Ready for a little good news? As investors take stock of the fallout from the Silicon Valley Bank failure and wonder about broader fallout for the economy in the coming months, the housing market has delivered some reason for optimism. The yearlong drag from the housing market slump is winding down. And while we probably won’t see housing suddenly rocket higher like it did in the middle of 2020, a stabilizing market will help counter any weakness stemming from regional banks.

The housing effect began pretty quickly after 30-year mortgage rates first hit 5% last April. Single-family housing starts, which had been running at greater than a 1.1 million unit annualized pace since the fourth quarter of 2020, fell immediately as homebuilders pulled back and assessed the situation. By July the single-family housing start pace had slowed to 900,000 units, and by November just over 800,000.

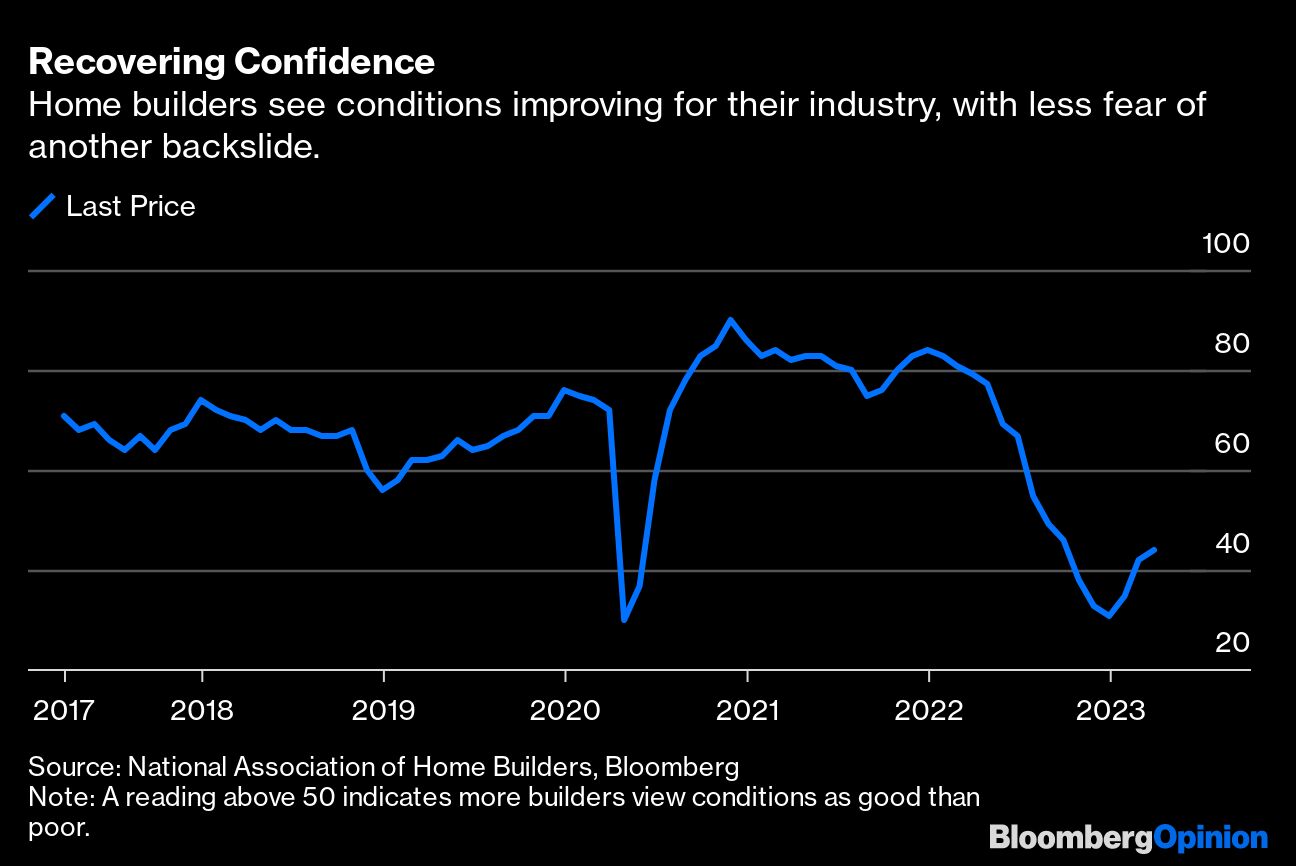

The sudden dire outlook was captured by the industry's monthly sentiment index, which collapsed from 77 in April to 31 in December (with 50 representing a neutral reading) — on par with the worst sentiment seen at the onset of the pandemic in 2020.

That decline in construction activity was a significant headwind to US gross domestic product in the last three quarters of 2022, detracting around 1.2% each quarter. Real GDP growth averaged 1.8% in that period; if not for housing it would have come in at 3%. The concern was that with mortgage rates remaining over 6% heading into 2023, weakness in housing would drag down an economy already slowing from the Federal Reserve's interest rate increases, tipping it into recession.

But rather than conditions worsening in the first quarter of 2023, they got better. Homebuilder sentiment has improved for three consecutive months. While it’s not quite back to a neutral level of 50, fears of another backslide have abated. Instead of builders sitting on a glut of unsold homes that they had begun building during the pandemic, last week's housing data showed that the number of single-family homes under construction has fallen to the lowest level since October 2021.

And after bottoming in November, single-family housing starts have picked up a bit — not the surge we saw in mid-2020, but another sign that builders feel like they are in a position to continue building in the current market rather than pulling back even more.

One of the largest homebuilders in the US, Lennar Corp., noted in its earnings call last week that its February cancellation rate “was 14%, much below our normalized cancellation rate.” They also said that base prices have stabilized in all of the markets they operate in.

The housing market shift from contraction to stabilization is an important dynamic as investors sort out problems with regional banks and watch for wider ramifications. In its weekly housing market update last week, the housing website Redfin noted that as mortgage rates fell in the wake of Silicon Valley Bank’s collapse, Redfin's mortgage-lending company locked a rate on more loans on Friday, March 10, than it had on any other day in 2023. So when it comes to housing at least, the failure of SVB might turn out to be a net positive — at least outside of the San Francisco Bay Area. Homebuilder stocks are up since the SVB collapse, suggesting investors aren’t yet concerned about spillovers negatively affecting the market for new home sales.

The kind of disruptive impact on the economy that people are worried about now would mean a lot of industries falling apart simultaneously, creating an avalanche effect that takes down employment, consumption, investment and overall economic activity. It’s tough for that to happen when the economy started out in a position of strength. Now the housing market might act as a stabilizing force rather than becoming part of the problem.

More From Bloomberg Opinion:

- Fed Needs to Keep Hiking Despite the SVB Turmoil: Editorial

- Investors Need to Ignore Turmoil-Driven Doomsayers: Nir Kaissar

- What Do US Growth Zones Have in Common? New Housing: Justin Fox

Want more Bloomberg Opinion? OPIN . Or subscribe to our daily newsletter.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Conor Sen is a Bloomberg Opinion columnist. He is founder of Peachtree Creek Investments.

©2023 Bloomberg L.P.