Our friends over at Domain (we don’t talk but I just know they like me) have released the 2022 edition of their annual First Home Buyer’s Report. Are we shocked to discover that Sydney is still an overly expensive pit of damnation? Absolutely not.

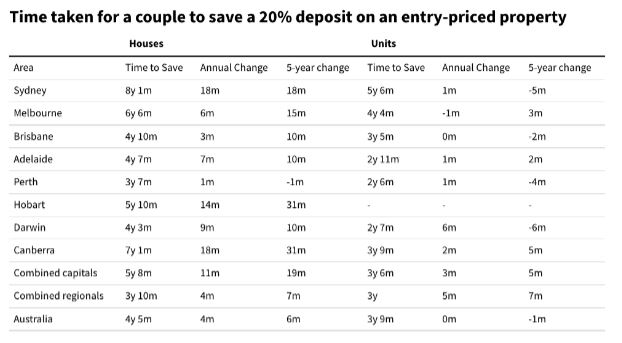

The report looked at roughly how long it will take an Aussie couple aged 25-34 to save a 20 per cent deposit on a home. It examined the difference in how much you’d need to save in every state and territory, as well as how much they have changed from last year’s report.

The most expensive area? Sydney of course, where it would take you eight years to save for a house if you’re a couple and roughly 16 fkn years if you’re single. Following that is the nation’s capital Canberra, where it would take you seven odd years as a couple.

Quite interesting that these two places are so close together considering there are one million things to do in Sydney while the most exciting thing to do in Canberra is leave. Quite interesting indeed.

Following these two big dogs are Melbourne (six years), Hobart (five years 10 months), Brisbane (four years 10 months), Adelaide and Darwin (roughly four years) and Perth (three and a half years) in that order. Guess I know where I’m moving to.

We spoke to Dr Nicola Powell, Domain’s Chief of Research and Economics about how these stats affect young Aussies looking to buy a home.

PTV: In the First Home Buyers Report it says house prices across all capitals have increased by 101% in the past decade. What’s going on?

“The 10-year lens shows significant growth across our housing market,” said Powell.

“What we’ve seen since the pandemic began (March 2020) is strong rates of price growth across our capital cities.”

“We also saw a big shift in our population. More people were staying in their homes and reevaluating what they wanted.”

“There was lots of demand with basically not enough supply to keep pace with it.”

In the 2022 Demographia International Housing Affordability Report Sydney was the second most expensive city and Melbourne was fifth – is buying in these states a pipe dream?

“I think for some, it’s about thinking outside the box,” said Powell.

“Homeownership is a basic need, and Australians aspire to own their own home. It’s something that is built within all of us.

“What [our] report highlights is that saving for an entry house has blown out for houses in terms of time to save because house price growth has far exceeded wage growth.

“What we’re seeing is a bit of disruption of what we deem as the first home. Since those dreams were first imagined, our population has changed and our population density has changed.

“For buyers that don’t have the bank of mum and dad, haven’t had an inheritance or even a lottery win, saving for that lump sum deposit is the biggest hurdle for a first home buyer.

“Gaining access to the market is now a matter of compromise, and that compromise looks different depending on who you are as a buyer. Perhaps its location, perhaps its property type, perhaps its dwelling size.”

Given the current costs of living are pretty grim, should young Aussies still be aiming for a house or settle for a unit?

“It honestly depends on the size of your family,” said Powell.

“It becomes about what can you afford. In today’s market when you purchase your first home the most crucial thing is to stay within budget. Your first home is not your forever home, it’s your first step on the property ladder.”

The report states that it will take roughly eight years for a couple to save in Sydney — how long would it take for someone single?

“Roughly double that.”

Brb, I’m gonna go cry into my pillow.

In Domain’s report both Canberra and Sydney have experienced the largest annual change. Why do you think these places are equally as costly given how vastly different they are?

“Canberra in particular has seen extreme rates of price growth since March 2020.”

“Canberra was less affected by the economic impacts of COVID. A large population are employed by government and that feeds into the economy.”

“What Canberra saw was an increase of people moving from other states and territories into the ACT, because it was not as impacted by lockdowns. Life was more normal in the ACT and that became attractive to many people.”

As someone who lives in Canberra, I am still confused but go off.

Maybe we should all start polycules and split the house cost between like, six people? Shit’s looking grim.

The post Home On The (Out Of My Price) Range: This Report Says It’ll Take 16 Years To Save For A House appeared first on PEDESTRIAN.TV .