Sometimes, combinations are dramatically better than stand-alone inventions.

Before Steve Jobs introduced the iPhone, he realized the plastic screen on his prototype would be prone to scratching and breaking. He approached Corning and asked for superstrong glass. Corning created Gorilla Glass to meet Jobs’ specs, and the result was a consumer product that took over the world.

Many retirees own two products that are separately valuable — IRAs and homes with equity. Combined, they can change a retirement. Despite similar average savings in an IRA ($375,000) and in the value of a home ($315,000) for investors 65 and over, the IRA account is considered most often in retirement planning.

Challenges in building a plan

Here are some challenges that retirees grapple with when considering using IRA accounts and home equity in their plans:

- Distributions from the rollover IRA account are taxable

- Most such distributions require the liquidation of a portion of IRA account assets, with related market risk

- Every IRA distribution reduces liquidity that might be needed for unplanned expenses

- Maintaining the home for aging-in-place carries significant costs

- Unless they’re renting it out, retirees don’t generate additional income from their home to pay for these and other costs

The answer may be to see the savings in the IRA account and the value of the home together and to use a planning approach that allows each to complement the other and produce the best opportunities for income, liquidity and legacy.

Real life goals

Our sample investor, a female, age 70, with $1 million in her rollover IRA account and $1 million in the value of her home, hopes she can convert her savings to meet these financial goals:

- Income: 6.5% on IRA savings, or $65,000 in first-year starting income

- Liquidity: $1 million at age 85 to meet unplanned expenses

- Legacy: $2 million at age 95 to pass on to kids and grandkids

They are not unreasonable goals, she thinks. However, although she’s not trained as a retirement expert, she knows that with an IRA alone, she’ll be spending down her savings and taking required distributions under IRA rules. That is particularly the case if she follows the 30/70 rule, with 30% invested in equities and 70% in fixed income.

Create a new map

Here’s another way to allocate this sample investor’s savings:

IRA account:

- Balanced portfolio (50%/50%) between fixed and equity components: $637,500

- Immediate income annuity: $212,500

- Future income annuity (QLAC): $150,000

Value of her home:

- HECM line of credit: $370,000

- Remaining value of home: $630,000

While the components are helpful, the new challenge is to utilize them in a tax-efficient way to meet our investor’s objectives. Set out below is a plan using an all-asset planning method (you can read more about this method in my article How to Create a Retirement Plan That Checks All Your Boxes.)

(Note: QLAC is short for qualifying longevity annuity contract. Read more in For Longevity Protection, Consider a QLAC. HECM is short for home equity conversion mortgage. Read more in How to Add Home Equity to Your Retirement Income Planning.)

Results for a new plan combining IRA and home equity

Here are the results that the new plan returned:

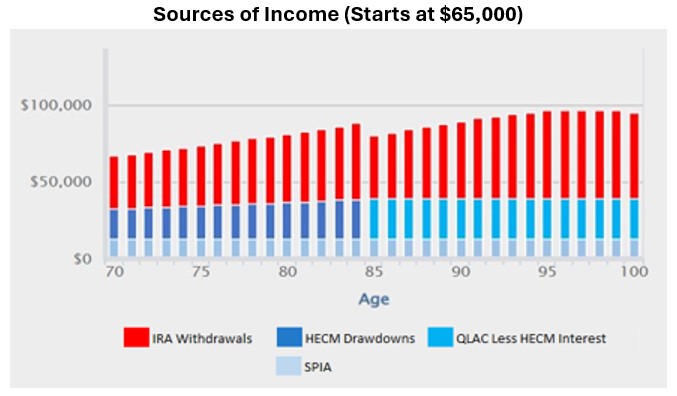

Our investor’s income before age 85 comes from both an IRA account held in a QLAC and drawdowns from the HECM. In turn, the distributions from the IRA account are made of guaranteed income from an annuity and distributions from a balanced portfolio of fixed and equity investments. After she turns 85, the HECM drawdowns are replaced by annuity payments from the QLAC, minus the interest on the HECM.

