- JPMorgan analyst David Karnovsky upgraded Take-Two Interactive Software, Inc (NASDAQ:TTWO) to Overweight from Neutral with a price target of $175, down from $205, following a period of restriction.

- With the close of the Zynga acquisition, Take-Two now offers a scaled portfolio of mobile games, apart from leading PC/console intellectual property and a pipeline of content set to "ramp significantly," Karnovsky noted.

- Karnovsky observed that the shares were down 20% since the deal's announcement on January 10, reflecting investor concerns over pandemic comps and platform privacy changes.

- Karnovsky expects the headwinds to ease in the coming quarters and further see the post-IDFA landscape favoring scaled operators.

- On the PC/console side, following a period of investment, Take-Two is set to substantially increase its output of AAA games, which Karnovsky forecasts will drive a step-function increase in revenue and profitability.

- Price Action: TTWO shares traded higher by 0.51% at $132.07 on the last check Thursday.

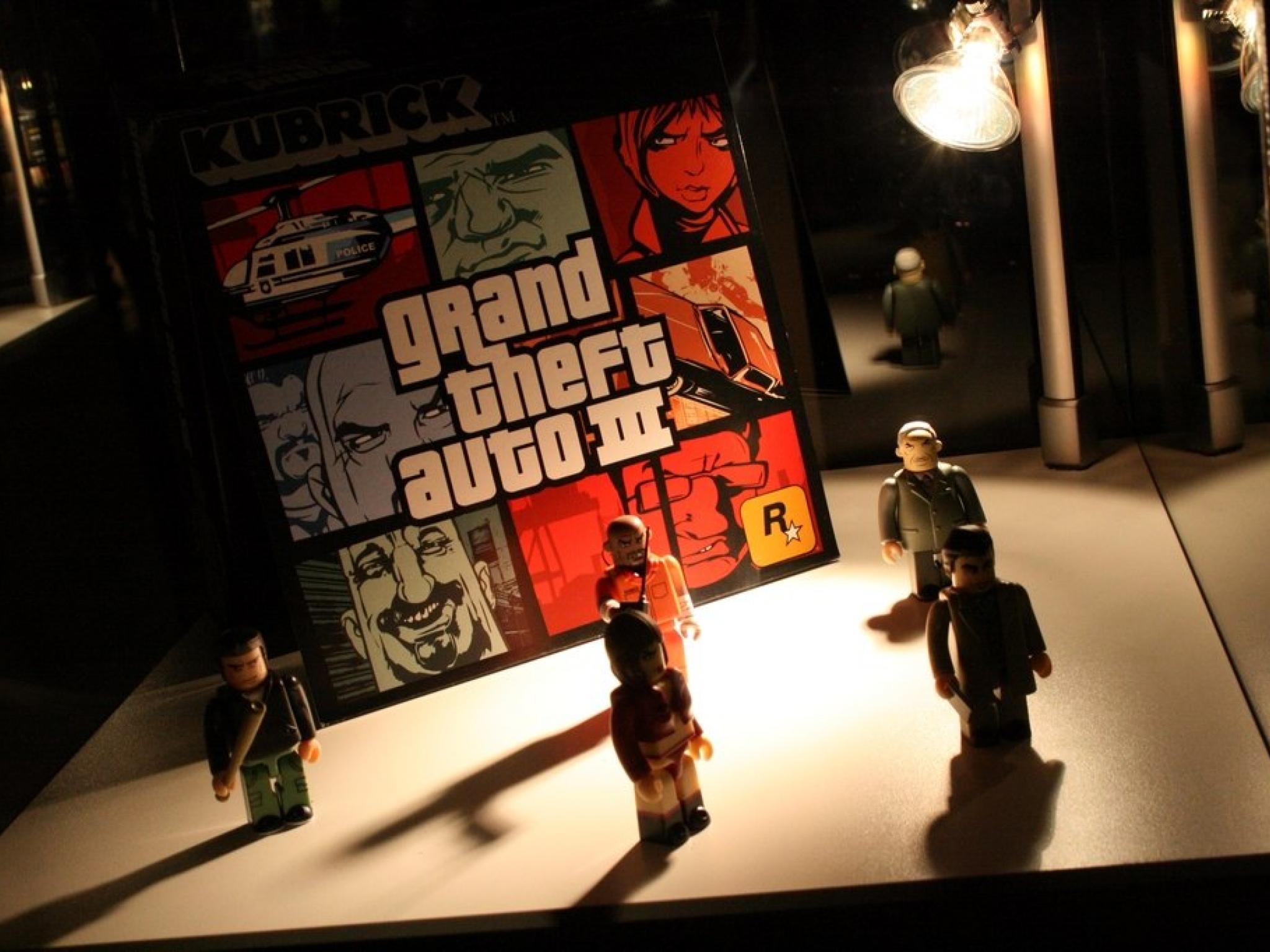

- Photo via Wikimedia Commons