When I started writing this story, Alphabet (GOOGL) (GOOG) was trading higher in the premarket session following better-than-expected earnings.

I just didn’t know if it would hit new all-time highs.

Well, it did when it opened, tagging a high of roughly $3,031. However, it was sold right from the open. While shares ultimately faded more than $120 a share from the high, the bulls are buying the dip.

That said, the news has been overwhelmingly positive. The company delivered a top- and bottom-line beat after the close on Tuesday, with revenue surging more than 32%.

More so, the company announced a 20-for-1 stock split and you know how much Wall Street loves a stock split.

The news triggered speculation as to whether Alphabet stock may be added to the Dow next, much like Apple (AAPL) was after its split. Further, it’s got investors wondering if Amazon (AMZN) will finally split its stock, too.

Trading Alphabet Stock

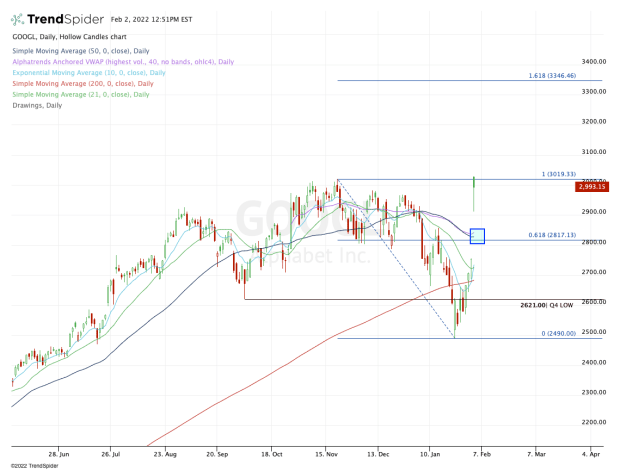

Chart courtesy of TrendSpider.com

Despite the fade, shares of Alphabet are trading pretty darn good right now. The stock hit new all-time highs and even though it’s fading from those levels now, the fact that it’s near the highs is impressive given the state of the market right now.

On the upside, $3,000 is a clear line in the sand.

If Alphabet stock can get above and stay above this level, then bulls will be in control. In the long term, I suspect that could open the door up to the 161.8% extension, near $3,300.

That’s particularly true if the stock market can rebound and the bulls can regain control as well.

In that scenario, Alphabet can help lead the market out of the hole it’s in. On the flip side, should the overall market continue to struggle, it could act as an anchor to Alphabet stock.

Should the latter play out and Alphabet loses its post-earnings low near $2,910, then it might be wise to look at the $2,915 to $2,935 area.

There it finds the 61.8% retracement of the current range, along with the 50-day moving average and the daily VWAP measure.

By then, the 10-day moving average may even be in play too.

The company just stunned investors with a blowout quarter. Like Apple, MasterCard (MA) and others, it goes back on the go-to list for traders.