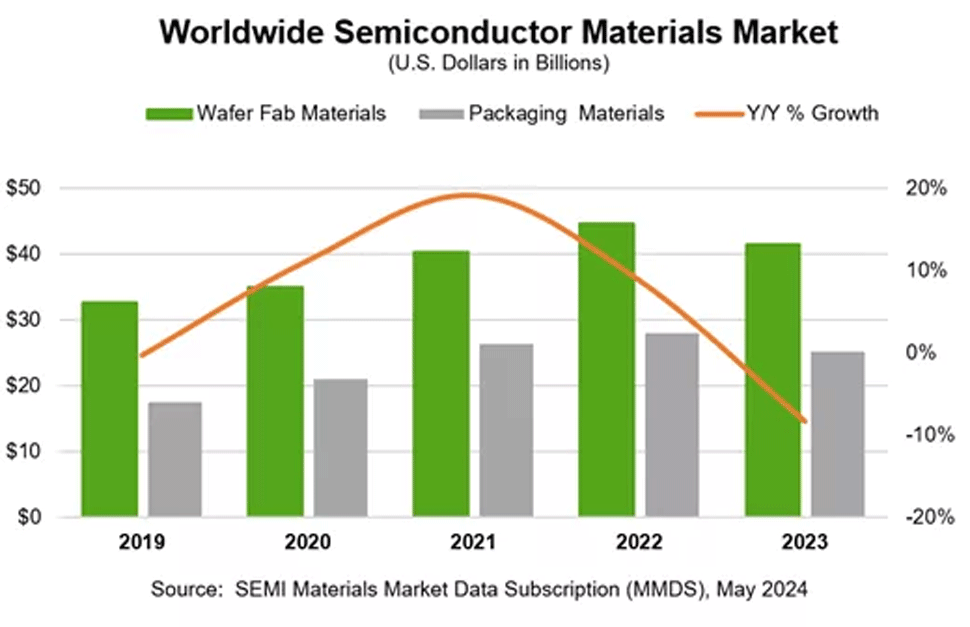

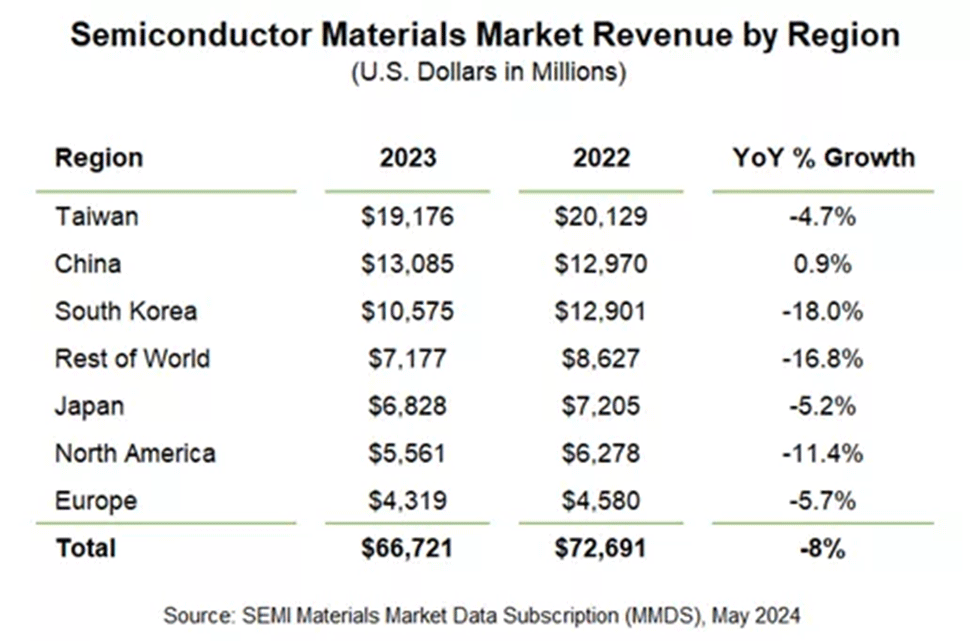

In 2023, the global semiconductor materials market saw a revenue decrease of 8.2%, totaling $66.7 billion, down from $72.7 billion in the previous year. All regions of the world saw revenue declines except China, which managed to scrape out at least some growth. SEMI, the global industry association for the electronics manufacturing and design supply chain, reported this downturn.

The decline in revenue was observed across different segments of the market. Wafer fabrication materials experienced a 7.0% drop in revenue to $41.5 billion. The most significant decreases in this segment were noted in silicon, photoresist ancillaries, wet chemicals, and chemical mechanical planarization (CMP). Meanwhile, the packaging materials used to build chip enclosures, reported a sharper decline of 10.1%, bringing their revenue down to $25.2 billion, largely due to reductions in the organic substrates sector.

The reduction in market size is attributed to the softening of semiconductor demand as manufacturers tried to minimize their surplus inventory last year. This inventory management led to underutilized fabrication facilities, directly impacting the consumption of semiconductor materials. The reduced operational rates at these facilities were a key factor in the reduced material usage.

Geographically, Taiwan continued to lead as the top consumer of semiconductor materials for the fourteenth straight year, with revenues reaching $19.2 billion. This is not particularly surprising as Taiwan-based TSMC produces chips for the whole world, including tech giants Apple, AMD, Intel, and Nvidia.

Following Taiwan, China saw an increase in consumption, achieving $13.1 billion in revenue and maintaining its second-place ranking. Keeping in mind that China leads the world in terms of new fab openings, it is logical that Chinese companies buy more semiconductor materials than others.

South Korea stood third with $10.6 billion, which is not surprising as companies like Samsung and SK Hynix produce the majority of their 3D NAND and DRAM memory devices domestically.

Outside of these nations, most other regions experienced significant downturns in their semiconductor material consumption. Most notably, the North American chip materials market totaled $5.561 billion last year after contracting by 11.4%, which is not unexpected as the U.S. continued to lose chipmaking market share last year. The only smaller market was Europe, with $4.319 billion in 2023, a 5.7% decline year-over-year.