GitLab (NASDAQ:GTLB) is preparing to release its quarterly earnings on Thursday, 2024-12-05. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect GitLab to report an earnings per share (EPS) of $0.15.

The announcement from GitLab is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

Earnings Track Record

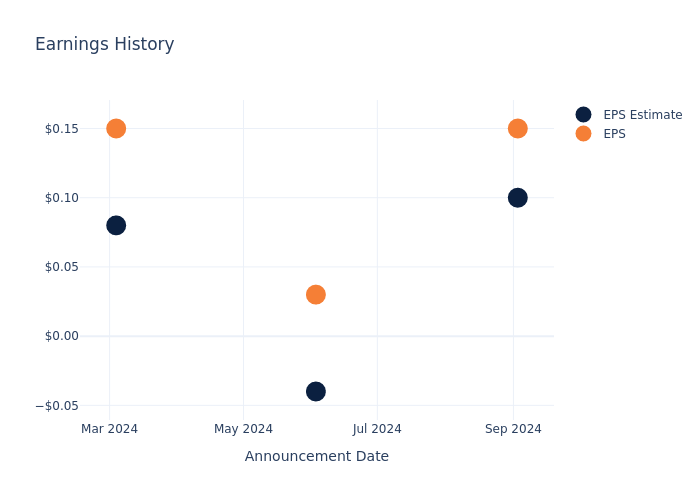

Last quarter the company beat EPS by $0.05, which was followed by a 21.64% increase in the share price the next day.

Here's a look at GitLab's past performance and the resulting price change:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.10 | -0.04 | 0.08 | -0.01 |

| EPS Actual | 0.15 | 0.03 | 0.15 | 0.09 |

| Price Change % | 22.0% | -5.0% | -21.0% | 11.0% |

Market Performance of GitLab's Stock

Shares of GitLab were trading at $63.86 as of December 03. Over the last 52-week period, shares are up 15.74%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Insights Shared by Analysts on GitLab

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on GitLab.

The consensus rating for GitLab is Outperform, based on 7 analyst ratings. With an average one-year price target of $66.29, there's a potential 3.81% upside.

Analyzing Analyst Ratings Among Peers

The analysis below examines the analyst ratings and average 1-year price targets of SentinelOne, UiPath and Monday.Com, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- As per analysts' assessments, SentinelOne is favoring an Outperform trajectory, with an average 1-year price target of $30.0, suggesting a potential 53.02% downside.

- As per analysts' assessments, UiPath is favoring an Neutral trajectory, with an average 1-year price target of $15.55, suggesting a potential 75.65% downside.

- The consensus among analysts is an Outperform trajectory for Monday.Com, with an average 1-year price target of $318.8, indicating a potential 399.22% upside.

Insights: Peer Analysis

The peer analysis summary outlines pivotal metrics for SentinelOne, UiPath and Monday.Com, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| GitLab | Outperform | 30.81% | $161.21M | 2.14% |

| SentinelOne | Outperform | 33.14% | $148.24M | -4.26% |

| UiPath | Neutral | 10.07% | $252.93M | -4.46% |

| Monday.Com | Outperform | 32.67% | $225.03M | -1.28% |

Key Takeaway:

GitLab ranks highest in Revenue Growth among its peers. It also leads in Gross Profit margin. However, it has the lowest Return on Equity.

Unveiling the Story Behind GitLab

GitLab Inc operates on an all-remote model. GitLab, a complete DevSecOps platform delivered as a single application. It operates in two competitive landscapes: DevOps point solutions and DevOps platforms. In terms of point solutions that are stitched together, GitLab's offering is substantially different in that it is one platform, one codebase, one interface, and a unified data model that spans the entire DevSecOps lifecycle. DevOps platforms, the principal competitor is Microsoft Corporation following their acquisition of GitHub. GitLab is offered on both self-managed and software-as-a-service (SaaS) models. It is located in the United States, Europe, and Asia Pacific. It focused on accelerating innovation and broadening the distribution of its platform to companies across the world.

Key Indicators: GitLab's Financial Health

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: GitLab displayed positive results in 3 months. As of 31 July, 2024, the company achieved a solid revenue growth rate of approximately 30.81%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: GitLab's net margin excels beyond industry benchmarks, reaching 7.09%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): GitLab's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 2.14%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 0.96%, the company showcases effective utilization of assets.

Debt Management: GitLab's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.0.

To track all earnings releases for GitLab visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.