Bitcoin (CRYPTO: BTC) popped up over Thursday’s 24-hour session high briefly on Friday, but a lack of bullish momentum into the move caused the crypto to fall lower, rejecting from the eight-day exponential moving average.

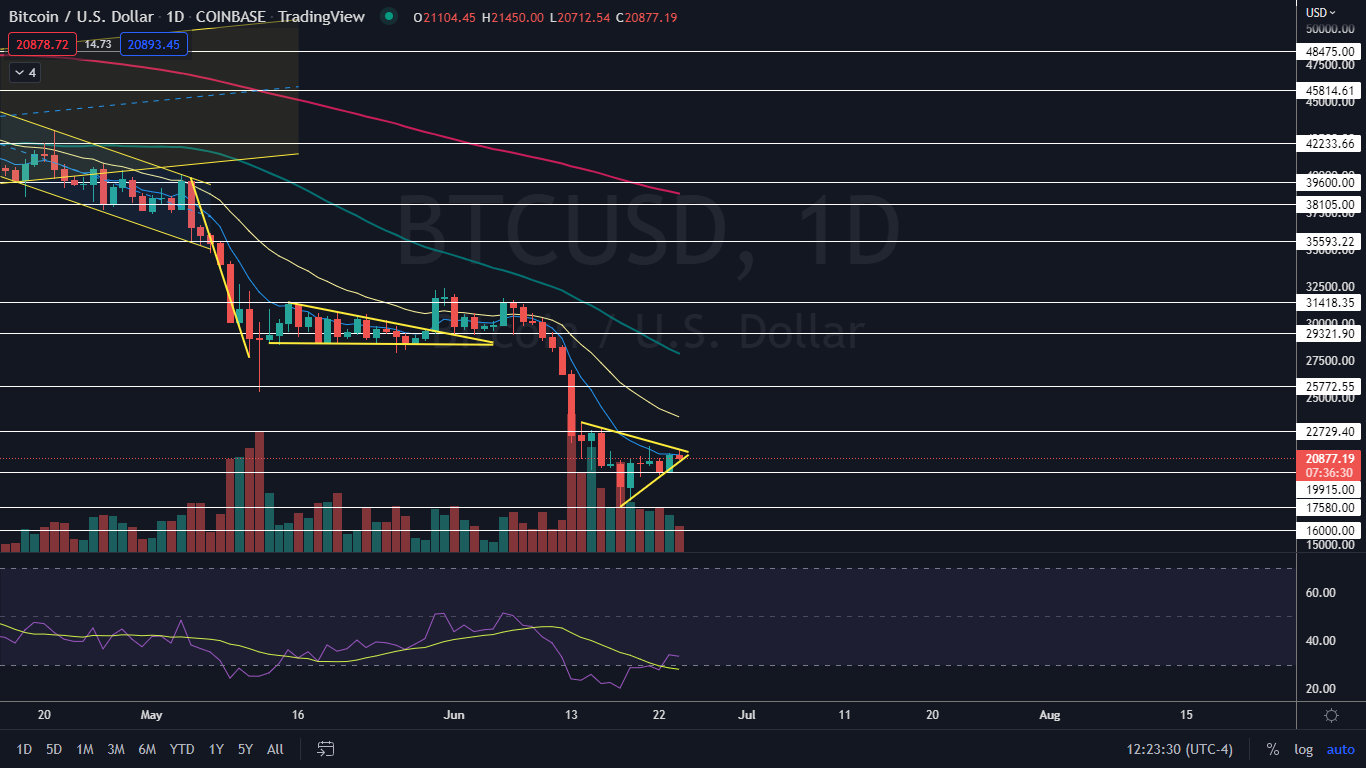

The crypto has been trading in a horizontal pattern over the last 11 trading days after plunging 28% between June 7 and June 13. The horizontal pattern, which has also consisted of a series of higher lows and lower highs, has settled Bitcoin into a symmetrical triangle pattern on the daily chart.

The pattern indicates that the bulls and bears are equally in control.

A symmetrical triangle is often formed on lower-than-average volume and demonstrates a decrease in volatility, indicating consolidation. The decreasing volume is often followed by a sharp increase in volume when the stock breaks up or down from the pattern, which should occur before the stock reaches the apex of the triangle.

- Aggressive bullish traders may choose to purchase a stock in a symmetrical triangle when the security reverses course on the lower ascending trendline, with a stop set if the stock rejects at the upper descending trendline of the pattern. More conservative traders may wait for the stock to break up bullishly from the pattern on higher-than-average volume.

- Aggressive bearish traders may choose to trade opposite to the bulls, entering into a short position on a rejection of the upper descending trendline and covering the position if the stock finds support at the lower trendline. Opposite to the bulls, conservative bearish traders may wait for the stock to break down from the lower trendline on higher-than-average bearish volume.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The Bitcoin Chart: Bitcoin is set to meet the apex of its symmetrical triangle pattern on Saturday. If the pattern is recognized by the algorithms, Bitcoin and other cryptocurrencies could be in for a big weekend move. Traders and investors can watch for the crypto to break up or down from the pattern on higher-than-average volume to gauge future direction.

- There’s a chance the symmetrical triangle, paired with the sharp decline that happened previously to the pattern forming, is a bear flag pattern, with the pole formed between June 7 and June 18 and the flag forming over the 24-hour trading sessions that have followed. If the bear flag becomes the dominant pattern, the measured move is 44%, which suggests Bitcoin could plunge toward $12,000.

- Bullish traders want to see Bitcoin hold psychological support at $20,000 and for the crypto to either react bullishly to the triangle pattern or continue to trade sideways and negate the pattern. If Bitcoin continues to trade sideways, further indication of whether the horizontal pattern represents accumulation or distribution will become more obvious.

- Accumulation appears to be the most likely scenario because Bitcoin’s relative strength index (RSI) has been increasing, which indicates momentum to the upside.

- Bitcoin has resistance above at $22,729 and $25,772 and support below at $19,915 and $17,580.