Your support helps us to tell the story

This election is still a dead heat, according to most polls. In a fight with such wafer-thin margins, we need reporters on the ground talking to the people Trump and Harris are courting. Your support allows us to keep sending journalists to the story.

The Independent is trusted by 27 million Americans from across the entire political spectrum every month. Unlike many other quality news outlets, we choose not to lock you out of our reporting and analysis with paywalls. But quality journalism must still be paid for.

Help us keep bring these critical stories to light. Your support makes all the difference.

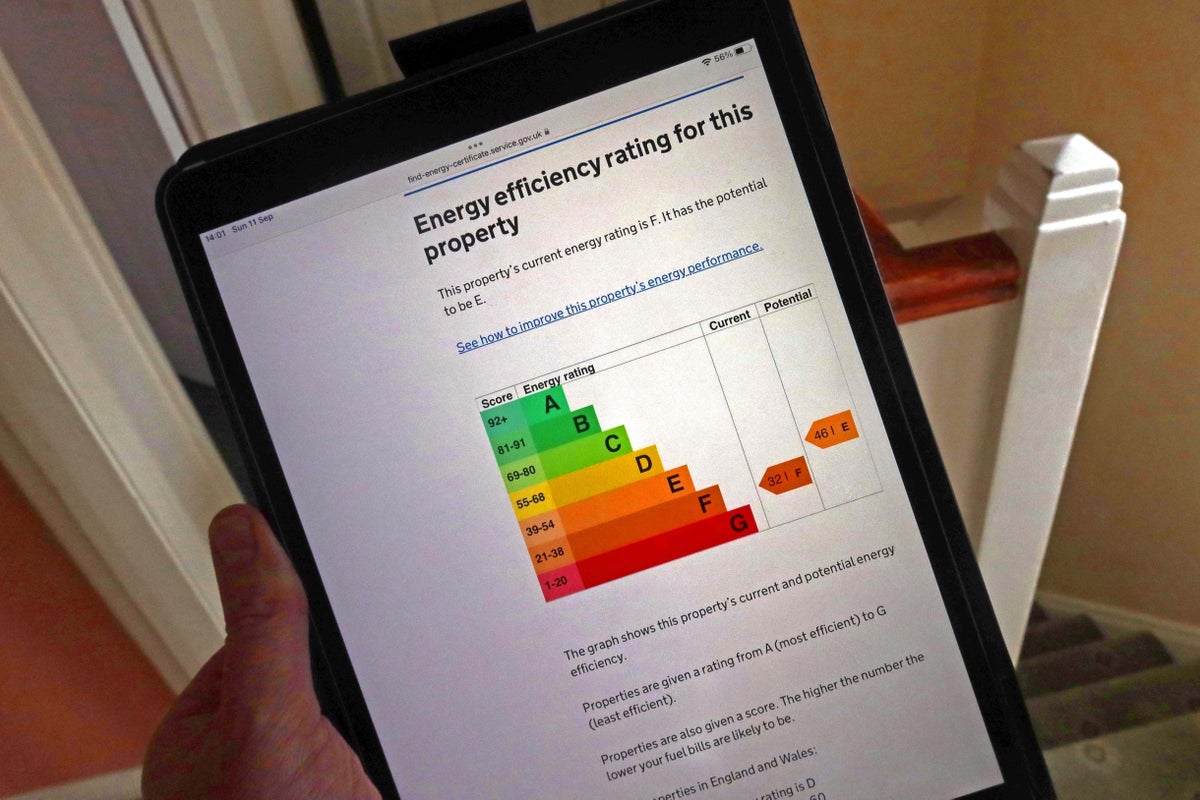

Energy-efficient properties can attract significant price premiums, analysis indicates.

A more energy-efficient buy-to-let property, with a rating of A or B, could attract a price premium of 10.9%, or £19,500 in cash terms, compared to a similar property rated D, if a landlord in England were to sell up, according to The Mortgage Works, a subsidiary of Nationwide Building Society.

Improving the property to a C rating could potentially generate a 3.4% (£6,200) premium for a landlord selling in England, it calculated.

While the impact is smaller than on property prices, landlords could also see a rental premium through green retrofitting, with A and B properties commanding a 7% rental income boost.

This would equate to around £70 per month, based on the typical rent in England, researchers said.

We must consider how we make it as appealing as possible for landlords to pour investment into their properties— Dan Clinton, The Mortgage Works

Properties with an energy performance rating of C attract a premium of around 2% or £20 per month, the report found.

Dan Clinton, head of buy-to-let at The Mortgage Works, said: “Our analysis shows there can be long-term gain with green retrofitting through increased property value and improved rental yields.

But he said it would be a “hard slog” for many landlords to “bring their homes up to spec, particularly those who have had to absorb higher mortgage rates and bigger tax bills in recent times”.

He added: “The time to act is now – we must consider how we make it as appealing as possible for landlords to pour investment into their properties.”