Chancellor Rachel Reeves’s financial headache has been inflamed by a surprise jump in borrowing in December, when it leapt to a four-year high of nearly £18bn.

The Office for National Statistics (ONS) said public sector net borrowing stood at £17.8bn last month – the third-highest figure for any December on record. Borrowing was £10.1bn higher than in the same month the year before, and significantly higher than the £14.1bn expected by most economists.

Borrowing costs have risen because of lower economic growth, which reduces tax takings; higher spending on public sector wages; and higher benefits payments, as well as a few one-off spending items, including military housing.

The unexpected jump in December’s borrowing spells out the challenge the chancellor faces “in underlined, bold and capital letters”, said Danni Hewson, an analyst at stockbroker AJ Bell.

“Despite a chunky rise in the tax take of £4bn, the cash coming in just isn’t covering what’s going out,” Ms Hewson said.

The ONS said the figure was driven higher largely by soaring debt interest payments, which rose £3.8bn year on year as a result of higher Retail Prices Index inflation.

Government bond prices barely shifted, suggesting that traders were not concerned by the sudden surge in borrowing. But yields are still not far off the highs seen a few weeks ago, when gloomy growth figures and stubborn inflation were worrying economists.

Investors are still offered 4.59 per cent yields on 10-year government debt compared to highs of nearly 5 per cent in the middle of January.

Borrowing in the financial year so far is £129.9bn, £8.9bn more than in the same period the previous year and the second-highest financial-year-to-December borrowing since monthly records began – only outstripped by the mammoth borrowing seen at the height of the pandemic in 2020.

Borrowing in the year to date is £4.1bn more than the £125.9bn forecast by the independent fiscal watchdog, the Office for Budget Responsibility (OBR).

Cara Pacitti, senior economist at the Resolution Foundation think tank, said that the figures should be digested together with longer-term data and the government’s cash position, which paints a slightly more benign picture.

“The UK’s recent run of poor economic data hasn’t yet fed through into the public finances. While high spending in December put the borrowing figures in a worrying light, tax receipts remain strong. Crucially, cash measures suggest borrowing was in line with the OBR forecast nine months into the fiscal year,” she said.

“However, with tax returns due at the end of this month, and market jitters adding further uncertainty around UK debt-servicing costs, there is still plenty for the chancellor to worry about.”

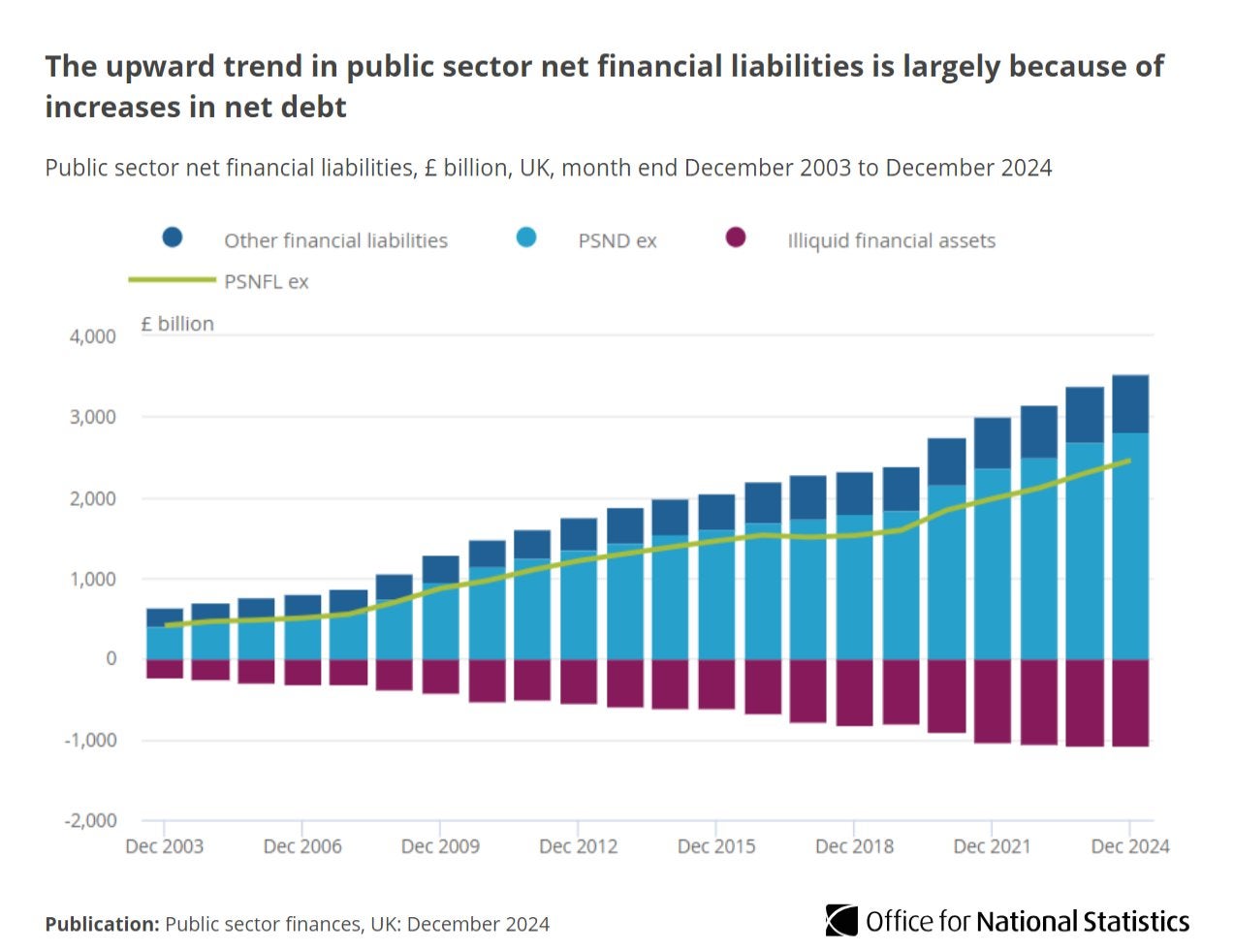

It comes after volatility in the UK government bond market at the start of the year, which sent public sector borrowing costs soaring and led to fears that Ms Reeves is on track to break her own fiscal rules.

Treasury chief secretary Darren Jones said: “Economic stability is vital for our No 1 mission of delivering growth. That’s why our fiscal rules are non-negotiable and why we will have an iron grip on the public finances.

“Through our spending review, we will interrogate every line of government spending for the first time in 17 years.”