Corruption has long been a scourge in parts of Latin America.

Traditionally, it has funneled down domestic routes, with local politicians, business interests and drug lords benefiting from graft and dodgy dealings. Indeed, a 2022 report from Transparency International found that 27 out of 30 countries in Latin America and the Caribbean have shown stagnant corruption levels with no improvement in recent years.

But over the last two decades, a new form of corruption has taken hold in countries in the region, a phenomenon we call “geostrategic corruption.”

It is characterized by external countries using corrupt methods – no-bid contracts, insider financial deals, special relations with those in power – to become stakeholders in multiple facets of the politics, economy and society of a country. China is a master of the art; the United States, less so.

As scholars of Latin American politics, we have seen how China has used geostrategic corruption to gain a foothold in the region as U.S. influence has waned.

What is geostrategic corruption?

Geostrategic corruption builds on traditional pervasive patterns of clientelism and patronage. In Latin America in particular, the growth of the drug gangs since the 1980s introduced “narco-corruption” in which police and local officials collude with organized gangs, which are able to “buy protection” from prosecution.

As a result, police, local governments and elected representatives are considered by watchdogs as among the most corrupt political entities in Latin America, with the region consistently scoring low in annual global corruption perception rating.

This pattern of corruption has coincided with a period in which the U.S. has turned its attention away from Latin America and toward first the Middle East and then Asia.

The vacuum has largely been filled by China. Trade between the region and China skyrocketed from US$10 billion worth of goods in 2000 to $450 billion in 2021. China is now the top trading partner of South America, making up to 34% of total trade in Chile, Brazil and Peru.

China’s expansion in the region is largely driven by the country’s search for resources such as cobalt, lithium, rare earths, hydrocarbons and access to foodstuffs, which are abundant in Latin America. In the past 20 years, China has also poured massive investments into infrastructure, energy and financial sectors of Latin America.

And China isn’t alone in upping its interest in Latin America. The last two decades have also seen an increase in investment and influence in the region from Russia and Iran.

These countries have found Latin America a fertile ground due in no small part to the region’s culture of corruption and weak institutions, we argue. Local criminal networks and the disregard of democratic norms on the ground have made it easier for countries that themselves are perceived to be dogged by corruption to gain a foothold in Latin America.

US-China global competition

China’s presence in the region forms part of the country’s long-term strategic objective to challenge U.S. influence across the globe through economic, military, financial and political means.

That process has been aided by global trends. Countries such as Brazil and Argentina have increasingly sought to diversify bilateral relationship and become less dependent on U.S. trade.

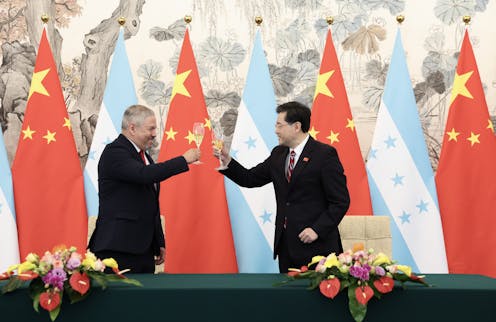

Meanwhile, Russian aggression in Ukraine has seemingly given China more weight on the international scene, with Beijing positioning itself as an alternative diplomatic force to Washington, especially to countries that feel nonaligned to the West. A recent example was seen in March, when Honduras announced it would establish diplomatic relations with Beijing and break off ties with Taiwan – a development that Taiwanese officials say followed the “bribing” of Honduran officials.

What gives China an added competitive edge as it extends its influence is that it is able to eschew constraints that bind many would-be investors in the West – such as environmental concerns or hesitation over a country’s labor rights and level of corruption. Chinese companies are judged by international watchdogs to be among the least transparent in the world, and bribery watchdogs have long noted Beijing’s reluctance to prosecute Chinese companies or individuals accused of bribery in regard to foreign contracts. A 2021 study found that 35% of China’s “Belt and Road” projects worldwide have been marked by environmental, labor and corruption problems.

The U.S. administration, in contrast, is more restricted by commitments to encourage democratic development as well as public pressure and international image. Washington does not have the same privilege of diplomatic pragmatism as China.

U.S. companies are, of course, not spotless when it comes to engaging in corrupt practices overseas. But unlike China, the U.S. government is bound to an international treaty prohibiting the use of bribes to win contracts. Moreover, the U.S. Foreign Corrupt Practices Act strictly prohibits American companies from bribing foreign officials; China has no such equivalent.

Chinese corruption in the region

Chinese investment has been easier where populist regimes govern and where the rule of law has long been undermined, such as Argentina, Bolivia and Venezuela.

For example, in Bolivia during the 14-year tenure of President Evo Morales, Chinese companies achieved a major foothold in key sectors of the economy that has translated into a monopoly over the lithium industry there, despite a strong anti-mining movement in the country.

Geostrategic corruption in Argentina is firmly rooted at the local level, in provinces and regions across the country, feudal-like governors have enabled a sophisticated corruption network that China has seemingly used to invest in everything from nuclear plants and building lithium battery plants to constructing a satellite-tracking deep-space ground station, railroads, hydroelectric plants, research facilities and maybe even fighter jets.

In Ecuador, such projects include a dam built in exchange for oil contracts; the Coca Codo Sinclair hydroelectric plant, which developed massive cracks soon after construction; and the Quijos hydroelectric project, which failed to generate promised volumes of power. Similarly, the Chinese-financed Interoceanic Grand Canal in Nicaragua was estimated by opponents of the project to irreversibly impact the ecosystem and displace about 120,000 people, while local activists faced harassment, violence and unlawful detention.

In Venezuela, China initiated but never completed construction of a multibillion dollar bullet train line, and an iron mining deal not only allowed the Asian country to buy Venezuela’s iron ore at a price 75% below market, but also turned out to be an instance of Chinese predatory financing, leaving Venezuela in a catastrophic $1 billion debt. Likewise, in Panama, port concessions and a high-speed train line were frozen or canceled, while the investor is under investigation in China.

Throughout the region, Chinese firms have been cited in numerous cases involving bribery and kickback schemes that have enriched local officials in return for contracts and access.

What does it mean for the US?

This use of geostrategic corruption works to the direct detriment of U.S. interests.

In Argentina and Bolivia, Chinese expansion means that sectors that are crucial for the success of the U.S.’s green energy goals are increasingly under Beijing’s hold. It also undermines U.S. efforts to counter corruption and human rights abuses in the region.

And U.S. companies are unable to compete. The Biden administration has set high standards for U.S. investment in the very sectors where the Chinese have a strong foothold. These include transparency and accountability, as well as commitments to environmental, labor and human rights standards.

President Joe Biden has stated that adherence to these standards is what distinguishes U.S. foreign investments from its competitors. But it does hamstring American companies when it comes to competing with China.

In the meantime, while the U.S. is looking for answers and trying to figure out how to reestablish influence in Latin America, China is quietly and pragmatically increasing its presence in the region.

As an academic and as director of a university research center, I've received funding from foundations, US government agencies, and multilateral institutions.

Valeriia Popova does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

This article was originally published on The Conversation. Read the original article.