Remember those early days of the pandemic when, full of fitness goals and motivation, you bought a Peloton (PTON) and signed up for online Zumba?

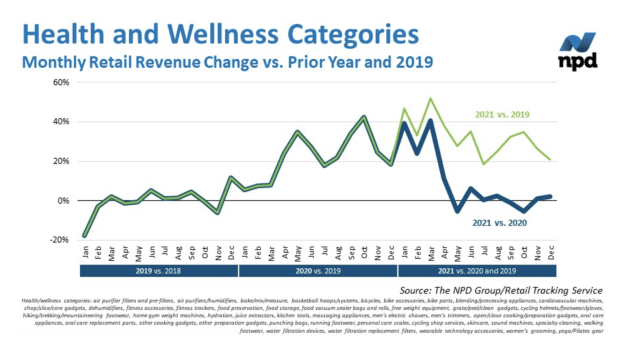

While that sense of "I'm going to get so fit!" has long faded for most, spending habits are still staying strong. According to new numbers released by market research firm NPD, spending on health and wellness remains higher than it was in 2019 by double digits.

We're Still Buying Up Weights And Air Purifiers

Health and wellness is a broad category that includes everything from workout clothes and special food to self-help books and air purifiers.

Air purifier filters, massaging appliances, free-weight equipment and sound machines remain some of the most popular items for people to buy; sales revenue for each more than doubled between 2019 and 2021.

Every year, health and wellness spending peaks around late February and March, likely around the time many start worrying about getting fit "for summer."

While spending did slow from the 2020 surge seen during lockdowns and shelter-in-place orders, it is still significantly higher than it was in 2019 — cleaning, fitness, and food preparation and books about home gardening, self-help and hobbies are some other categories continuing to see double-digit growth.

NPD

"This growth seems to indicate that health and wellness is an enduring pandemic trend, which could provide opportunities for continued consumer spending," Marshal Cohen, chief retail industry advisor for NPD, said in a statement.

What Does This Mean For Major Drugstore Chains?

Drugstores like Walgreens (WBA) and CVS (CVS) have followed an interesting trajectory throughout the pandemic.

After an initial surge in activity during the pandemic and ensuing vaccination campaign, the drugstores have navigated waning demand as well as issues related to global supply chain disruption.

Naturally, the increased interest spells good news for a corporation like Walgreens, with company shares are down more than 12% year-over-year.

CVS, which has seen share growth of 43.10% since this time in 2021, will also benefit from buyers who are still seeing high demand for many of its core products: beauty items, oils and rubs, vitamins and air purifying equipment.

"As consumers get out into the world and start to spend more on vacations and other experiences, health and wellness is likely to continue to play a role in their lives," Cohen said.

"Now it's time for retailers and manufacturers to not only retain, but also generate, new consumer attention, in a retail landscape where competition for the shopper’s share of wallet will soon expand."