Reliance Steel & Aluminum Co. (NYSE:RS) is benefiting from strong demand across key end-use markets, a diversified product base and strategic acquisitions amid headwinds from higher costs.

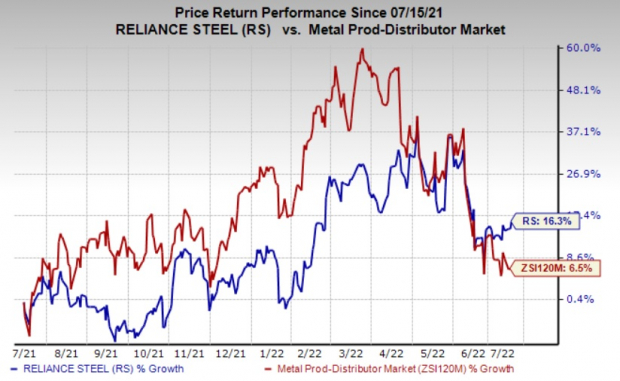

Shares of Reliance Steel have gained 16.3% in the past year compared with a 6.5% gain of the industry.

What's Favoring RS?

Reliance Steel is gaining from strong underlying demand in its major markets and the strength in metals pricing. It remains optimistic about the business environment in 2022 and sees robust demand in the majority of its end markets. The company also anticipates metals pricing to remain elevated in the near term.

Demand in non-residential construction, the company's biggest market, improved in the first quarter of 2022 after being affected by typical year-end seasonality in the fourth quarter. The company expects non-residential construction activities to strengthen through 2022, aided by strong booking trends.

Reliance Steel is also witnessing strength in semiconductors and continued recovery in the energy (oil and natural gas) market. Demand in the heavy industry for both agricultural and construction equipment also continued to improve in the first quarter.

The company is also seeing healthy demand for the toll processing services that it provides to the automotive market despite the impact of global microchip shortages on production levels. Additionally, demand in commercial aerospace is improving on higher activities.

The company has also been following an aggressive acquisition strategy for a while as part of its core business policy to drive operating results. Its latest acquisitions of Rotax Metals, Admiral Metals and Nu-Tech Precision Metals are in sync with its strategy of investing in high-quality businesses.

Reliance Steel also remains committed to boost returns to shareholders. It returned $73.8 million to shareholders through $56.7 million in dividends and $17.1 million in share repurchases in the first quarter. The company had around $696 million available under its $1 billion share repurchase authorization at the end of the quarter.

Cost Inflation a Concern

Reliance Steel is exposed to challenges from cost inflation stemming from higher input and other costs. It is witnessing higher fuel, freight, packaging and labor costs. Its selling, general and administrative expenses went up 13.5% year over year in the first quarter. The company expects a full-quarter impact from wage inflation in the second quarter.

Stocks to Consider

Better-ranked stocks worth considering in the basic materials space include Albemarle Corporation ALB, Cabot Corporation CBT and Allegheny Technologies Inc. ATI.

Albemarle has a projected earnings growth rate of 231.7% for the current year. The Zacks Consensus Estimate for ALB's current-year earnings has been revised 26.5% upward in the past 60 days.

Albemarle's earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 20%. ALB has gained roughly 6% in a year. The company flaunts a Zacks Rank #1 (Strong Buy).

Cabot, currently carrying a Zacks Rank #1, has an expected earnings growth rate of 22.5% for the current fiscal year. The Zacks Consensus Estimate for CBT's earnings for the current fiscal has been revised 2.5% upward in the past 60 days.

Cabot's earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 16.2%. CBT has gained around 16% over a year.

Allegheny, currently sporting a Zacks Rank #1, has a projected earnings growth rate of 1,046.2% for the current year. The Zacks Consensus Estimate for ATI's current-year earnings has been revised 18.3% upward in the past 60 days.

Allegheny's earnings beat the Zacks Consensus Estimate in the last four quarters. It has a trailing four-quarter earnings surprise of roughly 128.9%, on average. ATI shares are up around 9% in a year.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It's a little-known chemical company that's up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks' Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

ATI Inc. (NYSE: ATI): Free Stock Analysis Report

Reliance Steel & Aluminum Co. (NYSE: RS): Free Stock Analysis Report

Albemarle Corporation (NYSE: ALB): Free Stock Analysis Report

Cabot Corporation (NYSE: CBT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Image sourced from Shutterstock