Medigap, also called Medicare Supplement Insurance, is additional insurance you can buy from private health insurance companies to help pay the out-of-pocket costs, such as copays and deductibles, associated with original Medicare. You must have original Medicare, Part A, and Part B, to buy a Medigap policy. Medicare Advantage plan participants can't buy Medigap insurance.

A Medigap policy pays out after both you and Medicare have paid your share of the medical costs. However, unlike Medicare, there are circumstances when insurance companies factor in preexisting conditions when deciding whether to offer you a Medigap policy or when setting premiums. In some cases, Medigap will also cover emergency medical expenses if you travel outside of the U.S.

Although there are ten Medigap plans available — A, B, C, D, F, G, K, L, M, and N — some of these plans (C, F, E, H, I and J) are no longer available to new enrollees in Medicare. However, if you are already enrolled in one of these plans, you can keep it for now. If you were eligible for Medicare before January 1, 2020, you can still buy Plan C or F.

Medigap open enrollment only happens once

You get a six-month “Medigap Open Enrollment” period that starts the first month you have Medicare Part B and you’re 65 or older. During this period, you have what is called 'guaranteed issue rights' that protect you from denial of coverage for preexisting conditions and higher premiums. An insurance company can’t use medical underwriting to decide whether to accept your application or upwardly adjust your costs.

Keep in mind that after your Medigap open enrollment period is over an insurer can deny you coverage if you don’t meet their medical underwriting requirements, and you may have to pay more and there may be fewer options for you to consider.

Remember, the Medicare open enrollment period is October 15 to December 7.

How preexisting conditions can affect your Medigap eligibility

Many people don’t realize that even though preexisting conditions can’t affect your ability to get other types of health insurance, such as Medicare, the rules are very different for Medigap policies.

You can pick any Medigap plan available in your area within six months after you initially sign up for Medicare Part B. But after that, Medigap insurers in almost all states can reject you or charge more based on your health.

It can be challenging to switch to another insurer with better Medigap rates or if you had a Medicare Advantage plan for more than a year and want original Medicare and a Medigap policy instead.

You may also buy a Medigap policy without concern about preexisting conditions if you move out of your Medicare Advantage plan’s service area or change your mind within 12 months of signing up for Medicare Advantage at age 65. For more information, see Medicare's When Can I Buy Medigap?

Also, your insurer may let you switch to a less-comprehensive policy regardless of your health (such as switching from a Plan G to a high-deductible Plan G). See the Medicare Rights Center’s list of what each type of Medigap policy entails.

By the way, if you currently have a Medicare Advantage Plan, it’s illegal for someone to sell you a Medigap policy. But if you are considering switching to original Medicare, you can change plans during the Medicare open enrollment period each year.

States where insurers can't deny Medigap coverage after your initial enrollment period

