Stock markets in the UK and across Europe have been boosted while the US dollar has surged as traders around the world react to Donald Trump winning the US presidential election.

The UK’s FTSE 100 jumped by about 1.5% when markets opened on Wednesday as an anticipated Republican win provides some certainty for the future of the world’s biggest economy.

It remained about 1.2% higher later in the morning when it was declared that Donald Trump had won the election.

Strong gains in premarket trading in New York showed stocks on Wall Street look set for a fresh rally on Wednesday in response to the result.

But economists warned Mr Trump’s tariff plans would come as a “shock” to the UK economy.

Daniel Casali, chief investment strategist at Evelyn Partners, said markets were reacting positively to the prospect of a “clear Trump victory” and Republicans controlling Congress.

The combination of a clear victory along with the impact of those tax cuts will be beneficial for growth and the equity markets are reacting positively to that

“The combination of a clean sweep victory means tax cuts are likely over the coming year,” he said.

“That will be beneficial for equities as it means lower taxes will boost company earnings.

“So, the combination of a clear victory along with the impact of those tax cuts, will be beneficial for growth and the equity markets are reacting positively to that.”

The pound was down about 1% against the US dollar, at 1.292, with the American currency making sharp gains overnight.

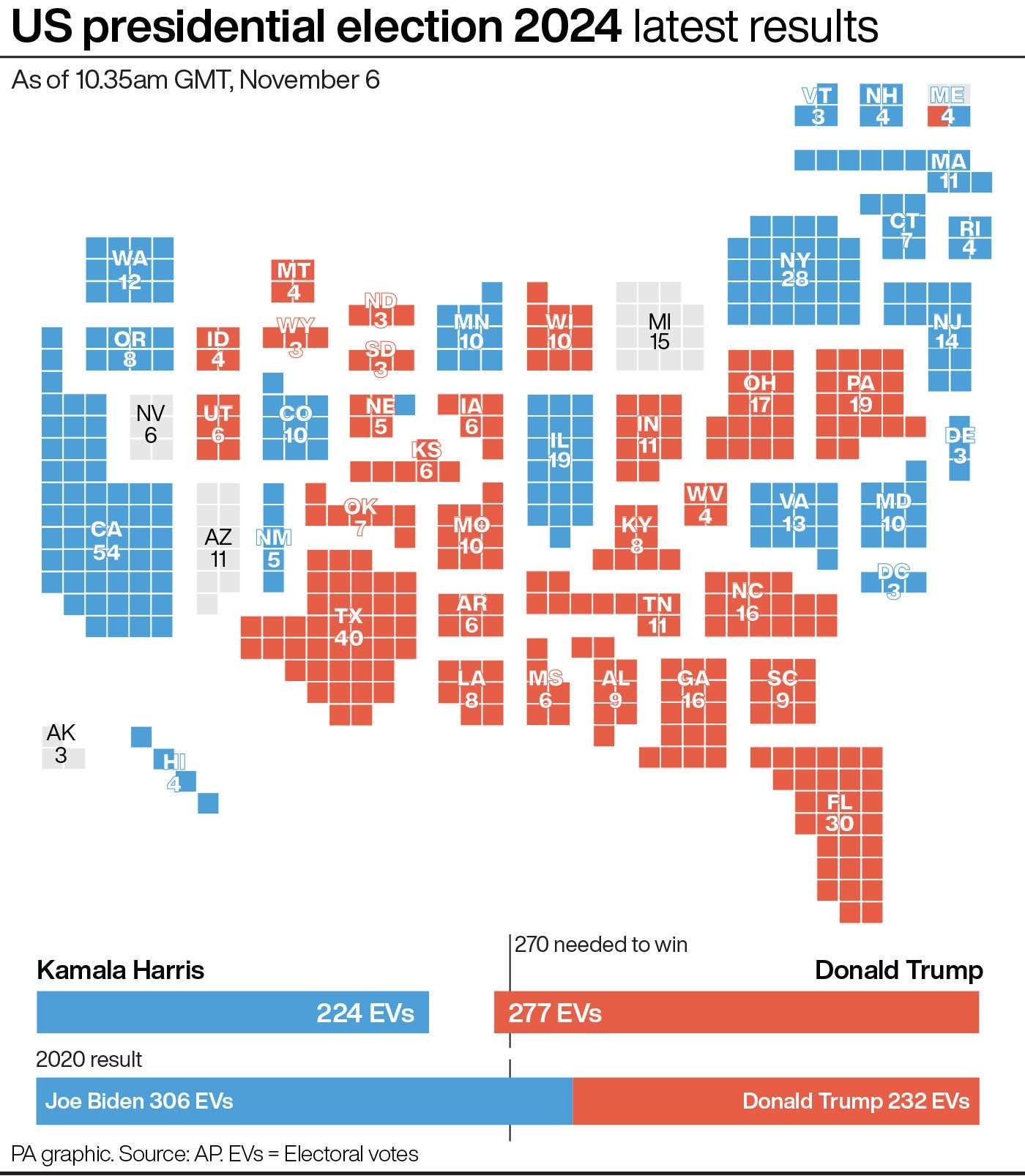

#Trump has declared victory in the 2024 elections.

— ING Economics (@ING_Economics) November 6, 2024

What does his win mean for the economy? A lower tax environment that should boost sentiment and spending in the near term. But promised tariffs, immigration controls and higher borrowing costs will become headwinds.

More… pic.twitter.com/90n83PBWPc

Economists said investor sentiment in the US is being bolstered by the prospect of a lower tax environment under a Trump presidency, while the implementation of trade tariffs could serve to strengthen the US dollar.

The rising dollar also reflects expectations that Mr Trump’s policies will add to inflation in the economy and therefore keep interest rates higher for longer, experts said.

Samuel Tombs, chief US economist for Pantheon Macroeconomics, said it was raising its forecast for US inflation under the expectation that Mr Trump will introduce higher tariffs on all imports next year.

This would give the Federal Reserve less scope to ease interest rates, he said.

Nevertheless, the knock-on impact on the UK economy and countries around the world continues to come under the spotlight.

Higher US import tariffs would reduce global economic growth by about one percentage point over the next two years, according to analysis from the National Institute of Economic and Social Research (Niesr).

For the UK, Niesr estimates that economic growth would slow to 0.4% in 2025, down from a forecast of 1.2%.

Ahmet Kaya, principal economist for Niesr, said the UK economy could be “one of the countries most affected” with the proposed tariffs coming as “yet another shock” to the country.

Donald Trump has said he wants to increase tariffs on goods imported from around the world by 10%, rising to 60% on goods from China.