/Dover%20Corp_%20logo%20and%20ebsite-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $22.7 billion, Dover Corporation (DOV) provides equipment, components, consumables, software, and services through five segments: Engineered Products; Clean Energy & Fueling; Imaging & Identification; Pumps & Process Solutions; and Climate & Sustainability Technologies. It serves industries including vehicle service, aerospace and defense, fueling, product traceability, fluid handling, refrigeration, and climate control. The Downers Grove, Illinois-based company is expected to release its fiscal Q1 2025 earnings results on Thursday, Apr 24.

Ahead of this event, analysts project DOV to report an adjusted EPS of $2, a 2.6% growth from $1.95 in the year-ago quarter. It has exceeded Wall Street's bottom-line estimates in the last four quarters. In Q4 2024, DOV beat the consensus adjusted EPS estimate by 5.8%.

For fiscal 2025, analysts forecast DOV to report adjusted EPS of $9.46, up 14.1% from $8.29 in fiscal 2024.

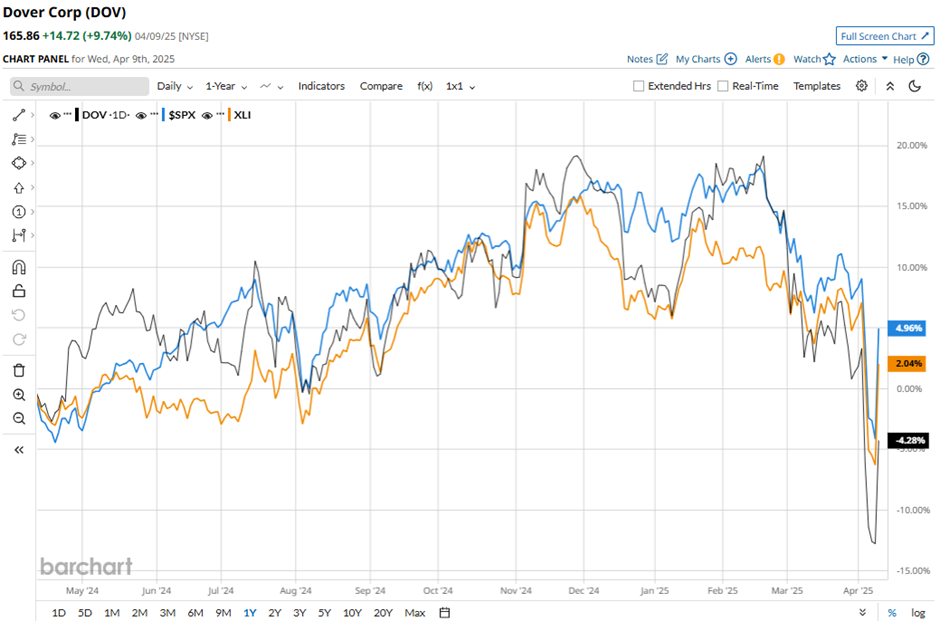

Over the past 52 weeks, Dover has declined 6.5%, underperforming the broader S&P 500 Index's ($SPX) 4.7% gain and the Industrial Select Sector SPDR Fund's (XLI) 1.3% rise over the same period.

Shares of Dover rose 4.1% on Jan. 30 after the company reported Q4 2024 adjusted EPS of $2.20, beating the consensus estimate. The company posted strong performances in Clean Energy & Fueling and Pumps & Process Solutions, with order trends improving and a book-to-bill ratio above one. Management’s 2025 guidance of adjusted EPS between $9.30 and $9.50 and expected organic revenue growth of 3% to 5% fueled optimism.

Analysts' consensus view on Dover stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 14 analysts covering the stock, nine suggest a “Strong Buy” and five recommend a "Hold." As of writing, DOV is trading below the average analyst price target of $222.28.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.