NEW DELHI: The Pakistan government is trying its best to secure a deal with the International Monetary Fund (IMF) for the release of a critical bailout package, failing which it can slump into default.

The full-blown economic turmoil being faced by the country has fuelled further due to its recent and biggest ever currency devaluation, soaring inflation and a record low foreign exchange reserves.

The country is undergoing measures to increase its revenues despite multi-decade high inflation of 27%, with roughly enough forex to meet 3 weeks of imports.

In a bid to secure the funds from IMF, the country has removed artificial caps on their rupee resulting in it shedding more than a quarter of its value, fuel prices have jumped by almost a fifth and are expected to rise further, and the key policy rate has been hiked.

Negotiations with the IMF are about to resume soon amid this wrenching economic crisis.

The government has banned all but essential food and medicine imports until a lifeline bailout is agreed with the IMF.

Another 'petrol bomb'

People in Pakistan faced yet another "petrol bomb" as the government opted for a historic price hike in the prices of petrol and gas in an attempt to appease the IMF for unlocking the critical loan tranche for the cash-strapped country.

The “petrol bomb” as the price hike is termed these days, was dropped around Wednesday midnight.

As a result, a litre of petrol now costs 272 rupees, after an increase of 22.20 rupees. The price of the high-speed diesel (HSD) hiked by 17.20 rupees, kerosene by 12.90 rupees and light diesel oil (LDO) by 9.68 rupees. The new price of HSD will cost 280 rupees per litre. Kerosene will be available at 202.73 rupees whereas LDO will be sold at 196.68 rupees per litre.

The increase in the price of petroleum products was one of the preconditions of the Washington-based lender, which will lead to a hike in the already record-high inflation, coupled with the new fiscal measures undertaken through the 'mini-budget'.

The latest hike came within a span of les than 20 days. On January 29, Pakistan finance minister Ishaq Dar had announced a 35 rupees increase in prices of petrol and diesel. The price revision went into effect within 10 minutes of his announcement.

According to Dawn's report, Dar recalled that in the last 4 months (October 2022 to January 29, 2023), the price of petrol was not increased.

“Despite international prices and rupee devaluation, on directions of Prime Minister Shehbaz Sharif, we have decided to increase the minimum price of these four products.

The price hike was criticised by opposition parties, who termed it as a "total mismanagement".

The increased prices are sure to put additional burden on the masses, who are already reeling under pressure due to soaring inflation in the country.

1/10:Inflation at 27%, petrol at Rs 272: All you need to know about economic crisis in Pakistan

Agencies

2/10:Economic crisis deepens

<p>Cash-strapped Pakistan economy is in dire states with plunging currency, soaring inflation, a balance of payments crisis, diminishing forex reserves all amid political chaos and a deteriorating security situation.<br /></p>Agencies

3/10:Fears of bankruptcy

<p>Pakistan has plunged into one of its worst economic crisis since its formation in 1947 and experts have sounded alarmed regarding the financial crisis in the country amid fears that the nation could go bankrupt.<br /></p>Agencies

4/10:Rising inflation

<p>The consumer price index rose 27.5% year-on-year in January, its highest in nearly half a century.<br /><br /></p>Agencies

5/10:Low-income households under extreme pressure

<p>Low-income households could remain under extreme pressure as a result of high inflation on account of being disproportionately exposed to non-discretionary items.<br /></p>Agencies

6/10:Long queues at fuel stations

<p>Long queues of automobiles and motorcycles were witnessed at filling stations in Pakistan's capital city of Islamabad and the Khyber Pakhtunkhwa province due to reduced supplies by oil marketing companies.<br /></p>Agencies

7/10:Petrol costs Rs 272 per litre

<p>Pakistan government hiked petrol price in the country by another whopping Rs 22 a litre on Thursday. Petrol now costs Rs 272 per litre, high-speed diesel will now cost Rs 280 a litre after an increase of Rs 17.20.</p>Agencies

8/10:Fuel supplies cut down

<p>According to petrol dealers, companies cut down supplies of petroleum products to the province over long delays in the issuance of letters of credit by private banks for imports.</p>Agencies

9/10:Debt-to-GDP ratio in a danger zone of 70%

<p>With Pakistan's debt-to-GDP ratio in a danger zone of 70%, and between 40% and 50% of government revenues earmarked for interest payments this year, only default-stricken Sri Lanka, Ghana, and Nigeria are worse off.<br /></p>Agencies

10/10:Food shortage

<p>A new report from the World Bank has revealed that an alarming six million people in Pakistan are currently experiencing acute food insecurity as a result of the devastating floods that hit the country last year. <br /></p>AgenciesA report by ANI suggested petrol is severely in limited supply in several cities of Pakistan. The majority of the gas stations are shut. Few are open, and those that only offer a little quantity of gasoline. At these gas stations, there are long lines of cars and bikes.

