major losses. However, knowing that you are a target is the first step in avoiding trouble down the road and building a winning defense.

The Peizer prosecution gives us some insight into what the government is looking for as they crack down on 10b5-1 plans. Peizer was criminally charged with securities fraud and insider trading, with similar civil charges filed by the SEC. According to the indictment, Ontrak’s biggest customer informed the company in May 2021 that would be terminating its contract with Ontrak. When the company disclosed the termination of that contract several months later, Ontrak’s stock price suffered a major decline.

Peizer allegedly set up the first of two defensive 10b5-1 plans in early-May 2021, when he knew the contract was at serious risk of being terminated. The initial broker Peizer approached informed him that a cooling-off period was required before he could trade stock. Instead of following this broker’s advice, Peizer contacted another broker that did not require a cooling-off period. Peizer entered into a second 10b5-1 plan in August 2021, approximately one hour after being informed that the contract would likely be terminated. Peizer allegedly certified that he did not possess material non-public information when he executed both plans, despite knowing of the high likelihood that this contract would be terminated.

The SEC’s civil enforcement action against Peizer was filed shortly after the SEC adopted amendments updating Rule 10b5-1. These amendments make it more difficult to use 10b5-1 plans effectively and include longer cooling-off periods before executives may start trading as well as cumbersome enhanced disclosure requirements.

The same approach used in the Peizer prosecution could be employed against former executives of Silicon Valley Bank. The SEC and DOJ are reportedly investigating sales of SVB stock by former executives. Many of the trades–some of which occurred only days before the collapse–were executed pursuant to 10b5-1 plans. The recent high-profile failures of publicly traded banks such as SVB and Signature Bank raise the issue of enhanced risk for bank executives where the bank’s stock drops after the establishment of a 10b5-1 plan. In such cases, prosecutors and regulators can come under extreme pressure to pursue executives who avoided major losses under a 10b5-1 plan. Questions of what executives knew and when they knew it may draw both banks and individuals into lengthy and costly investigations.

These recent developments make it clear that the government is focused on efforts by executives to evade insider trader laws by using 10b5-1 plans. As has been demonstrated by countless prosecutions and enforcement actions, insider trading penalties can be incredibly harsh. In addition to the heightened risk of civil or criminal liability, such plans are more likely to become public going forward, either as a result of companies seeking to appear more transparent or as a result of new legislation.

Although the DOJ and SEC have their sights set on executives who use these plans, 10b5-1 plans can still be effective and safe, provided that they are designed with expert legal advice to withstand the extraordinary scrutiny we are currently seeing. Companies and executives should have these plans reviewed by an external attorney who can testify to the executive’s good faith when he or she entered the plan. While this kind of review may seem burdensome, it is far less onerous than the risk of facing dual criminal and civil actions, like those Peizer is currently facing. Companies and executives would be well advised to err on the side of caution as the government increases its scrutiny of 10b5-1 plans.

John Carney is a partner with BakerHostetler and serves as the firm’s White Collar, Investigations and Securities Enforcement and Litigation team co-leader. He is a former securities fraud chief, assistant US attorney, US Securities and Exchange Commission senior counsel, and CPA with extensive experience in defending insider trading, accounting and disclosure cases.

Lauren Lyster and Alexandra Karambelas are associates with BakerHostetler’s White Collar, Investigations and Securities Enforcement and Litigation team.

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.

More must-read commentary published by Fortune:

- The ‘Elon Paradox’: He sells Teslas–but you’d expect him to drive a Ram. Here’s what your car says about your politics

- The alt-right economy is failing. Here’s the real performance of anti-woke entrepreneurs

- Asana CEO: ‘The way we work right now will soon look vestigial. Here’s how A.I. will make work more human’

- Why picking citizens at random could be the best way to govern the A.I. revolution