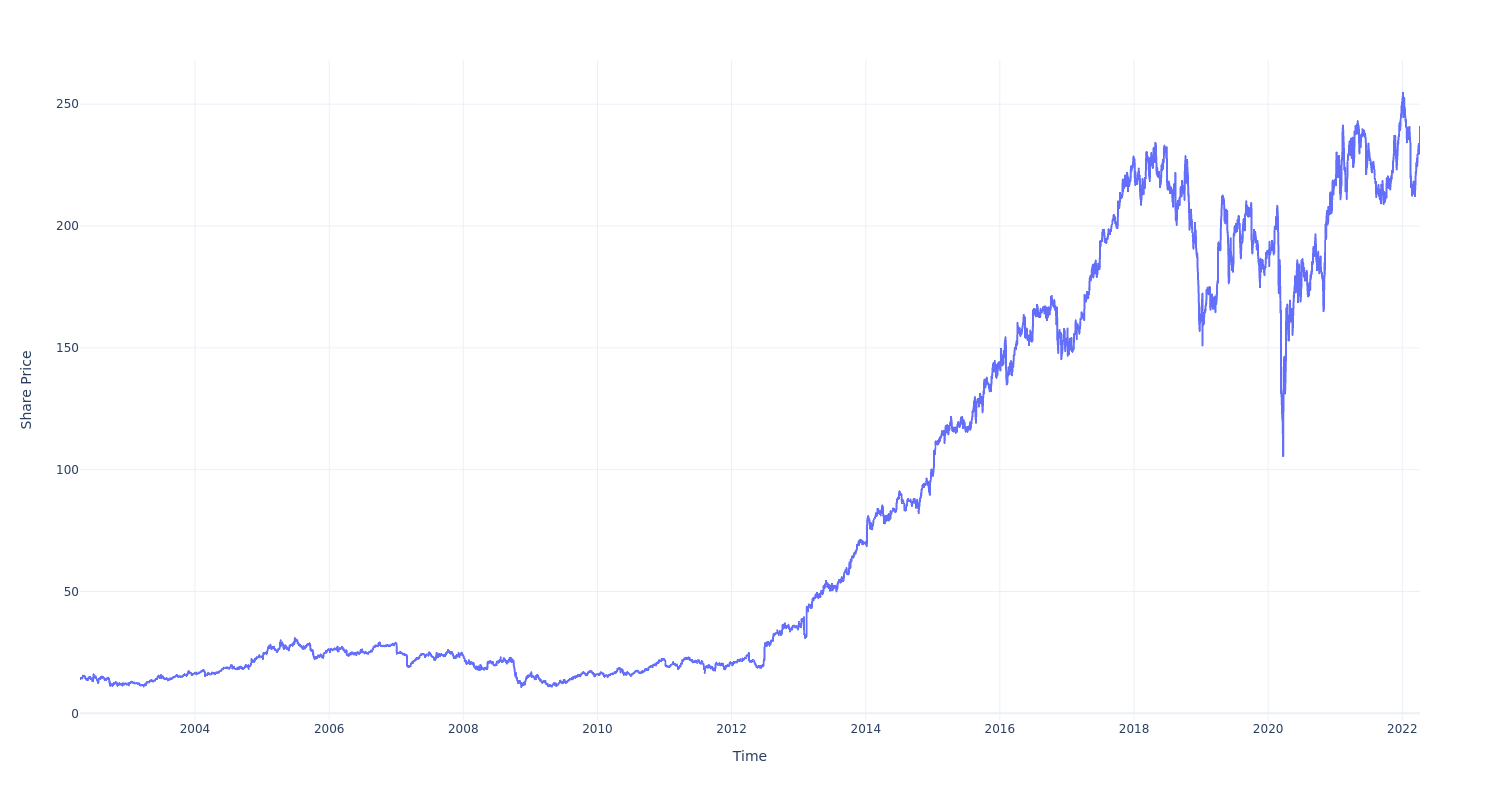

Constellation Brands (NYSE:STZ) has outperformed the market over the past 20 years by 8.1% on an annualized basis producing an average annual return of 15.2%. Currently, Constellation Brands has a market capitalization of $45.13 billion.

Buying $100 In STZ: If an investor had bought $100 of STZ stock 20 years ago, it would be worth $1,705.86 today based on a price of $240.64 for STZ at the time of writing.

Constellation Brands's Performance Over Last 20 Years

Finally -- what's the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga's automated content engine and reviewed by an editor.