Republicans baselessly claimed over the weekend that "woke" ideology contributed to the collapse of Silicon Valley Bank.

SVB was seized by the federal government on Friday after the start-up-focused, venture-debt-specializing bank went insolvent after a bank run, following a management decision to sell $21 billion in bonds at a $1.8 billion loss as a result of Federal Reserve interest rate hikes.

The collapse followed the Trump-era rollback of the Dodd-Frank bank regulation bill that passed in the wake of the 2008 financial crisis. The rollback exempted banks with less than $250 billion in holdings — like SVB — from more stringent bank regulations. SVB itself lobbied Congress to raise the threshold, according to The Lever.

"President Trump and Congressional Republicans' decision to roll back Dodd Frank's 'too big to fail' rules for banks like SVB – reducing both oversight and capital requirements – contributed to a costly collapse," Sen. Elizabeth Warren, D-Mass., said in a https://t.co/uKIQH5HXSu.

President Joe Biden, who on Monday vowed that the FDIC would cover depositors and said his administration would hold those responsible accountable, likewise cited the rollback as a key reason for the collapse.

"During the Obama-Biden administration, we put in place strict requirements on banks like Silicon Valley Bank... including the Dodd-Frank law to make sure that the crisis we saw in 2008 would not happen again," he said. "Unfortunately, the last administration rolled back some of these requirements. I'm going to ask Congress and the banking regulators to strengthen the rules for banks to make it less likely this kind of bank failure would happen again."

Republicans, meanwhile, blamed the collapse on the bank going "woke."

House Oversight Chairman James Comer, R-Ky., described SVB as "one of the most woke banks in their quest for the ESG-type policy and investing" during a Sunday appearance on Fox News' "Sunday Morning Futures."

"They were one of the most woke banks" -- James Comer on SVB Bank pic.twitter.com/nGw6GvZTRs

— Aaron Rupar (@atrupar) March 12, 2023

"This could be a trend and there are consequences for bad Democrat policy," Comer continued, speaking about environmental and sustainability-related investments. Comer ultimately failed to explain how such investments could have caused SVB to topple.

