/Brown%20%26%20Brown%2C%20Inc_%20magnified-by%20Pavel%20Kapysh%20via%20Shutterstock.jpg)

Daytona Beach, Florida-based Brown & Brown, Inc. (BRO) markets and sells insurance products and services in the U.S. and internationally. Valued at $34 billion by market cap, the company operates through Retail, Programs, Wholesale Brokerage, and Services segments.

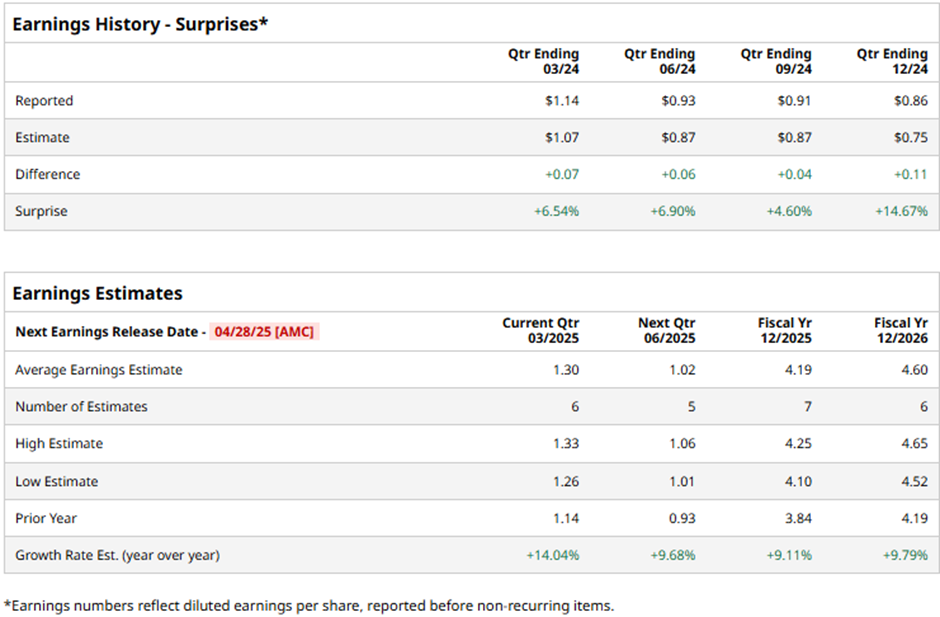

The insurance broker is gearing up to announce its first-quarter results after the market closes on Monday, Apr. 28. Ahead of the event, analysts expect BRO to report an adjusted EPS of $1.30, marking a solid 14% increase from $1.14 reported in the year-ago quarter. Moreover, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, BRO is expected to deliver an adjusted EPS of $4.19, up 9.1% from $3.84 reported in fiscal 2024. In fiscal 2026, its adjusted earnings are expected to further grow 9.8% year-over-year to $4.60 per share.

BRO stock prices have soared 47.6% over the past 52-week period, significantly outperforming the S&P 500 Index’s ($SPX) 5.5% gains and the Financial Select Sector SPDR Fund’s (XLF) 17.7% surge during the same time frame.

Despite outperforming Street’s expectations, Brown & Brown’s stock dropped 2.6% in the trading session after the release of its Q4 results on Jan. 27. Driven by solid organic growth, the company’s total revenues surged 15.4% year-over-year to $1.2 billion, exceeding the Street’s expectations by 6.4%. Meanwhile, driven by notable margin expansion, BRO’s adjusted EBITDAC grew 22.6% year-over-year to $390 million. Furthermore, the company reported a 24.6% year-over-year growth in adjusted EPS to $0.86, surpassing the consensus estimates by 14.7%.

However, due to the company’s aggressive acquisition spree, Brown & Brown has observed a notable increase in debt and goodwill on its balance sheet which could have settled investor confidence.

The consensus view on BRO stock is cautiously optimistic, with a “Moderate Buy” rating overall. Of the 16 analysts covering the stock, opinions include five “Strong Buys,” two “Moderate Buys,” eight “Holds,” and one “Moderate Sell” rating. As of writing the stock, trading slightly above its mean price target of $118.14.