Lyft (LYFT) stock is getting rocked on Tuesday, down about 20% so far on the day after reporting earnings.

Despite today’s decline, more losses could be on the way if the stock fails to hold a key support level.

When Uber (UBER) reported its quarterly results last week, shares initially climbed 12%. However, we outlined a key resistance level on the chart and we’ve since seen the stock cough up a bulk of its post-earnings gains.

Uber shares initially fell about 2% on Tuesday in sympathy with Lyft’s decline, although Uber stock has regained its losses and is now slightly higher in the session.

Lyft’s decline comes after the company missed on revenue estimates, reported a net loss of $135.7 million, and reported slightly disappointing fourth-quarter guidance.

At a time when loss-generating entities and growth stocks are both out of favor, a disappointment from Lyft is not going to get the benefit of the doubt from Wall Street — not during a bear market.

Trading Lyft Stock

Chart courtesy of TrendSpider.com

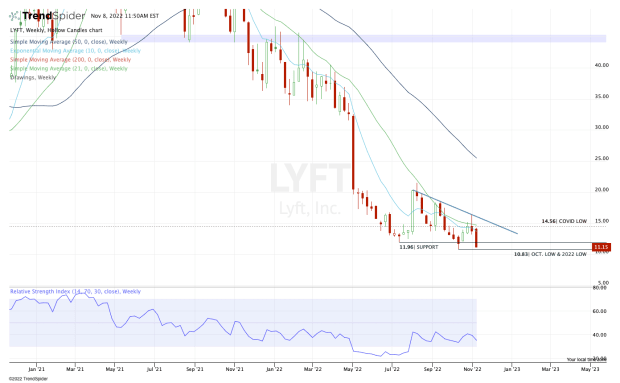

A few red flags stand out to me immediately upon looking at Lyft’s weekly chart.

First, we have a descending triangle pattern, which is a bearish technical setup. That’s as the stock makes a series of lower highs vs. a static level of support. That support level has been $12 since summer.

With shares currently trading at $11.15, it’s firmly below that support level.

Second, it’s also quite clear that the 10-week and 21-week moving averages — Lyft’s short- and intermediate-term trends — remain as active resistance and continue to squeeze the share price lower.

Third, the stock is flirting with a test of the October low and 2022 low at $10.83. Note that $10.83 is also an all-time low.

A break of this level — and particularly on a close below it — could quickly usher in $10 or lower.

Clearly, the trend is not working in Lyft’s favor and now investors are reacting bearishly to the company’s earnings results. Keep the $10.83 level on your screen if you're actively trading this stock. A break below this level and failure to regain it does not bode well for long.

Unless the trend in the market and in growth stocks can stem the bleeding, I’m not sure that Lyft stock can avoid a test or break of $10. Until then, let's watch last month's low.