SPRINGFIELD — Just days before the end of the legislative session, Illinois House Democrats on Wednesday outlined their own package of nearly $1.4 billion in tax cuts as party leaders in Springfield inch closer to hammering out the state’s election-year budget.

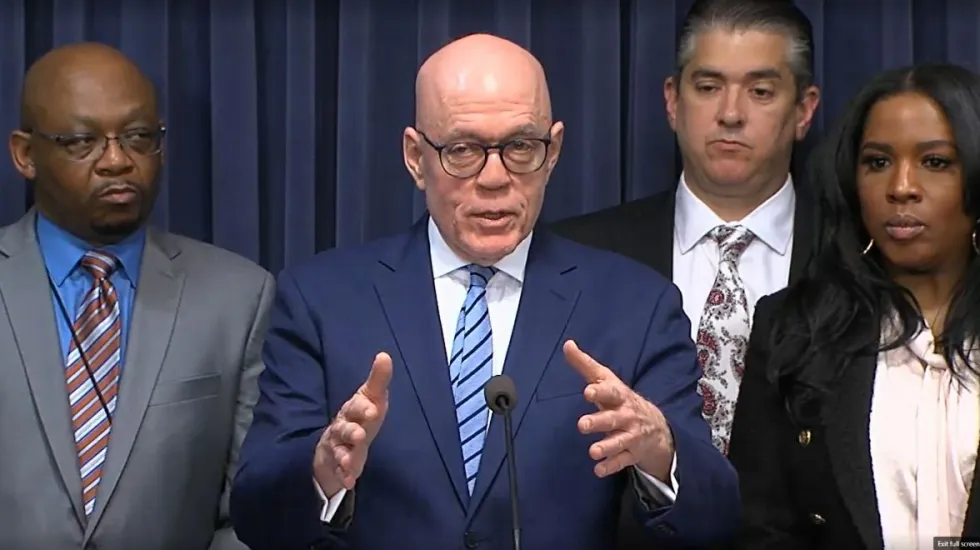

The tax relief in the plan announced by Illinois House Majority Leader Greg Harris falls squarely in the middle of the $1 billion in cuts Gov. J.B. Pritzker highlighted in his February budget proposal and the $1.8 billion that state Senate Democrats pitched last week.

That suggests a deal could be close as Democrats with supermajorities in both chambers of the General Assembly aim to send a budget bill to Pritzker’s desk by the end of the week — over the objections of Republicans who have dismissed the proposals as election-year gimmicks.

But Democrats argue that Illinois residents need a break.

“For House Democrats, this budget is about turning the corner for our state and turning the corner for our families, as we see our state and our nation turning the corner on COVID,” Harris, a North Side Democrat, said at a news conference in the State Capitol.

“There is recovery, but I think all of us … know that the recovery is uneven, and it is inequitable across the state.”

The plan Harris outlined jibes with Pritzker’s so-called “Illinois Family Relief Plan,” which calls for suspending the scheduled 2-cent-a-gallon hike of the state gas tax for the upcoming year; suspending the 1% state tax on groceries; and sending homeowners direct rebates of up to $300 each on their property tax bills. Those measures amount to an estimated $1 billion in relief.

On top of that, House Democrats are pitching a tax rebate for low-income families estimated to save them $165 million collectively — $100 per taxpayer who files for the Earned Income Tax Credit, plus $50 per child in each eligible home. The lawmakers also suggest permanently expanding the pool of taxpayers eligible for the Earned Income Tax Credit to include people 18 to 24 or over 65.

Combined with a handful of other measures, the plan amounts to an additional $380 million in tax relief, according to House Democrats, who say it’s feasible due to “higher than expected revenues” from last year’s spending plan.

At an unrelated news conference, Pritzker said he was still reviewing the latest proposal but commended it as a “comprehensive approach” to offering tax relief for families as inflation hits households statewide.

It shares plenty of common ground with the $1.8 billion plan offered up by Senate Democrats last week, but doesn’t include the Senate proposal to extend additional tax refunds, up to $200 each for most taxpayers.

“Stop and think about it for a second. Everyone is proposing balanced budgets and tax relief. That’s quite a turnaround from where we were not so long ago. We look forward to reviewing details and working together with the House and governor to deliver for the people of Illinois,” state Senate President Don Harmon said in a statement.

Harmon and state House Speaker Emanuel “Chris” Welch met Wednesday morning, with budgetary items among the topics discussed. Harmon said it was a “very positive, productive meeting,” according to spokesperson John Patterson.

Republicans said the House plan was no different than those put forth by Pritzker and Senate Democrats, dismissing them all as gimmicks meant to curry favor with voters in a tough election year.

“A couple of things are still concerning. One of them is that our normal spending is growing faster than our revenues are,” House Deputy Republican Leader Tom Demmer said. “Are we setting ourselves up for a cliff in future years if revenues don’t come in as high as we expect them to?”

Another Republican concern were the dollars toward “pork projects” for Democratic member initiatives, Demmer said.

The state legislative session is slated to end Friday, but lawmakers actually have until May 31 to pass the budget and other bills without requiring super majorities for them to take effect immediately.

Any bills passed after May 31 require a three-fifths majority for the law to go into effect within the next 12 months.

A three-fifths supermajority requires at least 71 votes in the House, and 36 in the Senate. The Democrats have those votes within their own caucus with 73 members in the House, and 41 in the Senate.

Taylor Avery reported from Springfield, Mitchell Armentrout from Chicago