The Venn diagram of investors and astrologists hasn’t traditionally had a very robust center. On the surface, the two crowds don’t seem like they would have much in common. Finance bros and astrology enthusiasts tend to look different, run in different circles, and fill different roles in the public imagination and cultural milieu.

Dig a little deeper, however, and the two occupations (hobbies? professions? interests?) actually begin to seem like strangely compatible bedfellows.

Astrologists look to the celestial bodies, studying their movements to make predictions, inferences, and decisions about the present and the future. Similarly, investors look at company fundamentals, industry trends, and technical indicators to make predictions, inferences, and decisions about what to do with their money.

Neither the stock market nor the stars present a universally clear picture — if they did, most everyone would have a good idea of what to do with both their investment portfolios and their life decisions. Instead, both fields are rife with contradictory talking heads, each pundit reading the financial or celestial tea leaves in their own way.

Related: Are we in a recession (or not)? 5 ways to tell

Within the astrology community, one recurrent event seems to generate by far the most buzz among the public, and according to many astrology devotees, the most chaos in our lives — Mercury retrograde. But just what exactly does Mercury retrograde mean? How frequently does it occur? And how does it impact the stock market?

Let’s dig into the term’s meaning and then comb through some data to see how the major stock indexes and market sectors have performed during Mercury’s retrograde periods in recent years.

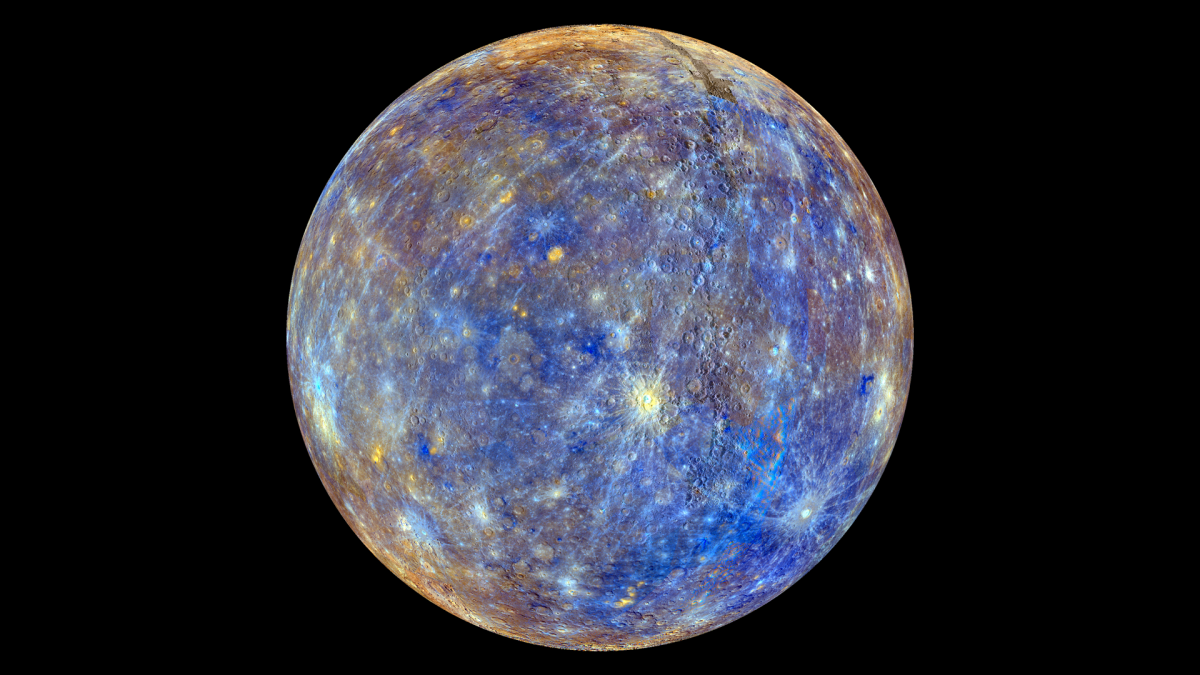

NASA Goddard Space Flight Center, CC BY 2.0 via Flickr

What is mercury retrograde?

Three or four times per year, the planet Mercury’s movement through the sky appears to change direction for a period of about three weeks. When this happens, astrologists say that Mercury is in retrograde. Typically, there are three or four periods of Mercury retrograde each year.

Here’s how it works: From our earthly perspective, any given planet usually moves slowly in one direction across the sky relative to the stars behind it. Any time a faster-orbiting planet (i.e., those closer to the sun) like Mercury or Venus passes Earth in its orbit, however, its apparent motion through the sky reverses in direction due to its new position relative to Earth (the same thing happens to the slower-orbiting planets when ours passes them in orbit).

While Mercury’s actual orbital direction never changes, the directional reversal in its apparent journey across our sky can have major implications for our lives here on Earth, according to astrological schools of thought.

How do astrologists think Mercury retrograde affects our lives?

In general, when a planet is in retrograde, the parts of our lives the planet is thought to govern can become unpredictable, unstable, or chaotic.

In Mercury’s case, these areas include contracts, communication, transportation, code, travel, and shipping, but many astrological devotees believe that it doesn’t end there. Some swear that the chaos unleashed by Mercury’s retrograde periods can upend and untether anything and everything in our lives, from relationships to sleep to finances.

So, how does Mercury retrograde affect finances — specifically the stock market? Let’s take a look.

