Uber (UBER) stock is flying higher on the day, up more than 13% following the ride-share and food-delivery company's earnings report.

That’s even amid weakness in the broader market. Stocks opened higher but turned lower and are near the day’s low.

For Uber’s part, the company delivered a top-line beat and beat on adjusted earnings, while its “net loss narrowed 50% from last year to $1.21 billion.”

That’s apparently enough for investors to hear, with the shares pushing higher. For Lyft (LYFT) stock, the shares are up about 6% in sympathy.

Despite today’s gain — and the fact that Uber shares are up 30% from last month’s low — Uber stock remains below the October high and below a key resistance point.

Will the report be enough to propel the shares higher?

Trading Uber Stock on Earnings

Chart courtesy of TrendSpider.com

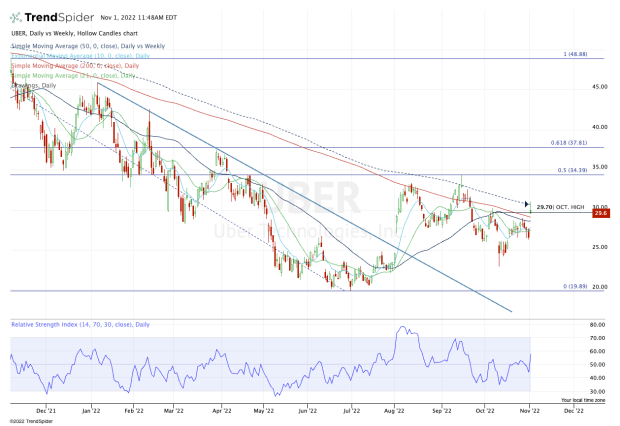

In early August, Uber stock gapped up, clearing a menacing downtrend resistance mark in the process (blue line).

Since then, the price action has been constructive as the stock works through hurdle after hurdle of resistance.

With today’s move, the shares are clearing four notable daily moving averages: the 10-day, 21-day, 50-day and 200-day.

But they're still struggling with the 50-week moving average, which stymied the rally in September in conjunction with the 50% retracement.

While the shares are up nicely on the day, they are fading a bit from the highs. As they do, the bulls will want to see if the stock can stay above the 200-day moving average and the October high at $29.70.

If it can, the 50-week moving average stays in play, along with today’s high at $31.

Above $31 — and particularly with a close above it — and the door opens to the third-quarter high from September at $34.33. That would again put the stock up against a test of the 50% retracement.

If Uber stock can clear that point, then the 61.8% retracement up near $38 is in play.

On the downside, failure to hold the 200-day moving average puts the gap-fill in play at $27.73. Below that and the stock price could face serious risk on a close below $26.30.

Specifically, it could open up $25 on the downside, followed by $23.