The stock market is under intense selling pressure at the moment.

The S&P 500 index has fallen in 10 of the last 11 weeks, dropped 5% in back-to-back weeks and made new lows just a few days ago.

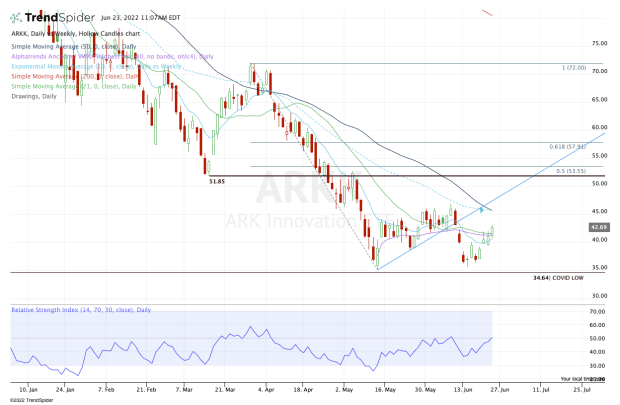

Do you know what didn’t make new lows though? The Ark Innovation Fund (ARKK). It’s also up in six of the past seven sessions, including a 4% gain on June 23.

Cathie Wood’s ARK has long been used as a proxy for growth stocks, which have been on the receiving end of a brutal bear market. Many of these stocks have fallen by 75% or more from the highs.

ARK is likely most popular for its large and longtime holding of Tesla (TSLA). Currently, Tesla makes up 8.9% of the fund, second only to Zoom Video (ZM) at 9.2%, a stock that Wood recently made an enormous upside call for.

The top five holdings are rounded out by Roku (ROKU), Block (SQ) and Exact Sciences (EXAS).

As the volatility increases, so does the “noise” or distractions we see online and in the news. The reality is that while the Nasdaq and S&P 500 were making new lows, ARK — the proxy for growth stocks — was not.

That in itself is noteworthy to me. The downside leaders of this bear market did not make new lows with the overall market. So is a shift about to occur?

Trading ARK

Chart courtesy of TrendSpider.com

Let’s just get this out of the way now: It’s totally possible that renewed and relentless selling pressure in the indices will eventually drive ARK and its larger components to new yearly lows as well.

I’m not trying to argue that that’s out of the question. Instead, I’m doing what everyone else is doing -- I’m looking at the clues and puzzle pieces that make up the market and trying to determine a likely path from here.

As I look at ARK, I see that last month it came within pennies of hitting its March 2020 low. Last week, it came within pennies of taking out the May low like the broader indices did. I also see that on Tuesday and Wednesday, it struggled with the 10-day and 21-day moving averages, as well as the daily VWAP measure.

However, ARK is now rallying through these measures on Thursday. The bullish checkmarks — at least in the short term — are starting to accumulate.

If ARK can maintain momentum, a push to the $45 to $47 area could be in the cards. That would thrust the ETF into the breakdown spot from a few weeks ago, where it was consolidating nicely until a three-day, 20% correction wiped out its progress. It’s also where the 50-day and 10-week moving averages come into play.

If ARK can clear these measures, that’s when more significant upside becomes possible. Specifically, it puts the $50 to $53 area in play and is roughly 25% above current levels.

That’s where we find a prior support level turned into current resistance, the May high, and the 50% retracement.

On the downside, use caution below $40. That puts ARK back below a number of key short-term moving averages and makes the May and June lows vulnerable to a retest.