Stocks are rocketing on Wednesday, with the S&P 500 and Nasdaq up 2% and 2.5%, respectively. The move comes after the July inflation report came in below expectations.

The CPI reading has become the most followed economic report in 2022, as inflation has become the main talking point for financial markets.

Not only did all four of the main CPI measures for July come in below expectations, they also marked a decline from the readings in June.

That has investors talking about "peak inflation," which is key for a market that is forward-looking. But it’s also important as the CPI reports influence the speed and severity of the Federal Reserve’s rate hikes.

For a more sustained move to the upside to occur, we’ll need a more dovish Fed — or at the very least a less hawkish one.

Today’s lower-than-expected CPI reading gives the market an opportunity to extend its upside push, and investors are taking full advantage.

Let’s look at the charts to see just how far this rally could go.

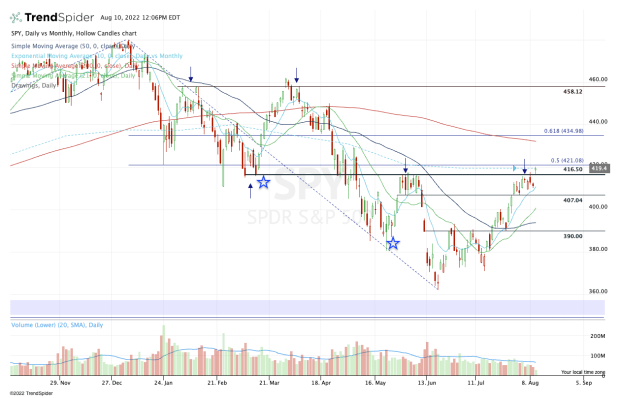

Trading the S&P 500

Chart courtesy of TrendSpider.com

Traders may not have noticed, but the SPDR S&P 500 ETF SPY declined in four straight sessions -- off 0.07%, 0.17%, 0.12% and 0.4%. That's probably because none of the declines were particularly noteworthy

Part of that was digesting and consolidating the big rally off the mid-July low, where the SPY rallied 12% in 15 trading sessions. The other part was a choppy couple of trading sessions ahead of today’s CPI numbers.

With the reaction clearly bullish, the SPY ETF is being thrust over the key $416.50 area, which had been resistance.

As long as the SPY stays above this level and the 10-day moving average, many traders will remain bearish.

Interestingly, the ETF is now running into the 10-month moving average and is backing off a bit, while the 50% retracement for the entire 2022 decline is just above this level, near $421.

As much as I want to champion the SPY’s ability to clear $416.50 resistance, this other area is noteworthy to me. On the plus side, a move above $421 could unlock a move to the $432 to $435 area.

There we find the 200-day moving average and the 61.8% retracement — again, two very significant levels.

If the SPY trades below $416.50 and the 10-day moving average, it puts this week’s low in play. Below that and $407 could be next, followed by $400.

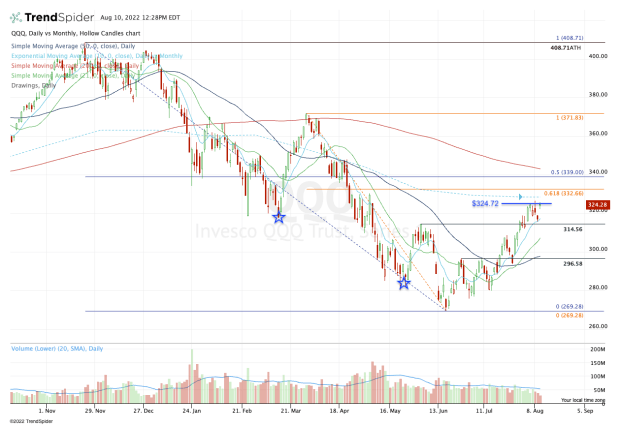

Trading the Nasdaq

Chart courtesy of TrendSpider.com

The Nasdaq is not as clear-cut as the S&P 500, partly because the former has been such a laggard vs. the latter.

Looking at the Invesco QQQ Trust QQQ, it held right where it needed to when it pulled back to the 10-day moving average yesterday.

Of course, today’s CPI report was either going to make or break the setup, as the QQQ would have likely plunged below it on a bad report or ripped higher as it’s doing today.

The QQQ ETF is looking very good right now, but it’s not out of the woods just yet.

The ETF has continued to struggle with the $324.72 level — last week’s high. Bulls need to see the QQQ clear this level and if it can, it will quickly put the 10-month moving average in play.

Above that opens the door to the $332.50 to $333 zone, which is the 61.8% retracement from the 2022 low to second-quarter high.

That’s followed by the $339 level — the 50% retrace from the 2022 low to the all-time high — and the 200-day moving average up at $343.

Tech has been buried, but it could add more fuel to the fire if this rally is sustainable.

Is the Low In?

Look at the chart above and note the sharp rallies we saw in mid-March and late May. They were abrupt, knee-jerk rallies; they were short-covering rallies. This rally has been different. We had a nice upside move, followed by consolidation and another move to the upside.

So far the dips are being bought and a more constructive uptrend is taking hold. Does that mean the bottom is in?

Not necessarily. But until short- and intermediate-term support levels are breached and until the uptrend is broken, the proper way to view the market is through a bullish lens.

If and when the trend unwinds, traders can become bearish — and that’s when we’ll find out if the low is in.