Notably, the oil companies of Pakistan are on the verge of 'collapse' due to a reeling economic crisis and devaluation of the currency. Pakistan is experiencing a balance of payments problem, and the falling value of the rupee is raising the cost of imported commodities.

U-turn on fuel imports

The government has now decided to reverse a long-haul strategy to import more fuel including liquified natural gas (LNG) in attempt to boost domestic energy sources.

In the last few years, Pakistan has struggled to secure LNG in the spot market owing to rising prices and limited supply. It has also failed to sign long-term deals to ensure future deliveries, threatening years of shortages.

As per a Bloomberg report, Pakistan will not build any new power plant that relies on imported coal, LNG or fuel oil over the next decade.

It will instead look to increase its domestic power capacity including solar, wind, locally-mined coal, hydro and nuclear, said the official, who requested anonymity to discuss details that aren’t yet public, the report said.

The country’s reliance on energy imports coupled with a financial crisis made it especially vulnerable to shortages exacerbated by Russia’s war in Ukraine. Unable to afford soaring LNG cargoes, it has suffered frequent electricity blackouts and has had to ration fuel.

No respite from inflation

The weaker rupee, which is plumbing record lows, is adding to imported inflation while domestically high energy costs on the back of tariff increases and still elevated food prices is likely to keep inflation high.

Last month, the central bank raised its key interest rate by 100 basis points (bps) to 17% in a bid to rein in persistent price pressures. It has raised the key rate by a total of 725 bps since January 2022.

The consumer price index rose 27.5% year-on-year in January, its highest in nearly half a century.

Low income households could remain under extreme pressure as a result of high inflation on account of being disproportionately exposed to non-discretionary items.

Unemployment fears loom

According to a Bloomberg report, Pakistan business chiefs are clamouring for the cash-strapped government to allow manufacturing materials stuck at the key port of Karachi into the country, warning that a failure to lift a ban on imports will leave millions jobless.

Industries such as steel, textiles and pharmaceuticals are barely functioning, forcing thousands of factories to close and deepening unemployment.

The steel industry has warned of severe supply-chain issues caused by a shortage of scrap metal, which is melted down and turned into steel bars. In the past few weeks, the bars have reached record prices.

Finance bill proposes to raise GST

Pakistan laid a supplementary finance bill before parliament on Wednesday, proposing to raise the goods and services tax (GST)to 18% from 17% to help raise 170 billion rupees ($639 million) in extra revenue during the fiscal year ending July.

The bill set before Parliament by finance minister Ishaq Dar proposed the exemption from the GST rise of "daily use" items such as wheat, rice, milk and meat, to reduce the impact of the budget on those most vulnerable to rising inflation.

It also proposed to raise taxes on luxury items to 25%, while hikes in taxes on first- and business-class air travel, cigarettes and sugary drinks were also proposed.

The government has also proposed an adjustable withholding tax on marriage halls and events at 10%.

Fitch downgrades rating

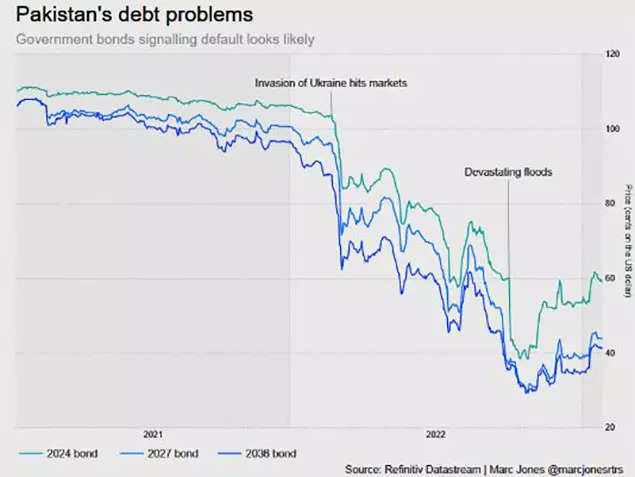

Ratings agency Fitch has downgraded Pakistan's long-term foreign currency issuer default rating (IDR) to ‘CCC-' from ‘CCC+', citing further worsening in liquidity and policy risks.

The downgrade reflected a sharp deterioration in external liquidity and funding conditions, along with decline of foreign exchange (FX) reserves to “critically low levels," Fitch said.

“Falling reserves reflect large, albeit declining, current account deficits (CADs), external debt servicing and earlier FX intervention by the central bank, particularly in 4Q22, when an informal exchange-rate cap appears to have been in place.

“We expect reserves to remain at low levels, though we do forecast a modest recovery during the remainder of FY23, due to anticipated inflows and the recent removal of the exchange rate cap,” the agency said.

(With inputs from agencies)