The bear market has been rattling the stock market since the start of the year. However, the same cannot be said for McDonald’s (MCD) stock.

While the S&P 500 is down 17% on the year, McDonald’s is actually up 2.5% so far in 2022. Over the last 12 months, the index is down 15% while shares of the Golden Arches are up 9.5%.

Further, McDonald's stock was hitting all-time highs earlier this month until a three-day pullback sent it lower.

The stock has outperformed Wendy’s (WEN), Yum! Brands (YUM) and Restaurant Brands International (QSR) — the owner of brands like Burger King and Tim Hortons — this year and over the last 12 months.

With its 2.25% dividend yield and McDonald's outperformance vs. the overall market and its peers, I think the stock is worth a second look.

Trading McDonald’s Stock Back to All-Time Highs

Chart courtesy of TrendSpider.com

If investors would look away from growth, tech and FAANG stocks, they might realize that there are some strong stocks in the market. McDonald’s has been one of them, but there have been many others as well.

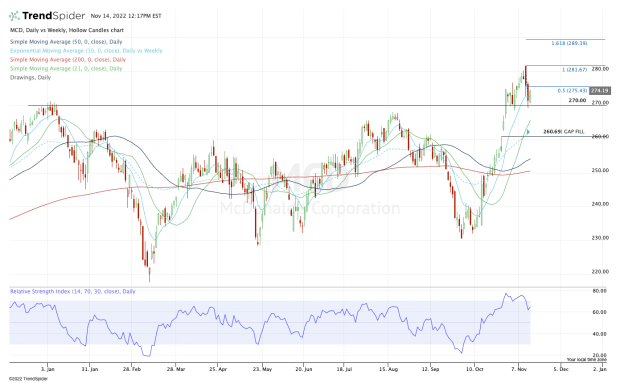

When looking at the daily chart above, notice how McDonald’s exploded higher in mid-October, then went an entire month without testing its 10-day moving average.

That’s incredibly strong price action — particularly as it came at a time where the market was not doing all that well.

In any regard, McDonald’s gave traders a bearish engulfing candle, as it opened above the prior day’s high and closed below the prior day’s low. That set up a multi-day correction where we got a test of the 10-day moving average and a retest of the prior highs near $270.

While the stock wavered a bit, holding this short-term moving average and prior breakout area is a key development for longs.

From here, let’s see how shares handle the $275.50 to $276 area, which is the 50% retracement of the recent correction.

Above $277 — which is the 61.8% retracement — opens the door back toward $280 and the all-time high at $281.67.

If McDonald’s stock can keep its bullish trend intact, the 161.8% extension up near $290 could be in play.

On the downside, bulls can use the recent low near $269 as their stop-loss. Below that and it seems possible that the 21-day moving average could be in play. In the case of a larger correction, the gap-fill near $260.70 is on the table.