No 10 has sought to dismiss reports that Boris Johnson is “wobbling” over increasing National Insurance, saying the Government is “fully committed” to introducing the tax rise in the spring.

The Prime Minister is under pressure from some Conservative MPs to scrap or at least delay the increase to win back support as he awaits the findings of Whitehall and police inquiries into claims of lockdown-busting parties held in Downing Street.

The Times cited a Government source as saying Mr Johnson is “wobbling” over the rise, which is designed to tackle the Covid-induced NHS backlog and reform social care, with the newspaper suggesting he is considering delaying the policy for 12 months to appease critics on the right of the party.

But, pressed on the reports on Friday, a spokesman for the Prime Minister replied affirmatively when asked whether Downing Street could say that the manifesto-breaking policy will come into force, “no ifs, no buts”.

The spokesman said: “The Prime Minister and Chancellor are fully committed to introducing the health and social care levy in April.

“We’ve spoken before about why we are doing that – in order to give the NHS the funds it needs to tackle the backlog that has built up, as well as tackling the long-term issue of social care.”

Questions about whether the 1.25 percentage point increase in National Insurance will go ahead were fuelled by Mr Johnson’s refusal this week to offer a cast-iron guarantee on the rise, amid growing concerns about cost-of-living pressures.

Defence minister James Heappey told BBC’s Question Time programme on Thursday that the Government is “in listening mode” when it comes to assessing the policy.

On Friday, however, No 10 and technology minister Chris Philp offered a stern defence of the tax hike, insisting it will be enacted as planned.

Mr Philp denied any delay is being considered, telling LBC the “plan is to proceed as intended”.

He said the rise, and subsequent introduction of the health and social care levy from 2023, will provide £36 billion over three years to fund the NHS and social care.

Political opposition to the change has come from all sides of the Commons, as MPs fear the impact that increasing financial demands could have on stretched household budgets.

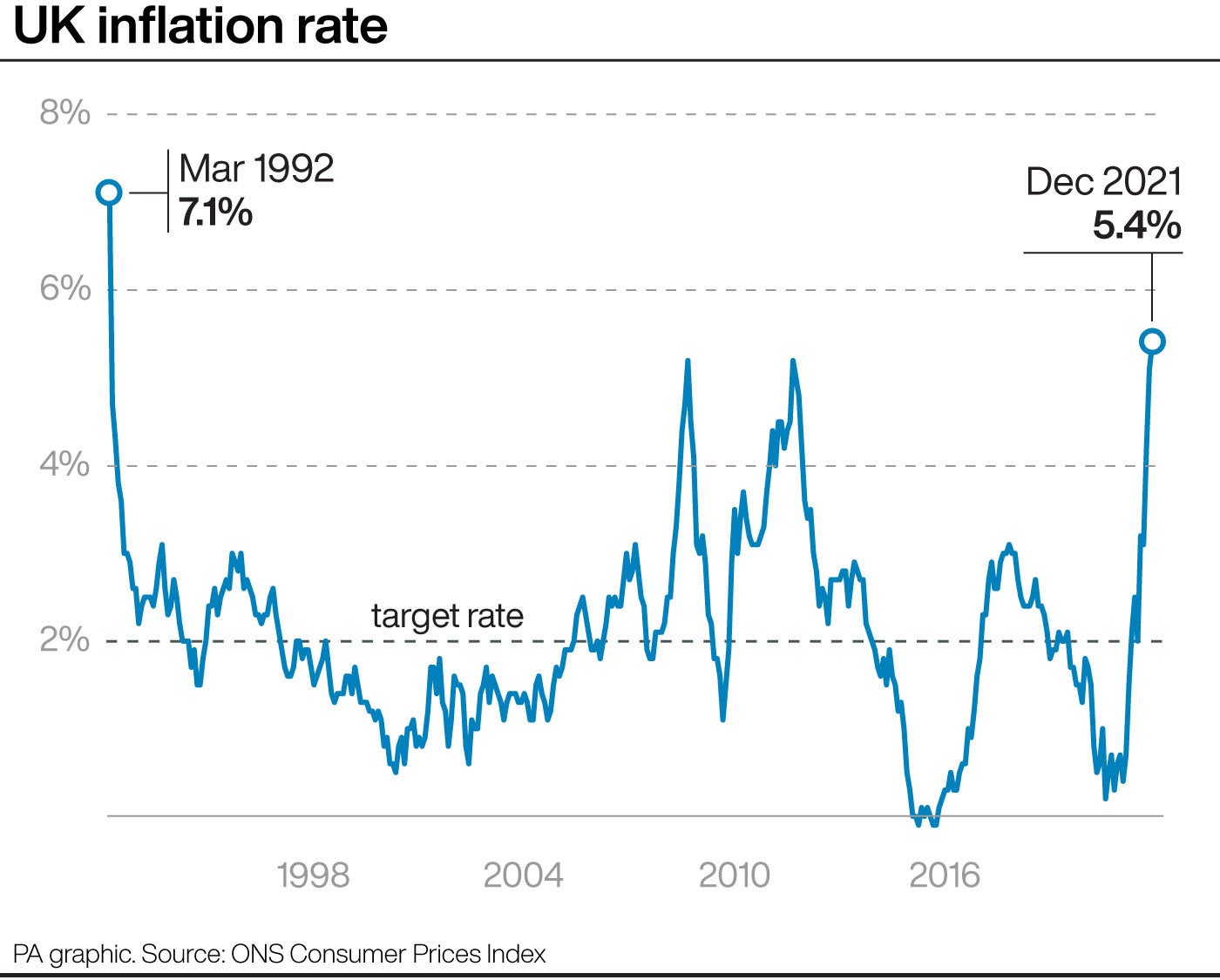

Inflation is at a 30-year high after the coronavirus pandemic, and the energy price cap is due to increase in the spring, possibly increasing bills by 50%.

Former minister Robert Halfon said the Government should look at different ways to support struggling families, including possibly cutting overseas aid, rather than ploughing ahead with the National Insurance rise.

The Tory chairman of the Commons Education Committee told BBC Radio 4’s Today programme that ministers should look at introducing “windfall taxes on businesses” or “possibly… increase capital gains tax” to replace the £12 billion per year that the new levy is forecast to produce.

Labour has regularly voiced criticism over the fiscal move, with party leader Sir Keir Starmer calling it the “wrong thing to do”.

Speaking to broadcasters on a visit to Glasgow, Sir Keir said: “The Prime Minister needs to act on this.

“We’ve got a very serious issue here, with everybody facing prices going up – whether that’s fuel, energy bills at home, inflation going up to something like 6%, the worst it’s been since the John Major years.

“And at that very moment, Boris Johnson and his Government want to impose a tax hike on people in April.”

Liberal Democrat leader Sir Ed Davey said: “The Government needs to stop faffing about and just scrap this deeply unfair and untimely tax hike.”

Under the current proposals agreed by Cabinet and voted for by MPs, National Insurance is due to rise in April by 1.25 percentage points for workers and employers.

From 2023, it is due to drop back to its current rate, with a 1.25% health and social care levy then applied to raise funds for improvements to care services.

In the 2019 Tory election manifesto, the party had ruled out increasing National Insurance if returned to power.