Happy Friday Everyone! 👋

There’s no telling when Crypto Winter will be over but the weather for crypto prices over the last week has been bright & sunny.

We’re also seeing signs of continued investments in the space as compressed valuations attract money from unusual sources.

One example is Christie’s—the auction house—which launched its own venture capital arm that will be investing in crypto and Web3 companies.

And despite the rumors, the VC funds are still out there—they’re just pickier.

Blockchain security Halborn represents just one of many crypto startups that have managed to raise capital despite the downturn. The firm raised $90M this week.

Of course, it wouldn’t be a complete newsletter without at least a mention of the latest on Three Arrows Capital. Court documents this week revealed crypto lender Genesis lent $2.4B to the now defunct hedge fund.

Yikes!

-

Solana (CRYPTO: SOL) is gaining ground

-

Polygon (CRYPTO: MATIC) launches new Ethereum (CRYPTO: ETH) scaling solution

-

The death of the margin call?

1. Solana is gaining ground

We’ve noted several times in this newsletter that we are keeping an eye on the projects that keep building amid the Crypto Winter.

One such project has been Solana.

The blockchain has been showing consistent growth in its user base throughout the bear market. In fact, it’s the only major layer-1 to do so.

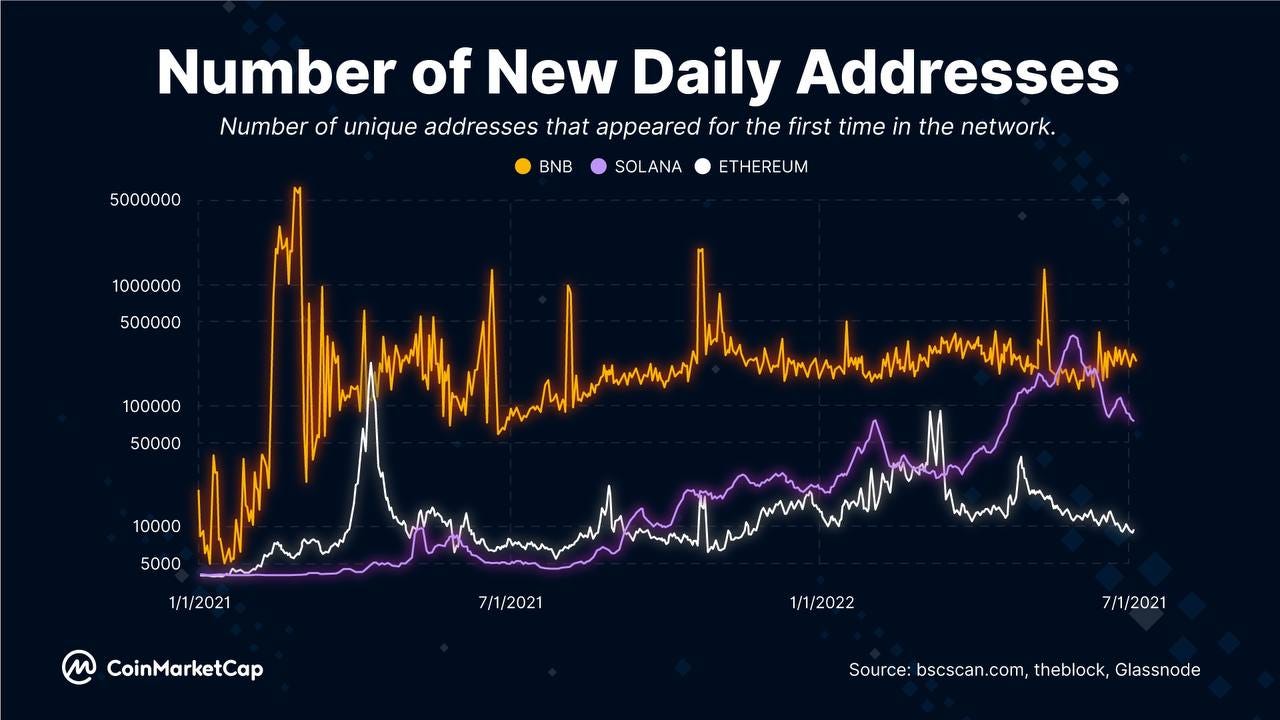

New Daily Addresses are indicators of growth and adoption. This year Solana has grown its new network participants by nearly 60%.

For comparison, rivals Ethereum and BNB Chain, have watched their new daily addresses figures tumble by 51.8% and 17.9%, respectively.

