Shares of Advanced Micro Devices (AMD) have been roaring as the chipmaker rides the AI-powered coattails of Nvidia (NVDA).

But does AMD have the same upside potential as Nvidia?

It’s no secret that Nvidia is the current AI winner. The firm recently reported robust guidance and its stock has soared to all-time highs.

Nvidia stock is now also in the $1 trillion market cap club, joining Apple (AAPL), Amazon (AMZN) and a couple of others.

Don't Miss: Buy the Dip in Snowflake Stock? Here's the Must-Hold Support Level.

Many are speculating that AMD will eventually benefit from the flood of AI-driven demand, even as its most recent earnings results and subsequent guidance did not show that demand happening right now.

That said, it doesn’t seem to matter. Traders are plowing into all sorts of technology and semiconductor stocks in hopes of nailing the next Nvidia.

Trading AMD Stock

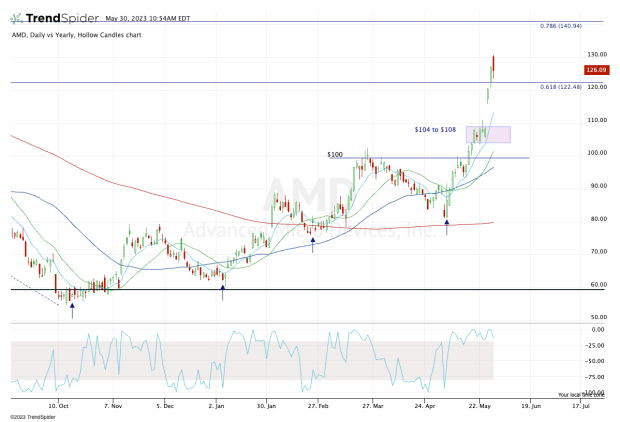

Chart courtesy of TrendSpider.com

On May 3, AMD stock closed more than 9% lower as investors were disappointed by the company’s earnings results.

A few days later,reports surfaced that AMD and Microsoft (MSFT) were working on AI chips, and the stock ripped higher. Three days later AMD was higher by more than 16% and it helped kickstart a five-week surge.

At today’s high, AMD stock was up more than 61% from its post-earnings low, marked less than a month ago. Amid the rally, the shares recently blew through the 61.8% retracement near $122.50, a level it’s trying to hold as Monday’s gains fade a bit.

If the surge continues, look for the rising 10-day moving average to act as support, and focus on the 78.6% retracement up near $140.

Don't Miss: Buy Costco Stock on Earnings? Here's the Must-Watch Breakout Level

If the gains begin to unravel, the first area of interest may be the $105 to $109 area. In that zone is a gap-fill level at $108.91. This zone was also a nice consolidation area before AMD’s big spike higher.

A bit deeper correction could land AMD at $100. Not only is this a nice psychologically relevant level, but it was a big resistance mark for the past several months.

It would be encouraging to see AMD stock pull back to this level and hold it as support.

Invest like a pro – for less. Our Memorial Day sale is on now! Get exclusive stock picks and ideas from our experts.