Unfortunately for investors in Goldman Sachs (GS), the stock is continuing the pattern we’ve seen with a few of its peers when they started reporting earnings last week.

Like JPMorgan (JPM) did last week when it pulled back on earnings, Goldman Sachs is down too. It’s lower by more than 7% on Tuesday.

JPMorgan missed on revenue estimates, which is what hit the stock hard. Goldman Sachs beat analysts’ revenue expectations, but missed on earnings estimates.

Revenue rose 7.7% year over year, fueled by investment banking revenue, which rose 45% from last year to $3.8 billion.

The concern here now becomes the financial sector as a whole.

As of just a couple of days ago, energy stocks and financial stocks were leading the way higher.

The rallies were covering many of the losses in other sectors and industries — particularly tech — as the broader market was under what many would consider mild selling pressure.

Trading Goldman Sachs Stock

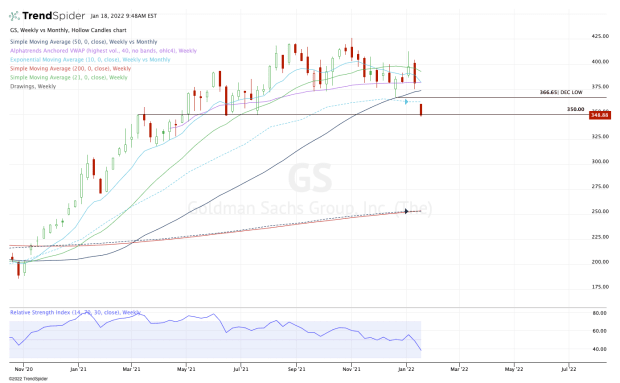

Chart courtesy of TrendSpider.com

Goldman Sachs stock is taking it on the chin Tuesday and was down as much as 8.8% at one point during the day.

In premarket trading, the stock was down “just” 4% or so, trading just below the December low at $366.65. Before today’s drop, that’s also near where the 10-month moving average was trading.

While the stock was gapping below last month’s low, the hope was that it could reclaim this mark and give bulls a quick reversal opportunity.

Clearly that didn't pan out.

The stock is now below both of these marks, technically putting a monthly-down rotation in play.

Goldman Sachs stock is now trading into the key $350 level. This mark was resistance in the first half of 2021 and support in the second half.

Aggressive bulls can be long from this level (now that the stock has already broken below it) and use a stop-loss just below today’s low.

On the upside, look for a test of the 10-week moving average. Above the December low puts the 50-day in play.

On the downside, there’s not a super obvious area of support in the short term -- which is never a good sign.

I would look at $338 to $340 (a downside extension level), followed by $325, a former support mark.

Mostly though, Goldman Sachs stock will be in no man’s land.