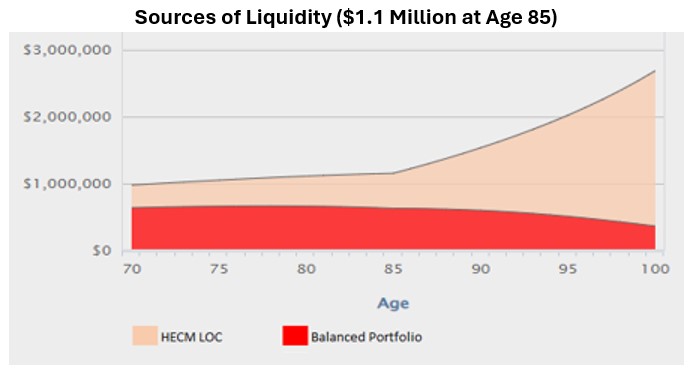

Liquid savings provide peace of mind that unexpected expenses can be met. The HECM line of credit remains and grows after age 85 even as the IRA savings portfolio declines — but doesn’t run out — and continues to provide access to cash. The HECM line of credit grows because a portion of the QLAC payments at 85 and later are paying the interest on the loan balance built up before 85. Importantly, accessing the line of credit does not create a taxable event, nor create possible market risk with the sale of portfolio shares.

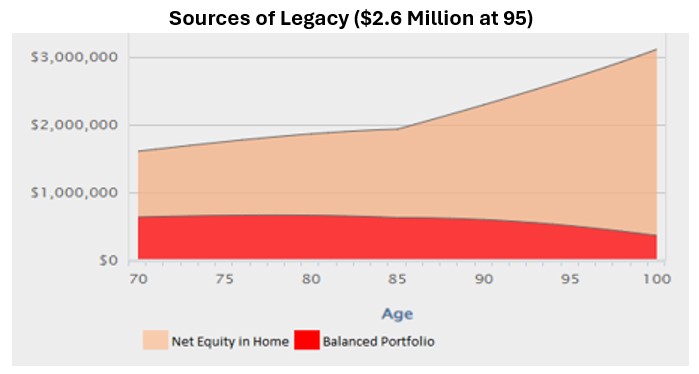

To meet her legacy goal of $2 million at her passing, our investor needs to look at both the value of her rollover IRA account and the net value of her home after deducting any HECM loan balance. From the above, you can see the IRA account inevitably falling because of required minimum distributions (RMDs). However, the net value of the home increases. And combined, they hit her goal.

Comparison to current plan

Our investor then compares the new approach to her existing plan. She tries to match the income and market risk.

To match the starting annual income of $65,000, she needs to withdraw all of that amount from her IRA account. Those annual withdrawals — and the loss of the growth if that money had stayed put — eat into the account, leaving only $264,000 at age 90, possibly enough to cover a relatively minor long-term health care event.

By the time she’s 94, that account is wiped out, and she’s living on Social Security benefits. She still has the value of the house, but Social Security is barely paying the bills. Finally, her taxes at the start are nearly three times what she would pay at the beginning of her new plan.

Is her new plan too good to be true? No. She’s simply combining two assets and using the smartest options within each asset class.

Some added benefits

Combining assets to meet a retiree’s objectives as to income, liquidity and legacy creates a series of added benefits, including:

- Lower taxes. About one-third of income is received tax-free until age 85

- Lower risk. Only one-third of retirement savings are in equities

- Predictable income. Annuity payments and HECM drawdowns don’t depend on market performance

Go2Income has created its version of an All-Asset Plan called IRA4Income. Get your complimentary plan and talk to the Go2Income specialist. Make sure your plan reflects basic information (marital status, savings, etc.), and talk through refinements that make it fit your objectives. Then consult with a qualified adviser for plan refinement and implementation options.