Boeing (BA) stock has not had an easy year. To be fair, not many stocks have. But some investors may be surprised by the underperformance of the airline and aerospace stocks.

Travel trends are booming despite high inflation and higher travel costs. We’re seeing packed airports and airlines operating at their highest level in years.

Nonetheless, stocks like Delta Air Lines (DAL), United Airlines (UAL), Boeing and others are lagging the overall market.

For its part, Boeing stock is down 23% in 2022. But only a month ago the shares were down more than 43% on the year. Helping save the stock’s performance has been a rally in excess of 40% from the June low.

Boeing has the wind at its back as orders finally begin to accelerate. Most recently, Delta Air logged an order for 130 737 Max jets.

Just last week, some investors were wondering whether Boeing stock was set to continue rallying or whether the stock would be grounded. So far, we have our answer, but can it maintain its momentum?

Trading Boeing Stock

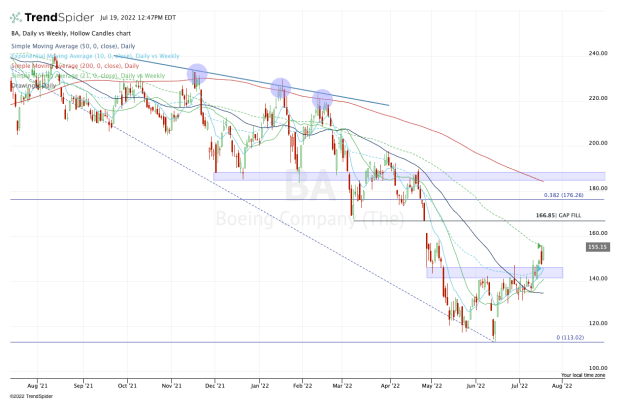

Chart courtesy of TrendSpider.com

For a while, this stock had only bearish momentum. Every rally was being sold and tests of its moving averages drew in sellers rather than buyers.

The stock is technically trading within yesterday’s range — giving traders an “inside day” — but that’s not what jumps out to me.

Instead, I’m watching the $146 level on the downside and $156 level on the upside. This $10 range could go a long way toward telling traders which way Boeing stock will go.

On the downside, $146 is the start of a notable support zone, between $141 and $146. But perhaps more important, it’s where we find the 10-day and 10-week moving averages.

These measures should give Boeing some solid footing on the pullback. If it doesn’t and Boeing trades below $140, it puts the 50-day moving average in play and saps most, if not all, of its current bullish momentum.

On the upside, $156 is not just on watch today as it comes into play near Monday’s high, but it’s also where we find the declining 21-week moving average.

Clearing this hurdle opens the door to the $166.85 level, where there’s a big gap waiting to be filled. That also comes in close to the Q1 low (at $167.58).

Above that opens the door to the 38.2% retracement, followed by the 200-day moving average. The latter has been stout resistance since Q4 2021.

If Boeing were to rally to this moving average, it puts a 15% to 18% gain within reach and potentially more should it continue higher.