Hurricane Milton is set to make landfall on Wednesday between Cedar Key and Naples, Florida, threatening significant damage along the Gulf Coast. The region is still reeling from Hurricane Helene, which claimed at least 234 lives and caused over $30 billion in property damage, according to CoreLogic, a real estate information services provider. Despite expensive emergency aid programs, too many Americans remain in dire straits. Instead, policymakers would be wise to consult the teachings of Nobel laureate economist Milton Friedman: "you don't let prices rise, you destroy the system…which coordinates the activities of different people."

It's understandable to call for government assistance when faced with the havoc wreaked by natural disasters. But the government is just one kind of human institution—one that often lacks sufficient information to help people. To deliver disaster victims the goods and services they desperately need, it's better to rely on market mechanisms.

In the early and mid-20th century, so-called market socialists Oskar Lange and Abba Lerner argued that centrally planned economies are theoretically more efficient than capitalism. But Ludwig von Mises and Friedrich Hayek disabused technocrats of such fatal conceits, winning the calculation debate and elucidating the knowledge problem. The historical record has empirically substantiated the superiority of markets to create, allocate, and innovate.

"But," the stubborn statist objects, "markets only work under normal conditions; in emergency situations we need the government to resolve the crisis." While such arguments are politically popular, they are economically vacuous.

The state does not become omniscient during times of crisis and the price system that conveys information about local circumstances is especially useful during such times. Recognizing their lack of knowledge, governments should adopt the following laissez faire policies to allow those with the know-how to recover from disaster.

Before: Don't create moral hazard

The federal government should not distort the single most reliable signal of risk: homeowners insurance. By subsidizing the premiums of insurance in Special Flood Hazard Areas (SFHA) through the National Flood Insurance Program, the Federal Emergency Management Agency (FEMA) has shielded residents from the expected consequences of living in disaster-prone areas.

During: Don't impose price ceilings

Economist George Horwich argues that post-World War II West Germany and Japan show the salutary effects of markets in the aftermath of disasters because the economic and human devastation suffered during wartime is analogous to that imposed by natural disasters. Notably, recovery in West Germany and Japan "began only with the removal of price ceilings imposed during the wartime inflations," says Horwich.

Increased prices for gas throughout the Gulf Coast during Hurricane Katrina "attracted imports of gasoline from overseas," increasing supply and lowering prices, explains the Foundation for Teaching Economics. Imposing price controls denies consumers the ability to express "their preferences and denies producers the information" they need to allocate their goods to their highest-valued use, Horwich concludes.

After: Suspend rent controls

In the aftermath of a domicile-destroying disaster, one of the most important things to do is house the homeless. To incentivize the construction of new apartments, condos, and single-family houses, policies should be adopted that increase expected returns. The simplest way to do this is eliminating rent controls that "inhib[it] the rapid market-wide expansion and sorting out of the remaining housing stock," Horwich explains.

The absence of rent controls alone enabled the rapid rebuilding of San Francisco following the earthquake of 1906 that killed 3,000 residents and destroyed 80 percent of the city's buildings. Following a 1985 earthquake, Mexico City did not witness the same recovery thanks to a 1947 rent control law that "left owners of nearly a square mile of real estate [with] no incentive for repairing it," per Horwich.

The laws of supply and demand do not disappear in the event of a disaster: Markets still direct resources to their highest-valued use while encouraging their conservation—exactly what needs to be done in response to supply shocks.

While high prices do prevent some from buying what they need, scarcity, though tragic, is inevitable in the immediate aftermath of a disaster. Government-imposed price controls perpetuate the shortage while market prices incentivize entry and expand supply. The government should avoid scrambling the very signals that allow consumers and producers to recover from devastation.

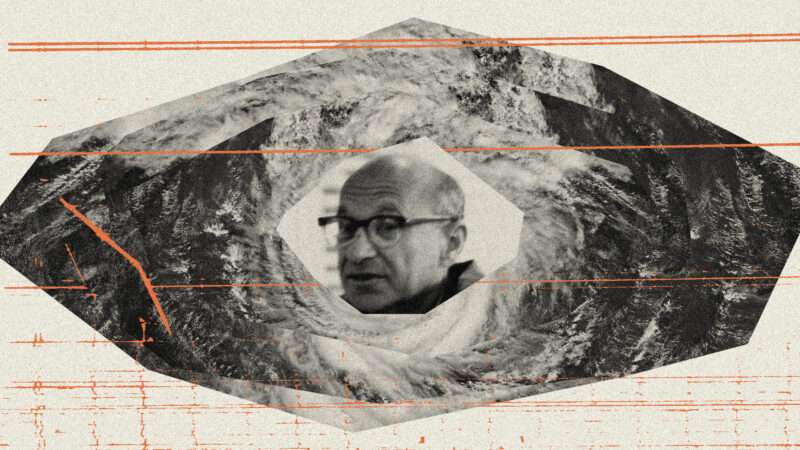

The post How Milton Friedman Can Help Us Get Through Hurricane Milton appeared first on Reason.com.