/Broadridge%20Financial%20Solutions%2C%20Inc_%20smartphone-by%20rafapress%20via%20Shutterstock.jpg)

Broadridge Financial Solutions, Inc. (BR), headquartered in Lake Success, New York, provides investor communications and technology-driven solutions for the financial services industry. Valued at $27.3 billion by market cap, the company offers a broad range of solutions that help clients serve their retail and institutional customers across the entire investment lifecycle, including pre-trade, trade, and post-trade processing.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and BR perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the information technology services industry. BR's market leadership in investor communication solutions is its key strength, along with its innovative ProxyEdge system and digital applications solidifying its position as a top provider for regulatory compliance and shareholder communication services. In addition, BR excels in providing essential infrastructure to global financial markets through cutting-edge technology solutions. The company's strategic investments in technology demonstrate its commitment to driving efficiency and client satisfaction.

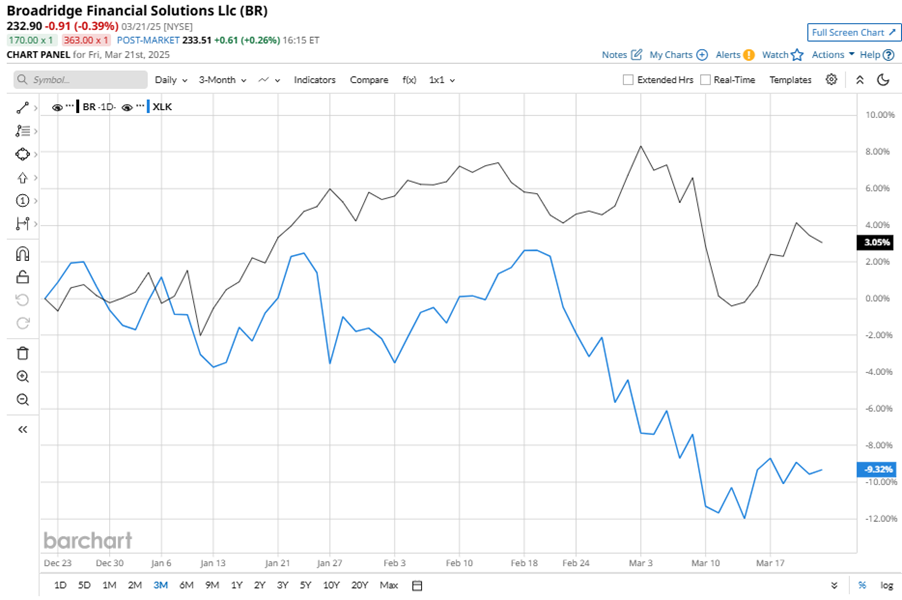

Despite its notable strength, BR slipped 5.5% from its 52-week high of $246.58, achieved on Mar. 3. Shares of BR gained 3.1% over the past three months, outperforming the Technology Select Sector SPDR Fund’s (XLK) 9.3% losses during the same time frame.

In the longer term, shares of BR rose 3% on a YTD basis and climbed 13% over the past 52 weeks, outperforming XLK’s YTD 8% losses and 2% returns over the last year.

To confirm the bullish trend, BR has been trading above its 200-day moving average over the past year, with slight fluctuations. However, despite the positive price momentum throughout the year, the stock is trading below its 50-day moving average since early March.

BR delivered strong performance driven by new business and internal growth. The global technology and operations platform was fueled by organic sales and the SIS acquisition. BR also emphasized regulatory compliance and highlighted ongoing innovation in AI and blockchain technology integration. The company's expansion is supported by the global shift towards digital platforms and outsourced operations.

On Jan. 31, BR shares closed down marginally after reporting its Q2 results. Its adjusted EPS of $1.56 surpassed Wall Street expectations of $1.39. The company’s revenue was $1.6 billion, exceeding Wall Street forecasts of $1.5 billion.

BR’s rival, Fidelity National Information Services, Inc. (FIS) shares lagged behind the stock, with a 9.2% dip on a YTD basis and a 1.5% gain over the past 52 weeks.

Wall Street analysts are cautious on BR’s prospects. The stock has a consensus “Hold” rating from the seven analysts covering it, and the mean price target of $244.33 suggests a potential upside of 4.9% from current price levels.