Shopify (SHOP) stock had a stunning rise, followed by a jaw-dropping collapse.

On Tuesday, the retail platform's shares plunged 14%. Shopify announced job cuts after looking to grow too aggressively.

It’s hardly the only tech stock slashing its workforce and/or pausing its hiring, but the shares were punished for it.

There were also likely some pre-earnings jitters amid that selloff, while the overall market decline on Tuesday didn’t help matters.

In any regard, Shopify reported earnings before the open on Wednesday, missing top- and bottom-line expectations. Still and all, the shares at last check were up nearly 7% on the day.

For what it’s worth, Alphabet (GOOGL) (GOOG) and Microsoft (MSFT) both reported earnings after the close on Tuesday, missed on earnings and revenue expectations, and are both nicely higher on the day.

Seeing a bullish reaction to a disappointing quarter is a positive development — it’s a victory for the bulls. It's also a development that will make Ark's Cathie Wood very happy, as she's back to buying Shopify stock.

The question becomes: Can these stocks maintain upside momentum or will the bears eventually regain control?

Has Shopify Stock Bottomed?

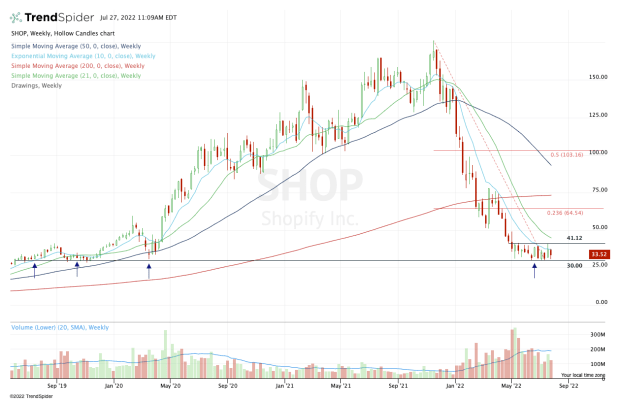

Chart courtesy of TrendSpider.com

The bulls really want to know whether we have seen the bottom in this stock. The answer to that question is not clear, but what is quite clear is that there’s a line in the sand near $30. This mark has been stout support over the past three months.

When we zoom out, we see that $30 also has been support in the past. Through 2019 and 2020, this level was stout support for the bulls. Keep in mind that the March 2020 covid low comes into play near $30.50 as well.

It’s been a stunning fall from its highs near $176 in November 2021 down to its current lows near $30. While one can make the case that Shopify is not operating at peak performance, it’s hard to make the case that it’s worse off than it was 30 months ago.

For instance, coming into 2020, Shopify generated about $1.6 billion in sales. Over the trailing 12 months, its revenue figure is more than triple that, at $4.82 billion.

When we return our attention to the charts, it’s clear that the 10-week moving average has been active resistance. The benchmark is currently nearly $36.75, and Shopify bulls are looking for the stock to clear this measure and close above it on a weekly basis.

If it can do so, it puts resistance in play between $40 and $41 but gives the stock potential for a monthly-up rotation over the current July high of $40.68.

Should the stock clear the declining 21-week moving average, $50 could be in play — particularly if a marketwide rally is also occurring.

Just for some perspective: If Shopify were to recover just under one-fourth of its losses by rallying to the 23.6% retracement at $64.54, it would equate to a more than doubling off the 2022 low.

On the downside, it’s pretty simple: $30 is must-hold support. A break of the 2022 low at $29.72 and close below that figure opens the door to more losses.