New York-based Warner Bros. Discovery, Inc. (WBD) operates as a media and entertainment company worldwide. With a market cap of $19.8 billion, the company offers a complete portfolio of content, brands, and franchises across television, film, streaming, and gaming. The leading global media and entertainment company is expected to announce its fiscal first-quarter earnings for 2025 before the market opens on Thursday, May 8.

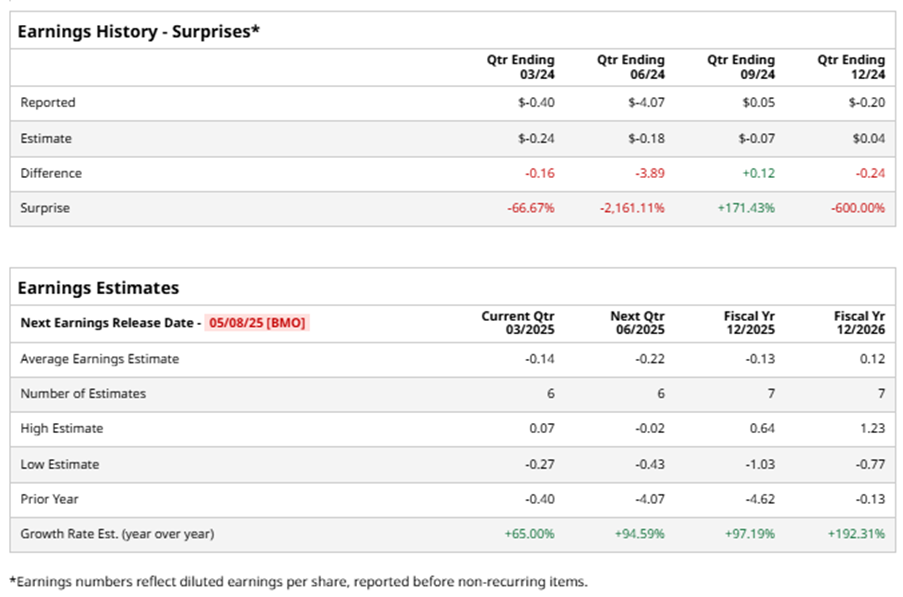

Ahead of the event, analysts expect WBD to report a loss of $0.14 per share on a diluted basis, up 65% from $0.40 loss per share in the year-ago quarter. The company missed the consensus estimates in three of the last four quarters while beating the forecast on another occasion.

For the full year, analysts expect WBD to report loss of $0.13 per share, up 97.2% from a loss of $4.62 in fiscal 2024. Its EPS is expected to rise 192.3% year over year to $0.12 in fiscal 2026.

WBD stock has underperformed the S&P 500’s ($SPX) 9.4% gains over the past 52 weeks, with shares up 3.6% during this period. Similarly, it underperformed the Communication Services Select Sector SPDR ETF’s (XLC) 21% gains over the same time frame.

WBD faces challenges in catching up to competitors like Netflix, Inc. (NFLX) and The Walt Disney Company (DIS) due to its smaller subscriber base. Ongoing struggles in the cable TV segment could continue to weigh on overall performance. In addition, aggressive international expansion and digital content creation may lead to increased costs, affecting profitability. The competitive streaming market may hinder achieving subscriber growth targets. Moreover, dependence on cost controls could hinder investment in content creation, impacting subscriber retention.

On Feb. 27, WBD shares closed up more than 4% after reporting its Q4 results. Its loss of $0.20 per share missed Wall Street expectations of EPS of $0.04. The company’s revenue was $10 billion, missing Wall Street forecasts of $10.4 billion.

Analysts’ consensus opinion on WBD stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 25 analysts covering the stock, 11 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and 13 give a “Hold.” WBD’s average analyst price target is $12.24, indicating an ambitious potential upside of 42.5% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.