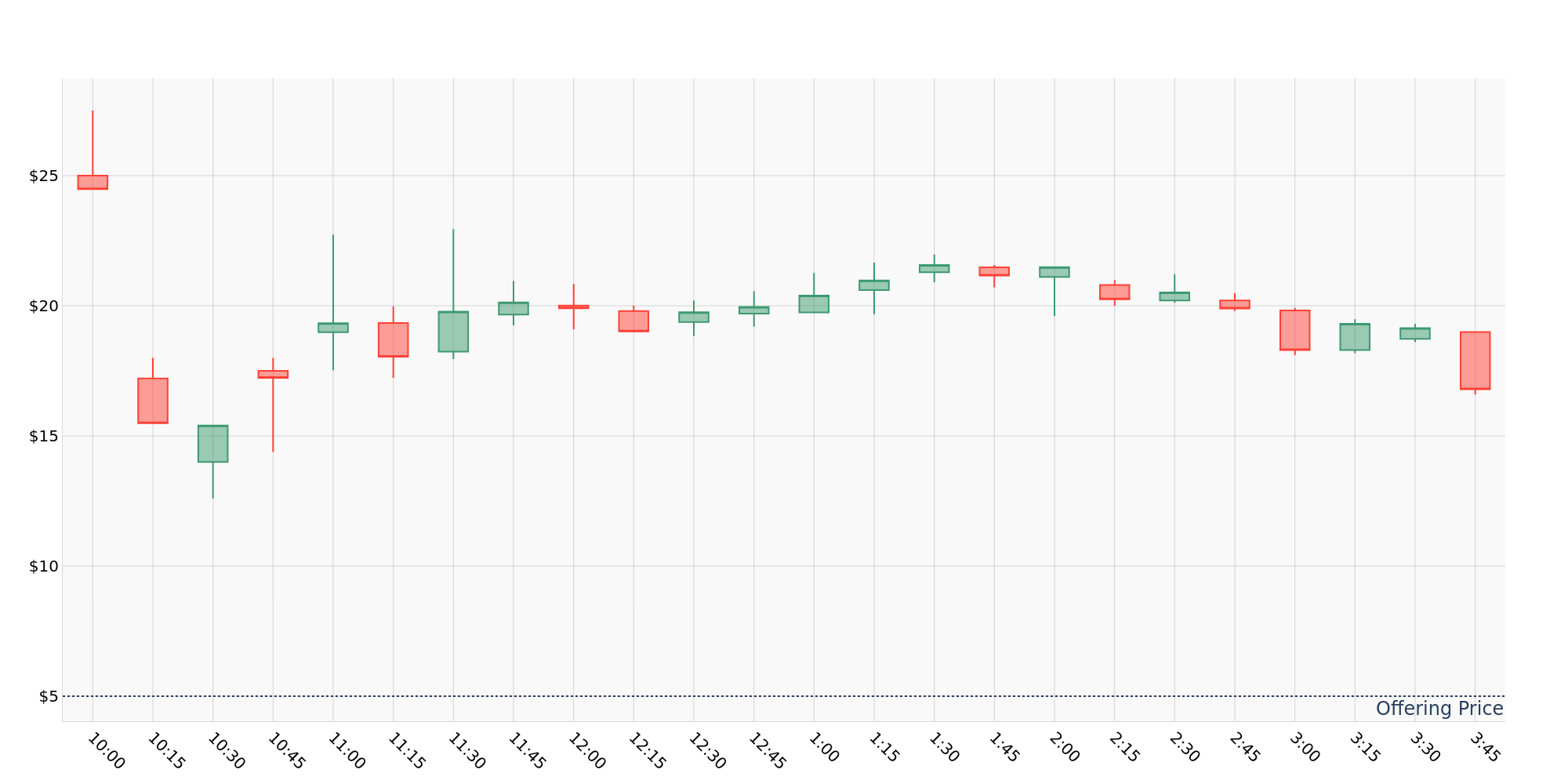

Zhong Yang Financial Group Limited (NASDAQ:TOP) opened up its shares for public trading for the first time since it filed for IPO in September 2021. The company agreed to initially offer 5.00 million shares to the public at a $5.00 per share. On its first day of trading, the stock decreased 32.04% from its opening price of $25.0 to its closing price of $16.99.

Zhong Yang Financial Group Limited Performance On First Day of Trading

About Zhong Yang Financial Group Limited and It's IPO

Zhong Yang Financial Group Limited isan online brokerage firm located in Hong Kong specializing in the trading of local and foreign equities, futures, and options products. We create value for our customers by providing reliable trading platforms, user-friendly web and app interface, and seamless customer support. We generate revenues primarily by charging commission fees on futures transactions at a flat rate for each futures transaction contract. Currently our customers are mainly high volume and frequency trading institutional and individual investors

For its IPO, TOP agreed to offer 5.00 million shares at a price of $5.00 per share, with an insider lock-up period of 180 days, ending on November 28, 2022.

An insider lock-up period is a period of time after a company first goes public where major shareholders are not allowed to sell their shares. The insider lock-up period makes sure that the market does not get oversupplied with shares of the company.

Traders may short the stock leading up to the lockup-period expiration date in hopes that the price will fall due to an increase in supply of shares. Retail traders should be watching this stock's short interest as it moves closer to lockup expiration.

See also: Benzinga's Most Shorted Stocks

This article was generated by Benzinga's automated content engine and reviewed by an editor.