The increase in users hasn’t necessarily translated into inflows, but as we’ve said before, the name of the game in this market is to keep building.

Solana is doing that.

2. Polygon launches new Ethereum scaling solution

Polygon zkEVM (zero-knowledge Ethereum Virtual Machine) promises to deliver the “Holy Grail” of Web3 infrastructure: scalability, security, and Ethereum compatibility.

It’s the first scaling solution to use zero-knowledge proofs which cut days-long validity processes down to minutes.

The Polygon team estimates ekEVM will reduce current layer-1 Ethereum network costs by ~90% while not just maintaining the blockchain’s security, but also significantly increasing its throughput capabilities.

The goal for throughput is ~2,000 TPS (transactions per second), which would one-up the capabilities of establishment processors like Visa, who process ~1,700 TPS.

The zkEVM is set for mainnet launch in early 2023 (after a run on the public testnet later this summer).

Polygon’s token, $MATIC, is up nearly 100% this month (above).

3. The death of the margin call?

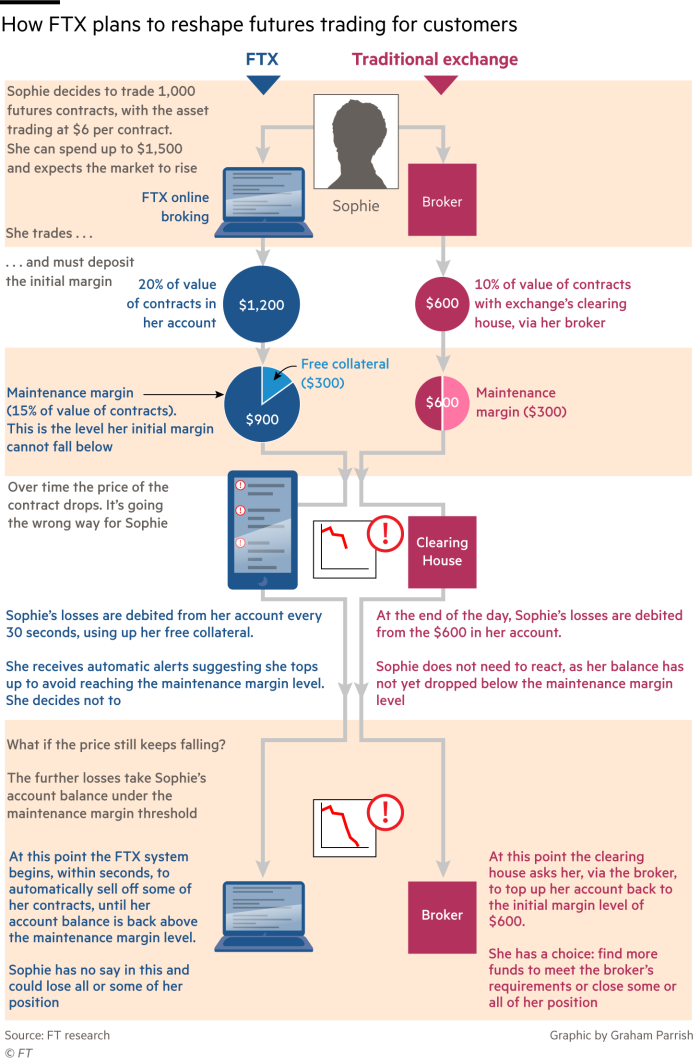

Sam Bankman-Fried’s FTX (CRYPTO: FTT) is looking to shake up a 40-year-old process in the US derivatives markets.

The crypto giant is seeking regulatory approval from the US Commodity Futures Trading Commission (CFTC) to offer Bitcoin (CRYPTO: BTC) futures that would render both margin calls and brokers obsolete.

At the heart of the suggested process—and the proposed replacement for margin calls—lies the concept of automatic liquidation.

In a nutshell: using a 24/7/365 monitoring system, an investor’s position would be automatically unwound accordingly if margin falls below a pre-determined level.

While this could protect investors from overnight/off-hours wipeouts that have become commonplace due to crypto’s extremely volatile nature, critics say it would eliminate the “breathing room” provided by margin calls.

Given the implications of the proposal—which would affect not only investors but also farmers hedging against price fluctuations and other such market participants—the CFTC is not likely to arrive at its decision until next year.

In any case, I’m staying away from crypto derivatives. Leverage and crypto are like Jim Cramer and stock-picking—the combination can very often lead to disaster (just ask 3AC).

Disclaimer: Not financial advice