Bulls are enjoying a strong day in the market so far on Friday, June 24, but FedEx (FDX) is roaring even higher.

Shares were up 9% at one point on the day but are still more than 6% after the company reported its fourth-quarter results.

Earnings matched expectations, growing more than 37% year over year, while revenue grew 8.1% and topped consensus estimates. Even better, the company guided to better-than-expected earnings for the year.

Just a few weeks ago, FedEx added three board seats for activist investors and raised its dividend by more than 50%.

That launched shares higher by 14.4% on June 14 and FedEx stock has consolidated and drifted higher since. Now popping higher again, let’s look at the charts.

Trading FedEx Stock

Chart courtesy of TrendSpider.com

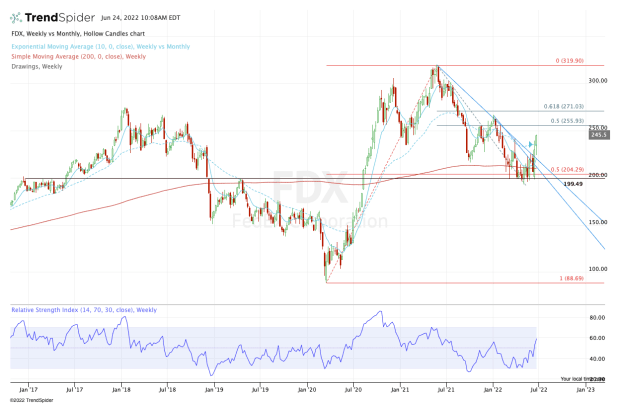

With Friday's action, we are looking at the long-term view with FedEx stock with the weekly chart.

Today’s rally sends the stock to its highest levels since February. Perhaps more importantly, it’s building off last week’s progress when shares cleared downtrend resistance (blue line).

From March through May, FedEx held an important area on the pullback. That zone was the key $200 level, the 50% retracement and the 200-week moving average.

Now pushing higher, I’m watching the $235 to $240 area. In that zone, we have the 10-month moving average and last week’s high. If FedEx stock can clear these marks, it keeps more upside potential on the table.

Specifically, the $250 to $255 zone could be on the table. Above the latter, which is the 50% retracement, and FedEx stock could climb to the $270 to $275 zone.

It would need some time and some consolidation along the way, but if it can clear the 61.8% retracement, then FedEx stock could be on its way to $300.

But what happens if FedEx can’t stay above last week’s high and the 10-month moving average? If these levels ultimately reject the stock, then we could be looking at a pullback and retest of prior downtrend resistance and the 10-week moving average.

This would not be the worst development in the world — after all, there are a lot of positives going on for FedEx stock right now — but purely from a technical analysis standpoint, it does increase the risk of a larger correction.

Specifically, if FedEx were to pull back and fail to hold support at the 10-week, then it would put the $200 area back in play. If that scenario plays out, this zone is must-hold support.