In the United States, about 50% of all marriages end in divorce, according to World Population Review, that is about the sixth-highest divorce rate in the world.

And while a divorce is never easy, tax experts say there are some strategies divorced couples need to consider. One of the first things to consider is the date that your marital status changed.

Recommended: Divorced and Retired? Tax Advice for 'Gray Divorce' Couples

Taxes and Divorce: Here's What to Know

"Your marital status at the end of the year determines how you file your tax return, according to Lisa Greene-Lewis, CPA and tax expert for our partners at TurboTax. "If you were divorced by midnight on December 31 of the tax year, you will file separately from your former spouse"

Recommended: Taxes and Divorce: Here's What to Know About Filing Taxes After Divorce

"Who claims the children" is another important consideration, according to Jeffrey Levine, CPA and tax expert from Buckingham Wealth Strategies. Watch the video above, or continue below for his 5 Top Tips for Recently Divorced Couples.

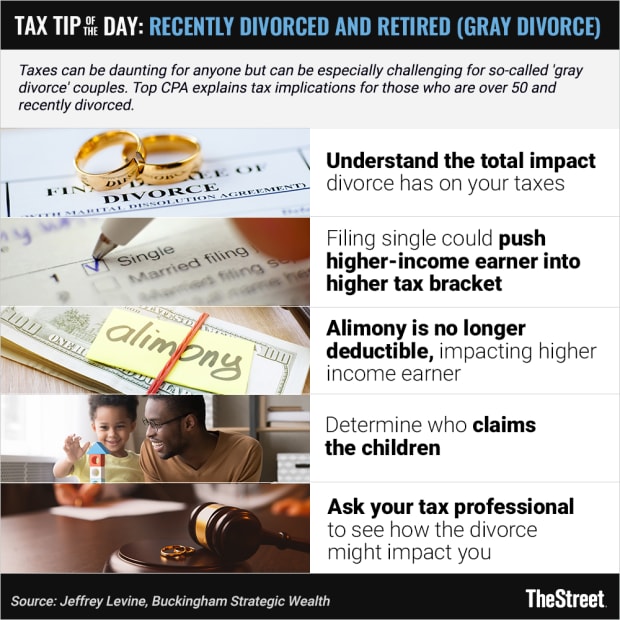

5 Tips for Recently Divorced

- Understand the total impact divorce has on your taxes

- Filing single could push the higher-income earner into a higher tax bracket

- Alimony is no longer deductible, impacting the higher income earner

- Determine who claims the children

- Ask your tax professional about possible tax implications.

Robert Powell, TheStreet's Retirement Daily, also talked to Levine about a recent phenomenon that has been called the 'gray divorce'

TurboTax Live experts look out for you. Expert help your way: get help as you go, or hand your taxes off. You can talk live to tax experts online for unlimited answers and advice OR, have a dedicated tax expert do your taxes for you, so you can be confident in your tax return. Enjoy up to an additional $20 off when you get started with TurboTax Live.

What Is a Gray Divorce?

A 'gray divorce' is when a couple over the age of 50 ends their marriage. Divorces over the age of 65 have reportedly tripled in the last 25 years. High-profile gray divorces include Microsoft ( (MSFT Get Microsoft Corporation Report) founder Bill Gates and his wife Melinda and Amazon's ( (AMZN Get Amazon.com Inc. Report) founder and former CEO Jeff Bezos and his wife McKenzie.

TheStreet spoke at length with Levine, for a Divorce and Taxes 101. Their extended conversation is below.

Quotes| Here's What 'Gray Divorce' Means for Your Taxes

Jeffrey Levine, Chief Planning Officer, Buckingham Strategic Wealth

Jeffrey Levine, Chief Planning Officer, Buckingham Strategic Wealth

Video Transcript| Jeffrey Levine, CPA and Tax Expert, Buckingham Strategic Wealth

Robert Powell: Jeffrey, we're living in a day and age of what's called the gray divorce. What tax tips do you have for those who are recently divorced?

Jeffrey Levine: Well, if you're going through a divorce, the first thing you want to do is understand what the impact is going to look like. What does getting a divorce mean for me and my taxes? For some individuals that might mean a much lower tax bill than they were accustomed to before, at least on a proportional basis.

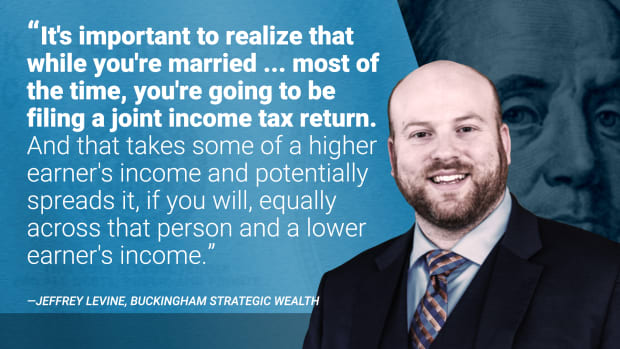

For other individuals, it can mean a much higher tax bill. It's important to realize that while you're married, a lot of the time, or most of the time, you're going to be filing a joint income tax return. And that takes some of a higher earner's income and potentially spreads it, if you will, equally across that person and a lower earner's income.

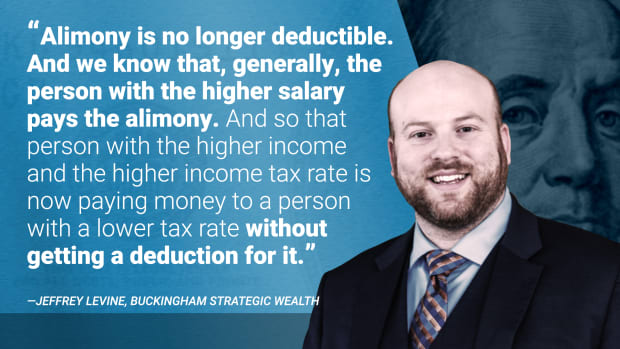

If you have a divorce, you may end up filing single, and that could push you into higher brackets, and, on top of that Bob, since 2019 alimony is no longer deductible. And we know that, generally, the person with the higher salary pays the alimony. And so that person with the higher income and the higher income tax rate is now paying money to a person with a lower tax rate without getting a deduction for it.

Of course, when there are children involved, we have to look at who's claiming the children. Does one person get to claim them every year? Do you switch it off every other year? That can impact your filing status, the credits that you are able to qualify for, and what deductions you're able to receive. So the first thing to do is to go forward and ask your tax professional to do a pretend tax return to see how that divorce might impact you.

Robert Powell: Jeffrey, thanks for those tax tips, and we know that we have some more in store for our viewers in the weeks and months to come.

Jeffrey Levine: Well, I look forward to it and joining you and answering some more reader questions.

Editor's Note: Reviewed for tax accuracy by a TurboTax CPA expert.