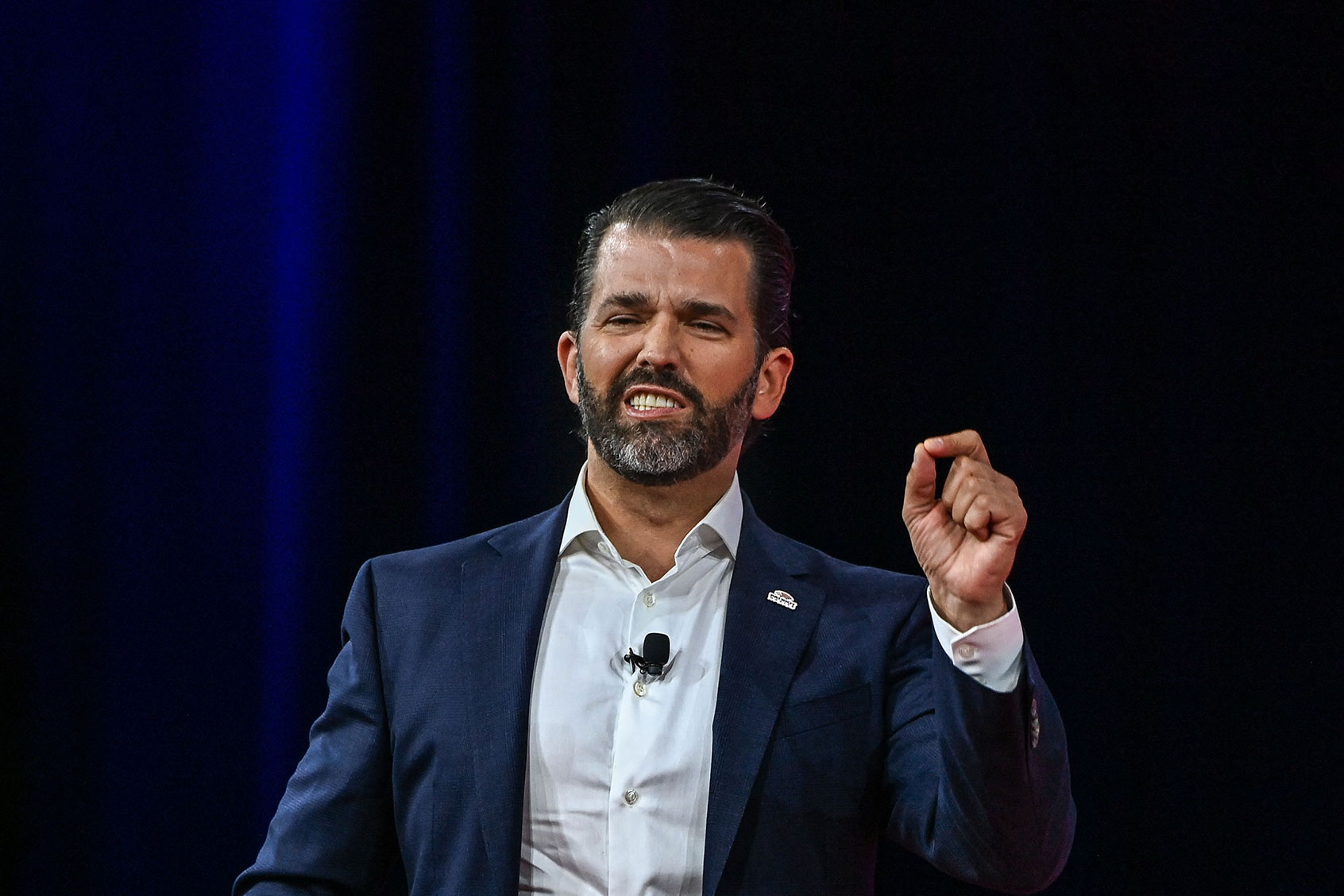

Donald Trump Jr. joined the fray on Twitter, writing that "SVB is what happens when you push a leftist/woke ideology and have that take precedent over common sense business practices."

"This won't be the last failure of this nature so long as people are rewarded for pushing this bs," he said.

SVB is what happens when you push a leftist/woke ideology and have that take precedent over common sense business practices. This won't be the last failure of this nature so long as people are rewarded for pushing this bs. https://t.co/xuthUl6Kdt

— Donald Trump Jr. (@DonaldJTrumpJr) March 12, 2023

Florida Gov. Ron DeSantis also condemned SVB as left-leaning, singling out "DEI and politics" as key factors in the financial institution's collapse.

"I mean, this bank, they're so concerned with DEI and politics and all kinds of stuff," he told Fox News. "I think that really diverted from them focusing on their core mission."

Home Depot founder Bernie Marcus, known for his staunch support and sizable financial donations to former President Donald Trump, blamed the Biden administration during an interview with Fox News.

"I think that the system [and] the administration has pushed many of these banks into [being] more concerned about global warming than they do about shareholder return," Marcus said. "And these banks are badly run because everybody is focused on diversity and all of the woke issues and not concentrating on the one thing they should, which is shareholder returns."

Several Democratic lawmakers have pushed back on claims of wokeness, which remain entirely unrelated to SVB's downfall.

"Woke? Nope. This is old fashion greed," Rep. Jimmy Gonzalez, D-Calif., wrote on Twitter. "In 2018, Trump & the [GOP] majority rollbacked regulations, in place since the financial crisis, that were meant to protect workers, homeowner, small businesses & prevent this from happenings. Don't let Rs fool you."

Woke? Nope. This is old fashion greed.

In 2018, Trump & the @GOP majority rollbacked regulations, in place since the financial crisis, that were meant to protect workers, homeowner, small businesses & prevent this from happenings.

Don't let Rs fool you. #siliconevalleybank https://t.co/koc6gO0iv8

— Rep. Jimmy Gomez (@RepJimmyGomez) March 12, 2023

Sen. Chris Murphy, D-Conn., accused Republicans of thinking that "voters are so dumb" that "they won't catch on" to a longstanding trend of categorizing entities in political opposition to GOP ideals as overly liberal and "woke."

The term is just a joke now. They think voters are so dumb they won't catch on. https://t.co/uKIQH5HXSu

— Chris Murphy (@ChrisMurphyCT) March 12, 2023

NBC News reporter Ben Collins leveled blame at Republicans for SVB's closure, alleging that the bank run was "frontrun by some of the GOP's biggest donors."

"I'm telling you, they're actually running with the 'woke banks' thing. They're already using scary placeholder acronyms ESG and DEI, which to them mean 'diversity,'" Collins wrote on Twitter. "It serves to obfuscate the reality: there was a panicky bank run, frontrun by some of the GOP's biggest donors."

I'm telling you, they're actually running with the "woke banks" thing. They're already using scary placeholder acronyms ESG and DEI, which to them mean "diversity."

It serves to obfuscate the reality: there was a panicky bank run, frontrun by some of the GOP's biggest donors. https://t.co/Rrhxj6rTOs

— Ben Collins (@oneunderscore__) March 12, 2023

NBC Senior business analyst Stephanie Rhule echoed this sentiment, writing that SVB's demise "has absolutely NOTHING to do with a bank being 'woke.'"

This has absolutely NOTHING to do with a bank being "woke".

- 1 bank with an extreme Industry concentration got caught on the wrong side of the trade investing in MBS/UST.

- bad timing + communication around SVB raising $$ led to MASSIVE withdrawals & a run on the bank. https://t.co/OVtiwcvpyr— Stephanie Ruhle (@SRuhle) March 12, 2023