How has the stock market performed during recent Mercury retrograde periods?

First, let’s look at how the stock market at large has performed during recent periods of Mercury Retrograde. We can do this using the Wilshire 5000 total market index, which tracks the aggregate stock performance of every public company that trades on a major U.S. exchange like the NYSE and Nasdaq, with each stock’s weighting in the index corresponding to its market capitalization.

In other words, its components and proportional weighting make it the best approximation of the U.S. stock market at large, even though it’s not as popular as some better-known bellwether indexes like the S&P 500. Here’s how the index has performed during the last 10 Mercury retrograde:

| Mercury retrograde period | Wilshire 5,000 direction | Wilshire 5,000 change |

|---|---|---|

04/01/24–04/25/24 |

Down |

-3.85% |

12/13/23–01/01/24 |

Up |

+1.63% |

08/23/23–09/15/23 |

Up |

+0.32% |

04/21/23–05/14/23 |

Down |

-0.51% |

12/29/22–01/18/23 |

Up |

+2.64% |

09/09/22–10/02/22 |

Down |

-11.97% |

05/10/22–06/03/22 |

Up |

+3.31% |

01/14/22–02/03/22 |

Down |

-7.76% |

09/27/21–10/18/21 |

Up |

+0.94% |

05/29/21–06/22/21 |

Up |

+1.43% |

Looking at the data above, the stock market at large, as measured by the Wilshire 5,000, went up during 6 out of the last 10 Mercury retrogrades.

However, the average percentage change across all 10 of the most recent retrogrades was -1.38%, meaning that Mercury retrogrades were more associated with negative performance than positive performance in general from a total percentage-change standpoint since mid-2021.

How have communications stocks performed during Mercury retrograde?

Since Mercury oversees communication according to astrological schools of thought, perhaps its retrograde periods have an even more pronounced association with communication-related stocks.

We can use the S&P 500 Communication Services Index (an index designed to track the stock performance of companies in the communications industry) as a barometer for this sector of the market. Here’s how this index (known as the SP500-50 for short) performed during each of the 10 most recent Mercury retrograde:

| Mercury retrograde period | SP500-50 direction | SP500-50 change |

|---|---|---|

04/01/24–04/25/24 |

Down |

-4.59% |

12/13/23–01/01/24 |

Up |

+3.79% |

08/23/23–09/15/23 |

Up |

+2.04% |

04/21/23–05/14/23 |

Up |

+5.79% |

12/29/22–01/18/23 |

Up |

+5.90% |

09/09/22–10/02/22 |

Down |

-13.89% |

05/10/22–06/03/22 |

Up |

+1.81% |

01/14/22–02/03/22 |

Down |

-6.91% |

09/27/21–10/18/21 |

Down |

-1.55% |

05/29/21–06/22/21 |

Up |

+1.73% |

The S&P 500 Communication Services Index, like the market at large, went up in value during 6 out of the last 10 Mercury retrograde.

Its average percentage change across these 10 instances, however, was smaller at -0.59%. In other words, communications stocks lost less value than the market at large during recent retrogrades.

More on finance and pop culture:

- 5 major companies (besides X) that went from public to private

- Looking back at the banking crisis of 2023

- What is financial trauma? Is there a cure?

How have transportation, shipping & travel stocks performed during Mercury retrograde?

Other facets of life thought to be overseen by Mercury include transportation, travel, and shipping. The S&P Transportation Select Industry Index is a collection of publicly traded companies across these industries, including passenger and cargo transportation companies across the air, rail, and marine sectors.

Here’s how the index (known as SPSITNTR for short) performed over the last 10 Mercury retrograde periods:

| Mercury retrograde period | SPSITNTR direction | SPSITNTR change |

|---|---|---|

04/01/24–04/25/24 |

Down |

-6.40% |

12/13/23–01/01/24 |

Up |

+3.31% |

08/23/23–09/15/23 |

Down |

-1.72% |

04/21/23–05/14/23 |

Down |

-2.79% |

12/29/22–01/18/23 |

Up |

+10.76% |

09/09/22–10/02/22 |

Down |

-14.07% |

05/10/22–06/03/22 |

Up |

+5.55% |

01/14/22–02/03/22 |

Down |

-4.02% |

09/27/21–10/18/21 |

Up |

+0.16% |

05/29/21–06/22/21 |

Down |

-5.39% |

The S&P Transportation Select Industry Index went down in value during 6 of the last 10 Mercury retrogrades, marking a notable departure from both the stock market at large and the communications industry.

Overall, however, the index’s average percentage change across all 10 retrogrades was -1.46%, which is closer to the average for the market at large than it is to the average for communications stocks.

The takeaway

There doesn’t appear to be a particularly strong connection between Mercury’s recent retrograde periods and the stock market’s performance, even when looking at particular segments like communication stocks or transportation/shipping/travel stocks. Perhaps astrological indicators are not the most useful when it comes to predicting stock market trends.

Nevertheless, stranger indicators have been proposed. The hemline indicator, for instance, claims that the higher hemlines rise on average, the better the economy and stock market perform. The lipstick index (a term coined by Estee Lauder heir Leonard Lauder after the dot-com crash), posits that sales of so-called “affordable luxuries” tend to go up during periods of economic hardship.

The stock market, much like the cosmos, is enigmatic, and analysts will no doubt continue to search for correlations in strange places in their attempts to find a connection that can allow them to make profitable predictions.

Related: Veteran fund manager picks favorite stocks for 2024