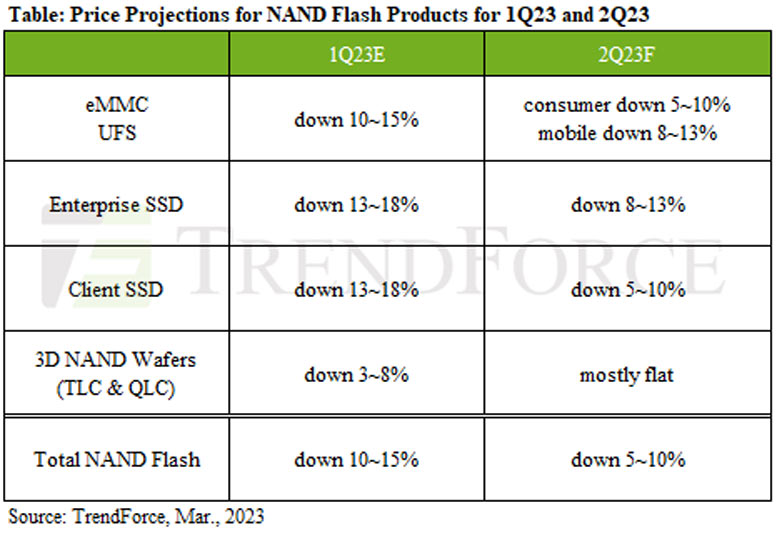

As weak demand persists, market researchers at TrendForce expect the average selling price (ASP) of NAND Flash to decline a further 5-10% in 2Q23. There appears to be a pivot point in the second half of the year where supply and demand could be balanced and a turnaround could happen. A lot rests on manufacturers cutting back on production, plus shipments of NAND Flash packing products like servers, smartphones, and computers.

Even if things fall favorably for the NAND Flash industry, TrendForce’s best estimate is that 3Q23 will be a stable period, with the chance of a rebound in 4Q23. The report from TrendForce comes hot on the heels of the terrible financial report shared by memory giant Micron. In case you missed that, Micron’s YoY revenue dropped nearly 53% on reduced take-up of its NAND and DRAM products. Micron’s forecast was similar to TrendForce’s in at least one respect, with a gloomy prediction for 2Q23.

TrendForce doesn't offer a lot of positivity with regard to client SSDs – consumer devices sold as PC components or through PC-makers. Inventories of PCIe Gen 3 SSDs are being actively whittled down, while take-up of PCIe Gen 4 drives are slower than some expected. And the decline in QLC NAND pricing has dragged down TLC NAND as well.

It will be difficult for NAND makers to cut prices further, but they are still expected to drop 5-10% in the coming quarter. There remains some hope that at some point in the second half of 2023, the industry will see positive momentum on dependent markets like laptops and smartphones – with new generation devices helping shift more NAND.

Enterprise SSDs have a rosier outlook this year. TrendForce says that Chinese demand will be strong due to government initiatives that have recently been approved. Moreover, the launch of AMD Genoa is a positive for server makers and thus NAND suppliers. Nevertheless, NAND Flash makers are in a weak negotiating position, so TrendForce is also predicting an enterprise SSD price decline in the order of 8-13% in 2Q23.

There are similar stories to be told in the eMMC (smartphone / laptop), and UFS NAND (smartphone) markets. However, UFS demand is looking more positive, with the introduction of UFS 4.0 for flagship smartphones, and expectations of a healthy mid-year and peak season for new / refreshed devices in 2023.

TrendForce’s report doesn’t specifically mention any underlying causes of the supply and demand issues we are now seeing, although some are pretty obvious. Memory is dealing with the same issues that the wider PC and tech industries are tackling, like inflation and its impact on disposable income, the Ukraine war, and the pandemic tech sales boom in preceding years. While that's not great for business, in the short term it should mean increasingly enticing SSD deals for those looking to increase storage in their PCs and game consoles.