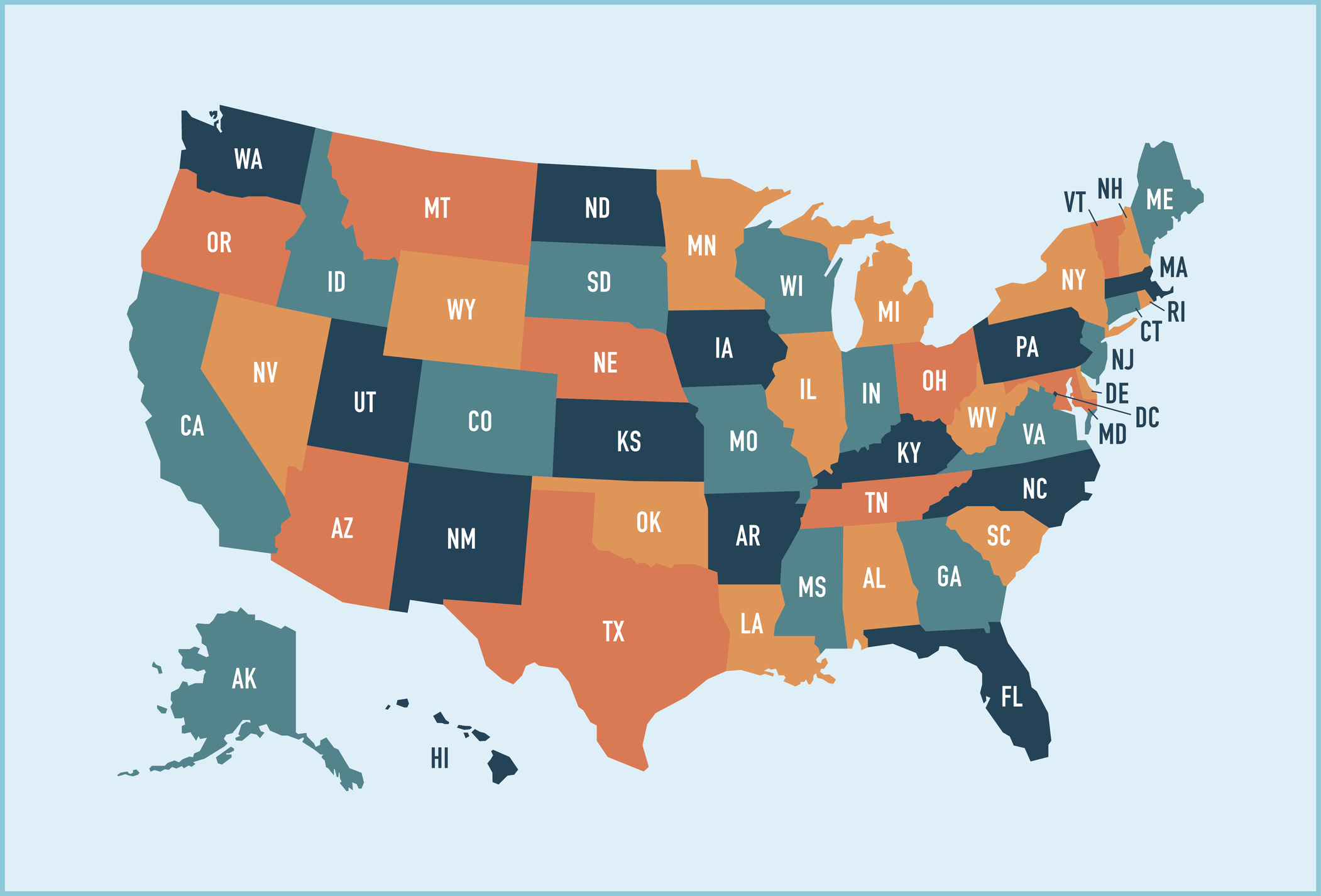

Four states — including Connecticut, Maine, Massachusetts and New York — have special rules that let residents switch Medigap plans regardless of preexisting conditions. These states require Medigap insurers to offer polices to beneficiaries age 65 and over on a contingent or annual basis.

The birthday rule. Other states waive underwriting requirements and permit you to change plans at certain times. For example, if you live in California, you can select a different Medigap plan that has the same or fewer benefits if you make a decision to change within 30 days after your birthday each year.

In addition to California, there are eleven other states that have a Medigap birthday rule: Idaho, Illinois, Kentucky, Louisiana, Maryland, Nevada, Oklahoma, Oregon, Utah, Virginia and Wyoming all have a form of the birthday rule. In 2026, a birthday rule will take effect in Indiana.

Some states allow Medicare participants to change plans during a specified window of days around their birthday. Some limit beneficiaries to keeping the same plan, but allow them to sign up with a different insurer. If you live in one of those states, check with your local SHIP office (State Health Insurance Program) to determine how long you have to make a change to your Medigap coverage.

The Medicare Select exception

In some states, it's possible to buy another type of Medigap policy called Medicare SELECT. A person with a Medicare SELECT policy is required to use hospitals or healthcare professionals within a specific network to get the maximum benefit from their plan’s benefits. Outside of emergency treatment, enrollees who use out-of-network hospitals or doctors will likely be liable for some or all of the costs that Medicare does not pay.

If you later decide that you don't like being limited to the network or want or think Medigap is better, you are allowed to switch to a standard Medigap policy within 12 months.

Resources to help find a Medigap policy

For more information about your state’s rules, check out www.naic.org/map. Most states have consumer guides that list Medigap prices and provide information for seniors searching for a plan. Your State Health Insurance Assistance Program can also help. See www.shiptacenter.org to find your state SHIP.